Trading position (short-term; our opinion): Full speculative short position in crude oil with a stop-loss order at $70.22 and the initial downside target at $60.12 is justified from the risk/reward perspective.

Crude oil’s prices increased in today’s pre-market trading as the uncertainty regarding the OPEC meeting in Vienna made traders anxious. The price usually moves on rumor, not on facts, and any impact that the meeting can have on the market will be limited to the extent that the investors will be surprised.

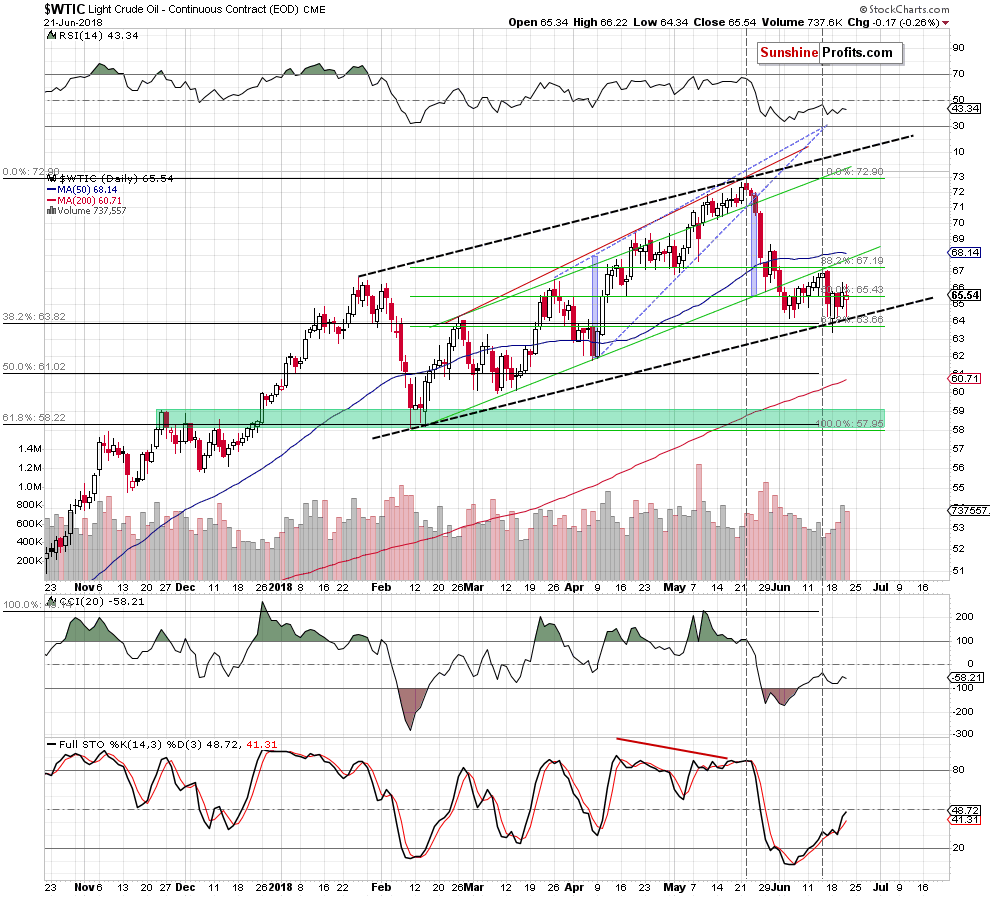

At the moment of writing these words, we have no meaningful signs from either the market or the OPEC officials, so all we can do at this time is to comment on yesterday’s price changes. And this means that today’s Oil Trading Alert is going to be even shorter than the previous one as basically nothing happened in the crude oil market yesterday. Let’s see just how little changed on the chart below (charts courtesy of http://stockcharts.com).

Crude oil’s price declined just like it was likely to, but only by 17 cents, which is next to nothing. The volume during yesterday’s session was relatively high, but since there was no decisive move in any direction, we can’t say much about the implications.

The overall shape of the session shows significant indecisiveness of market participants as the price moved in both directions quite widely. The likely reason behind this is today’s announcement regarding the oil production increase. The market might have been reluctant to slide before examining the latest news regarding oil production plans.

Now, since we still don’t have the details, we can only say that right before and right after the announcement the situation is likely to be volatile. Still, after a few hours (or on Monday), the uncertainty will become significantly lower and the trend can continue. As we explained earlier, the outlook is bearish mostly based on the shape of the monthly candlestick that we saw in May – it was a powerful bearish reversal accompanied by huge volume.

Summing up, yesterday’s session didn’t change much from the technical point of view as it simply emphasized the investors’ nervousness ahead of the oil production news. Based on the key technical development that we saw in May, we can expect another downswing in crude oil in the following days and weeks, but news coming from OPEC may distort the outlook for the short term. At this time, it’s too early to say what the impact will be, but we didn’t want to keep you waiting for the alert until the announcement. If it impacts the outlook in a meaningful way, we’ll send you an intraday follow-up to this analysis.

As always, we’ll keep you – our subscribers – informed.

Trading position (short-term; our opinion): Full speculative short position in crude oil with a stop-loss order at $70.22 and the initial downside target at $60.12 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts