Trading position (short-term; our opinion): Short position with a stop-loss order at $60.22 and the initial downside target at $50.38 in crude oil is justified from the risk/reward perspective.

Crude oil is marching higher but warning signs keep mounting. Is it clear skies from now on or is it like the moment of Wile E. Coyote not realizing having run past the solid ground, looking below to see there’s no support beneath and coming to terms with the commencing fall? Is there a moment of recognition like this for the oil bulls just ahead?

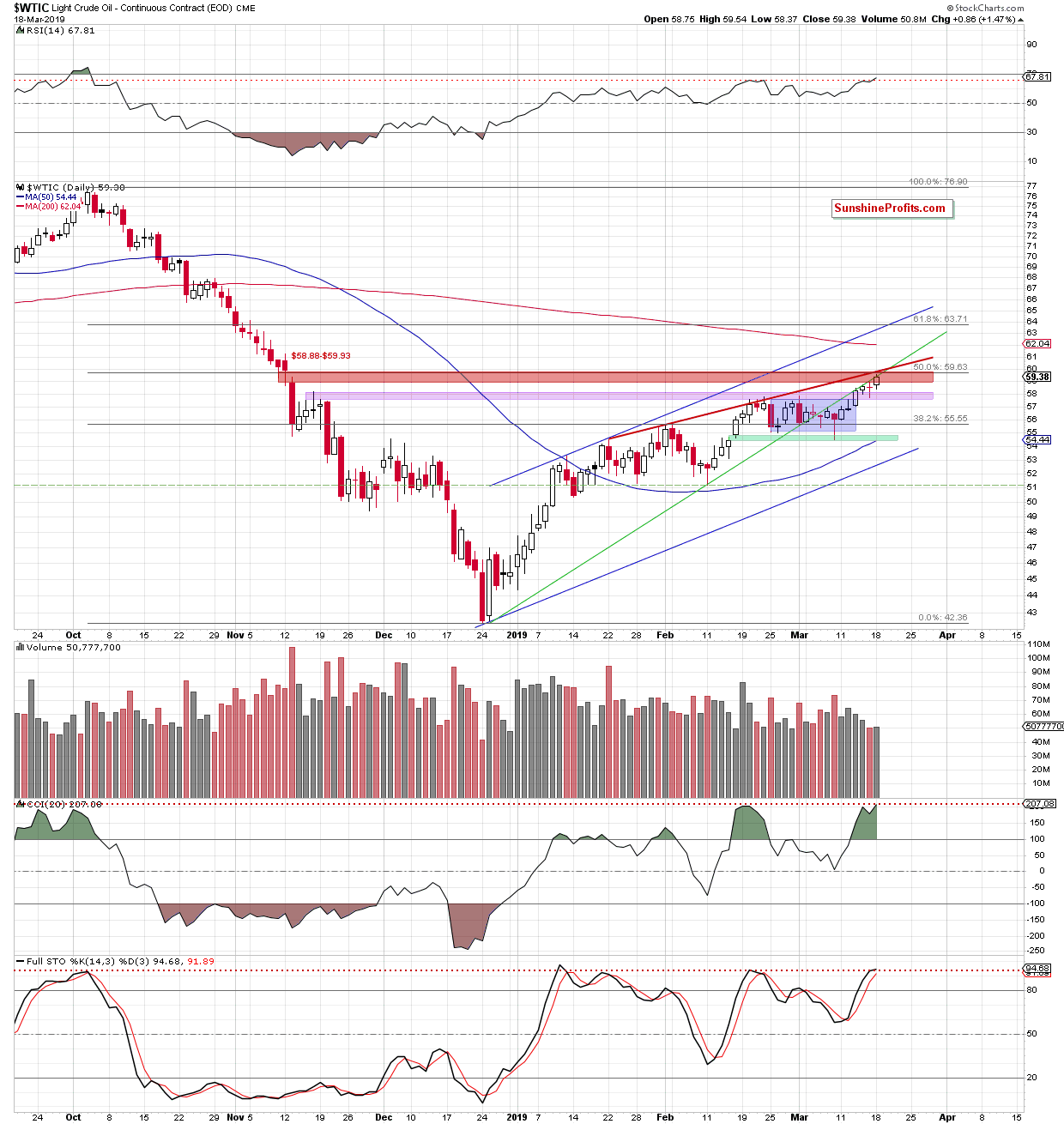

Let’s take a closer look at the chart below (chart courtesy of http://stockcharts.com).

Yesterday, we have seen another move higher in oil. While bullish on the surface, neither this nor any previous move managed to overcome the rising medium-term green line. Neither the rising red resistance line based on January and February peaks was bested. Yesterday’s upswing only closed the November price gap marked as the red resistance zone.

This is what a strong combination of major medium-term resistances at work looks like. It’s the 50% Fibonacci retracement based on the entire October-December downward move, the upper border of the red resistance zone (the November price gap) and the rising red resistance line based on January and February peaks. And don’t forget about the unbroken rising medium-term green line.

The volume wasn’t much bigger than the day before. Actually, it was among the lowest ones when comparing the volumes of previous up days either in February or March. Therefore, the volume as such doesn’t confirm bulls’ strength at this very moment.

All the above suggests that the space for further increases is most probably limited and a reversal looks to be just around the corner. Who knows, perhaps the catalyst for the reversal will turn out to be tomorrow’s Fed monetary policy decisions and the markets coming to terms with them.

Trading position (short-term; our opinion): Short position with a stop-loss order at $60.22 and the initial downside target at $50.38 in crude oil is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist