Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

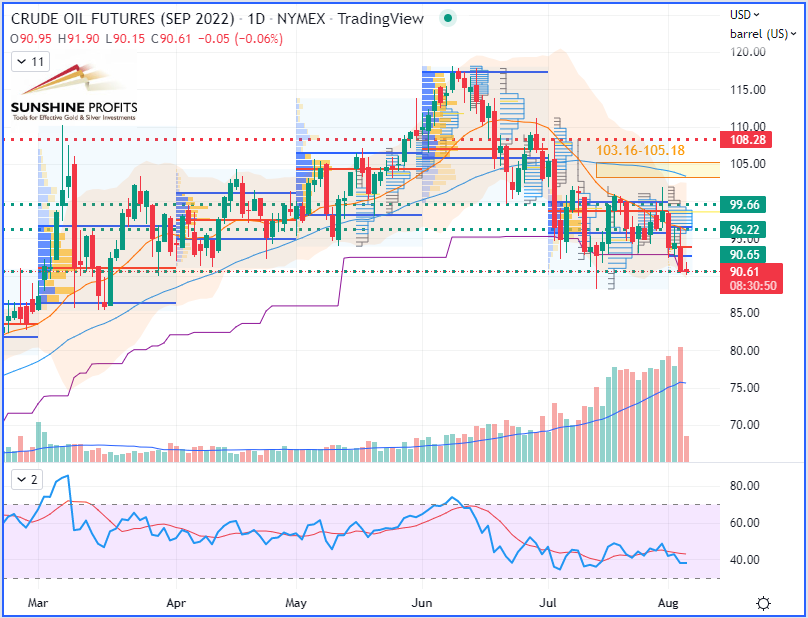

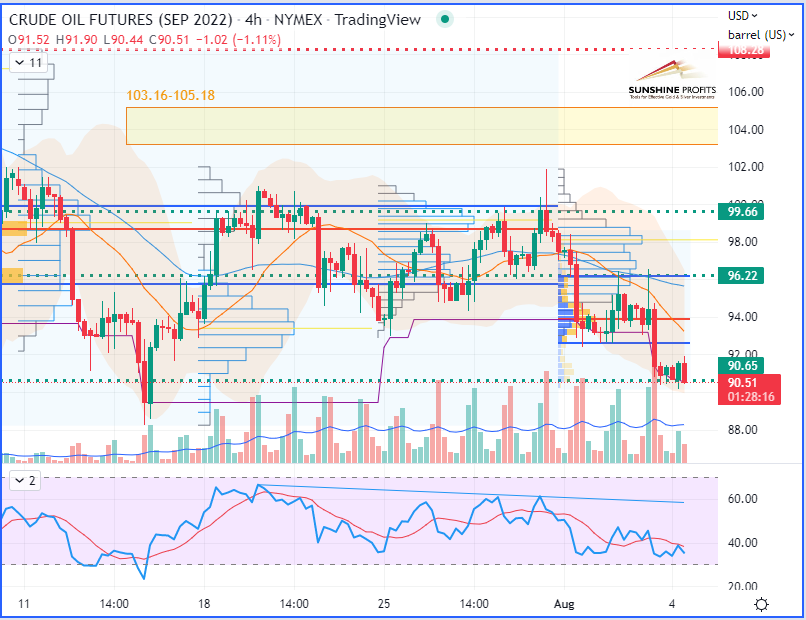

WTI Crude Oil [CLU22] Short around the $103.16-105.18 resistance area (yellow band) with stop just above $108.28 and targets at 99.66, 96.22 & 90.65 – Entry was not triggered in the end.

As expected last week, the trajectory for crude oil went back up towards $102 before dropping dramatically down to my 2 projected targets. The only problem was that the last rally before the fall was rejected by the bears, who took over. Given that I estimated the $103.16-105.18 resistance area (highlighted by the usual yellow band) to be the optimal risk/reward level to go short (for a stop placement just above July’s high, $108.28), I did not get the trigger at this level since the WTI market topped at $101.88 (~$1 lower) before skydiving.

However, this is part of trading, sometimes we miss an opportunity if it doesn’t fit into our trade plan.

Fundamental Analysis

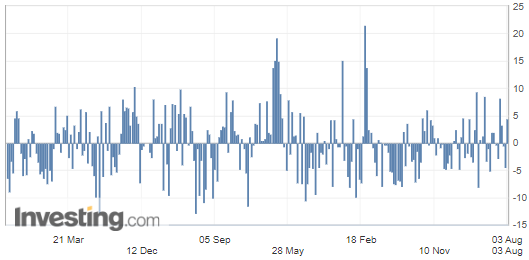

Fundamentally, yesterday we saw a sharp increase in commercial crude oil reserves (+4.5 million barrels) in the United States, according to the following oil stock figures released by the Energy Information Administration (EIA):

U.S. Crude Oil Inventories

The increase in inventories of 4.5 million barrels took the market by surprise, while forecasts were for a slight drop of 600,000 barrels.

In addition, OPEC+ announced an increase in their total production volume of just 100,000 barrels per day for September, which does not have a high significance for the market but is considered more like a kind of concession to calls for Saudi Arabia to increase its production.

WTI Crude Oil (CLU22) Futures (September contract, daily chart)

WTI Crude Oil (CLU22) Futures (September contract, 4H chart)

That’s all, folks, for today – happy trading!

As always, we’ll keep you, our subscribers well informed.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist