While the coronavirus-triggered declines are likely far from being over, many markets including crude oil, declined too far too fast. As a result, they are now correcting.

We have already entered a long position previously, after which we saw some short-term volatility. Crude oil rallied, and then it declined again. At the moment of writing these words, the black gold just moved back above $23.50, and then declined a bit. Our long positions are close to being flat at this minute.

What did the very recent test of the previous lows change? Practically nothing. The upside target area remains up-to-date, and so does the reasoning for it. This means that the profits on this position are likely to become significant soon, likely very soon - perhaps as early as this week.

In short, our target area for this rally is between $34 and $37, and we're conservatively going to place our profit-take level slightly below this area (in order to maximize the chance of getting the exit order filled).

This area is based on four resistance levels:

- The 38.2% Fibonacci retracement level

- The mid-March intraday high

- The mid-March high in terms of the closing prices

- The lower border of the huge price gap

Given the size of the size of the gap, it might be the strongest resistance here. This is yet another reason to place our exit a bit below it, and not at higher levels.

These were our Friday's observations:

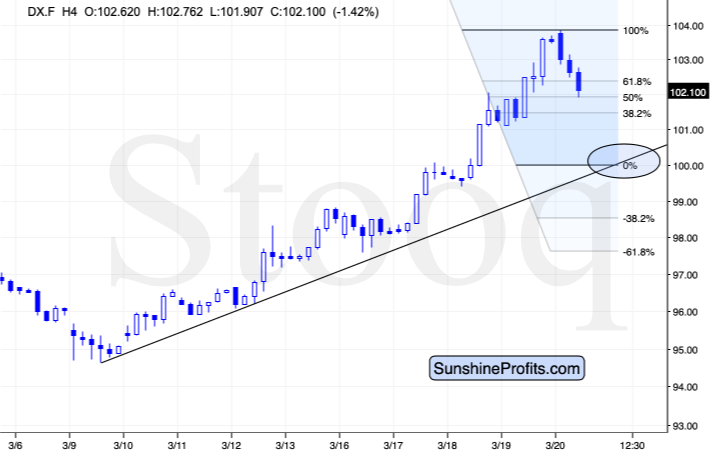

(...) At the moment of writing these words, crude oil seems to be about halfway done rallying, just as the general stock market and the USD Index are. Given how interconnected the markets are nowadays, it seems quite possible that they would all finish correcting at the same time or that their reversals would be relatively close to each other.

The target for the general stock market is based on the 38.2% Fibonacci retracement and the mid-March high, while the target for the USD Index is based on the rising support line, and on the previous highs, which are not visible on the above chart, but they are very close to the 100 level.

Stocks moved lower and the USDX moved back up, since we wrote the above, but both also started new moves: up in the case of stocks and down in the case of USDX. This suggests that what we wrote, remains up-to-date after all.

Summing up, the corrective upswing in crude oil appears to be underway and it seems that black gold will rally approximately as much as it has rallied from this week's low so far. The profits on our long position are likely to become bigger before the trade is over.

Trading position (short-term; our opinion): Long positions in crude oil (100% size of the regular trading position) are justified from the risk to reward point of view with $33.97 as the binding profit-take level, and with $19.78 as the stop-loss level.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager