Trading position (short-term; our opinion): Short positions in crude oil (100% size of the regular trading position) are justified from the risk to reward point of view with $11.22 as the binding profit-take level, and with $30.23 as the stop-loss level. We are moving the stop-loss level slightly higher.

Crude oil's rally continued on Friday, leading some to ask whether there's actually something to it. In today's Alert, we'll examine where the black gold market stands right now.

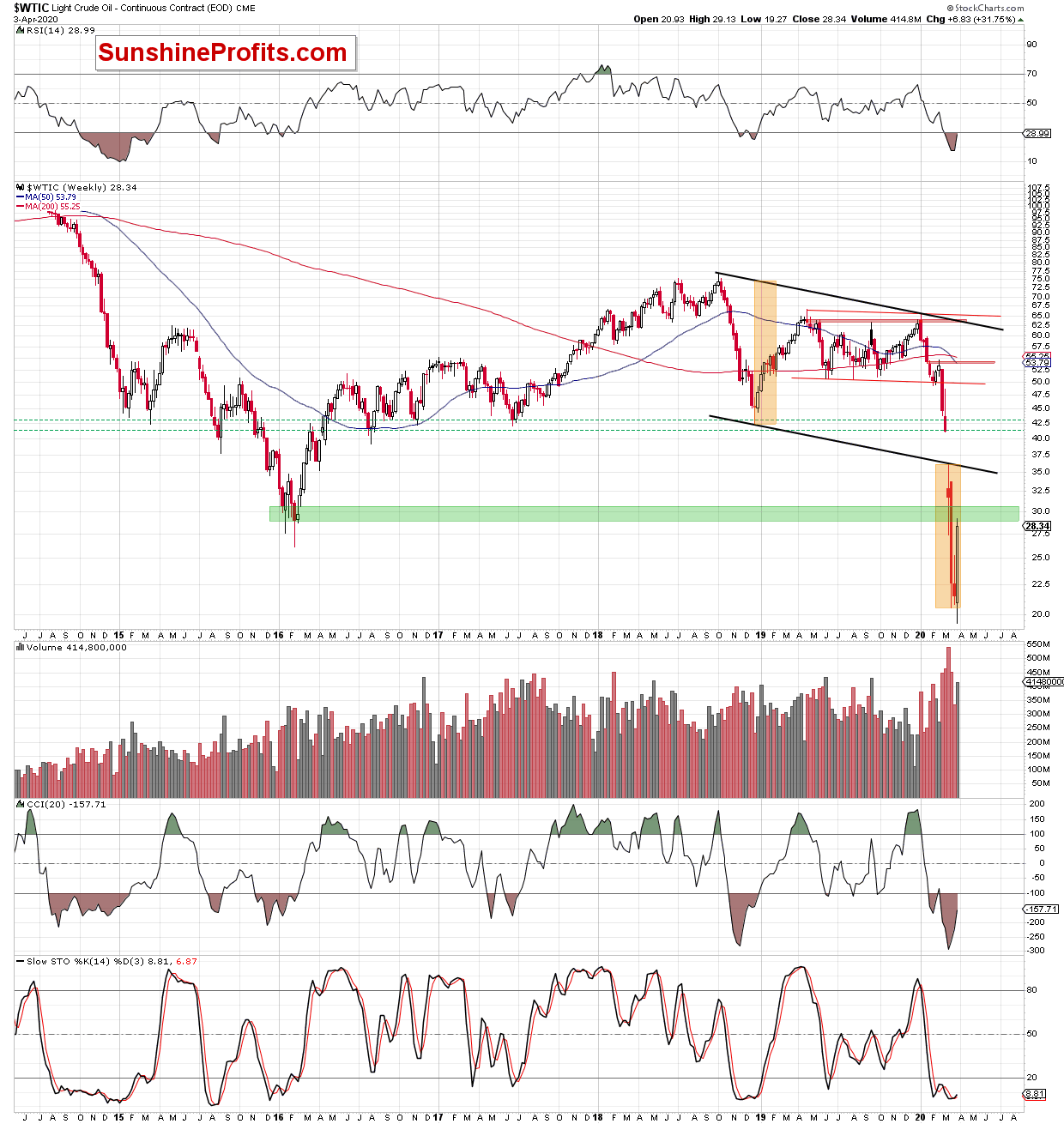

Let's start today's analysis looking at the long-term (chart courtesy of http://stockcharts.com and www.stooq.com ).

Looking at the weekly chart, we see that crude oil moved sharply higher in the previous week, which resulted in a climb to the previously broken green zone based on the early 2016 lows (in terms of weekly closing prices). This level now serves as resistance and could pause the bulls in the coming week.

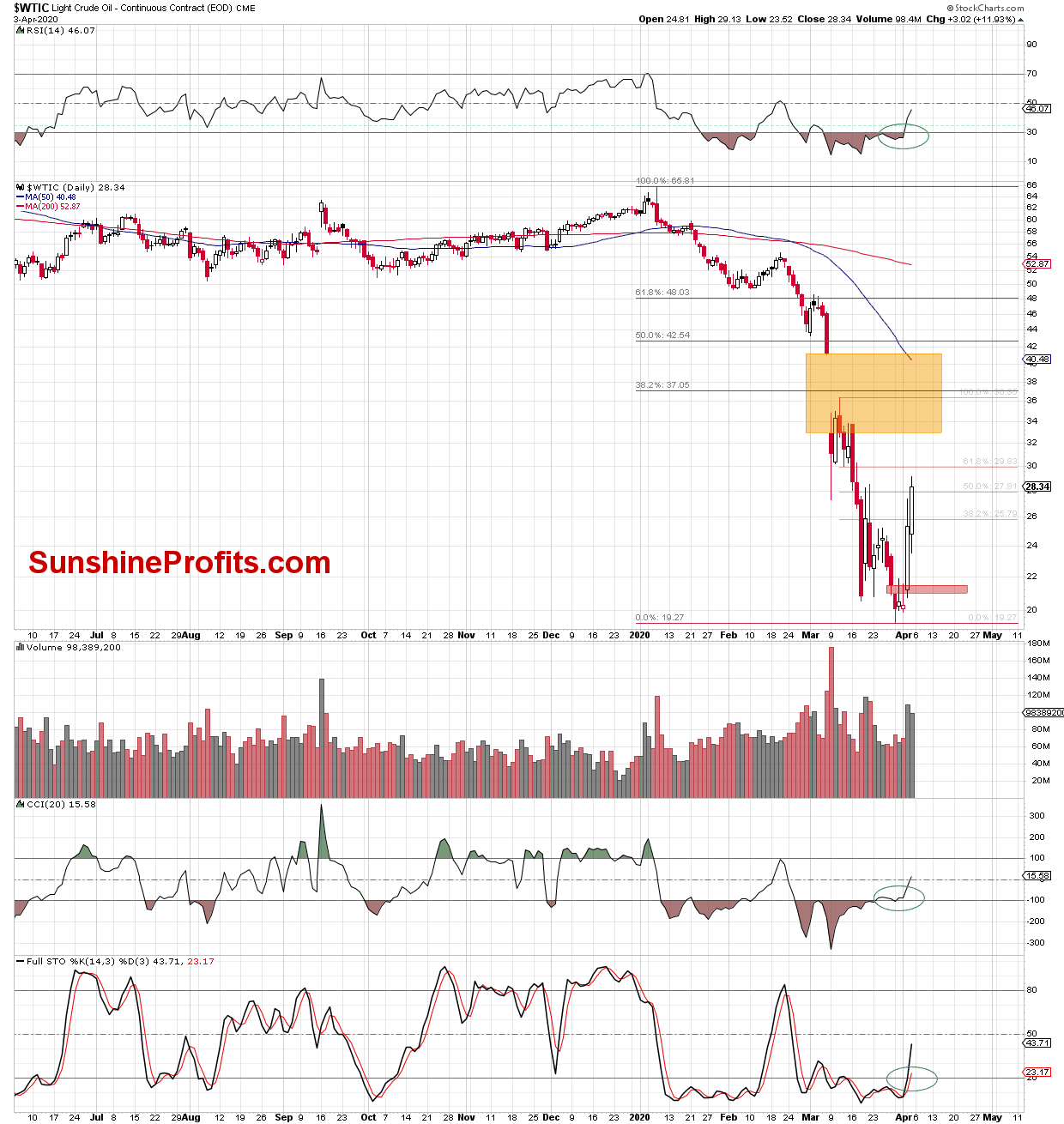

Additionally, when we take a closer look at the daily chart, we can notice that despite the last week's increase the commodity didn't even reach the 61.8% Fibonacci retracement based on the latest leg to the downside, which started on March 11, 2020.

The volume that accompanied Friday's upswing was lower than day earlier, which raises some doubts about the strength of the bulls. Nevertheless, we should also keep in mind that all daily indicators favor the buyers and further improvement.

How did all the above-mentioned technical factors affect investors' moods before today's session? Let's take a look at the chart below.

From this perspective, we see that crude oil futures opened this week with a quite big red gap, which serves now as the nearest short-term resistance. Therefore, as long as it remains open, a reversal from current levels and another attempt to move lower is very likely - especially when we factor in an invalidation of Friday's breakout above the upper border of the blue consolidation and the March 20 peak.

On top of that, when we zoom in our picture and focus on the 4-hour chart, we'll also see that thanks to today's gap, the futures invalidated the earlier breakout above the 50% Fibonacci retracement.

Additionally, the Stochastic Oscillator generated its sell signal, while the CCI is very close to doing the same. There is also a bearish divergence between the latter indicator and the price of the futures, which suggests that a reversal may be just around the corner.

Nevertheless, before summarizing today's Alert, we would like to consider what could happen if the bulls manage to close today's gap. In our opinion, even if the buyers show strength and push the futures higher, they will have to beat the nearest very short-term resistance - the 61.8% Fibonacci retracement at around $29.70.

If they win, the way to the next resistance area (around $32.70-$34.60) or even the 38.2% Fibonacci retracement (based on the entire January-March downward move) could be open.

Therefore, keeping an eye on today's closing price can determine further increases or decreases in the coming days. Stay tuned.

Summing up, it could be the case that crude oil's rally is already over, but it could also be the case that the very short-term outlook changes shortly. We are moving the stop-loss level a bit higher, to better align it with the short-term Fibonacci retracement level.

Trading position (short-term; our opinion): Trading position (short-term; our opinion): Short positions in crude oil (100% size of the regular trading position) are justified from the risk to reward point of view with $11.22 as the binding profit-take level, and with $30.23 as the stop-loss level.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager