Trading position (short-term; our opinion): Long positions in crude oil (100% size of the regular trading position) are justified from the risk to reward point of view with $26.87 as the binding profit-take level, and with $19.78 as the stop-loss level. We are moving the profit-take level lower.</position>

Very little has changed for crude oil in the last 24 hours. It moved back and forth and at the moment of writing these words, it's once again trading at about $24, which is above our entry level for the current long position.

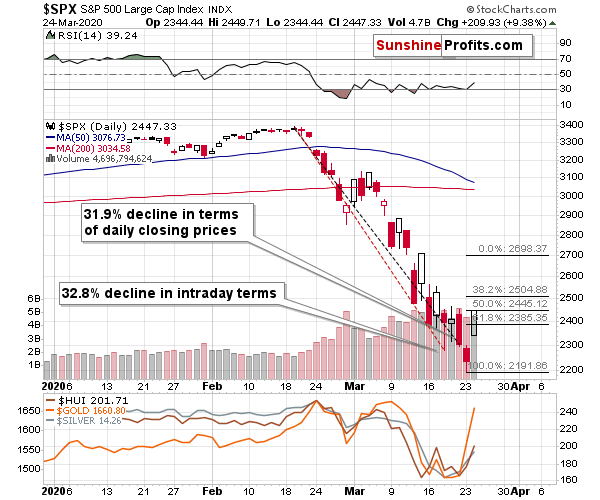

Crude oil's performance has been relatively weak given what's going on in the S&P 500 futures (they're moving up) and the USD Index (it's moving down). Both factors should contribute to higher crude oil prices, but they aren't.

This means that the continuation of the above-mentioned moves in the S&P 500 and USDX is likely to have a relatively small impact on what's going to happen in crude oil.

Consequently, we are moving our profit-take level considerably lower.

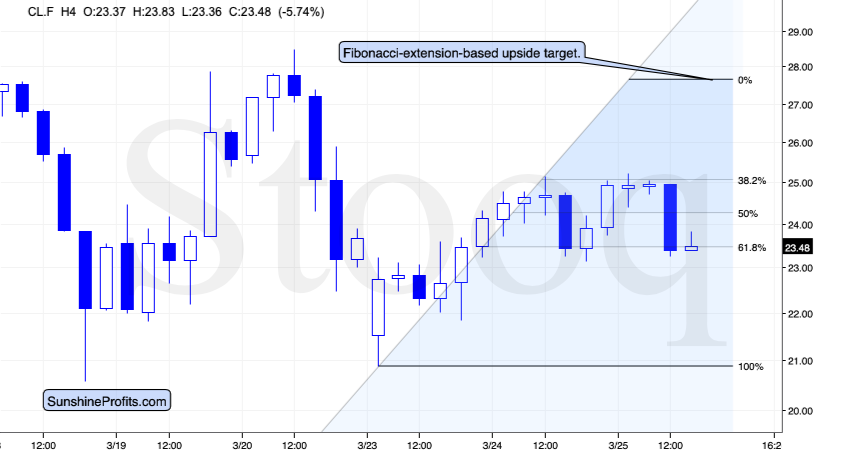

If crude oil multiplies its recent gains by the factor of 1.618, it will move slightly above $27. This level more or less corresponds to the intraday high from a few days ago. Still, in order to greatly increase the chance of exiting the trade, we are placing the profit-take level below $27.

Why would crude oil extent its previous upswing by the factor of 1.618? One reason is that this extension technique is quite useful on its own. The other reason is that this would be a bit lower than what the analysis of the general stock market would imply.

Stocks appear likely to double their recent upswing, which is based also on other resistance levels (such as the 38.2% Fibonacci retracement level that is based on the entire February - March decline).

Now, since crude oil was relatively weak compared to the general stock market, it might be more appropriate to use a smaller extension to this market than the one applied to stocks. Consequently, instead of 2, we're using 1.618 as the multiplier.

We realize that this level is considerably lower than the previous one, but it's much better to have smaller profits and to have them at all, than to enter a I-wish-I-would state after crude oil plunges below $20, as that seems to be a relatively likely outcome for the following weeks.

Summing up, the corrective upswing in crude oil appears to be close to its end, and given crude oil's relative weakness, we decided to move the profit-take levels lower. Moreover, please note that we might open a speculative short position in crude oil in the following days (or hours).

Trading position (short-term; our opinion): Trading position (short-term; our opinion): Long positions in crude oil (100% size of the regular trading position) are justified from the risk to reward point of view with $26.87 as the binding profit-take level, and with $19.78 as the stop-loss level.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager