Trading position (short-term; our opinion): Profitable short positions with a stop-loss order at $71.34 and the next downside target at $66 are justified from the risk/reward perspective.

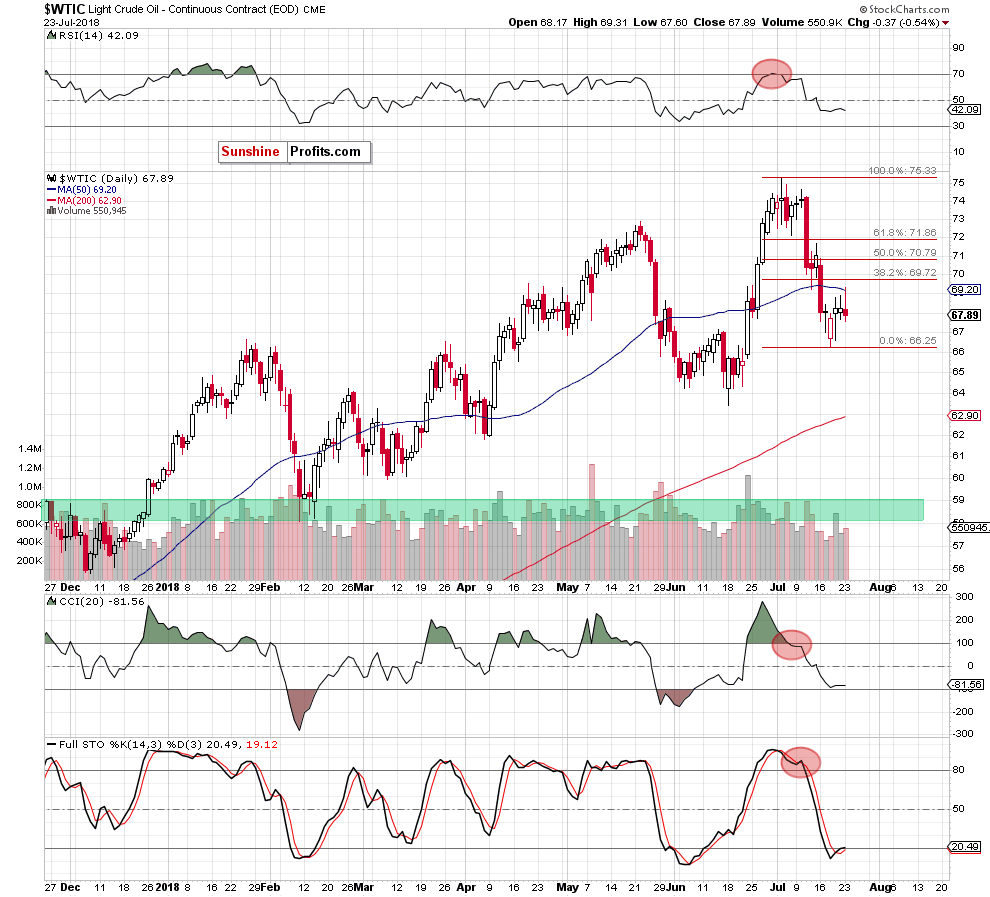

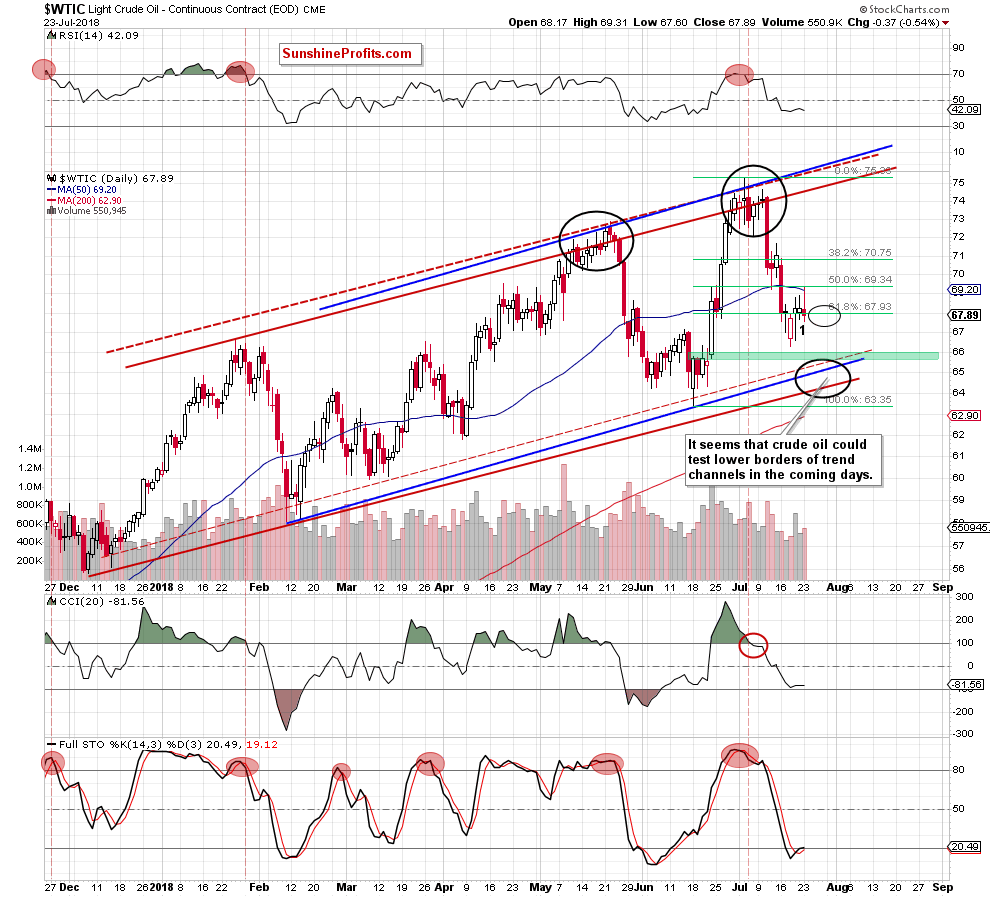

In yesterday’s Alert, we explained that crude oil is likely to move to its 50-day moving average and we didn’t have to wait long for the market to agree with us. Moreover, this MA was touched very briefly, and the black gold reversed and declined before the end of the session, thus forming a bearish reversal. That’s a classic sign pointing to further declines – will the regular interpretation be correct also this time?

For details, let’s take a closer look at the charts below (charts courtesy of http://stockcharts.com).

Technical Picture of Crude Oil

In our Monday’s Oil Trading Alert, we wrote the following:

(…) despite recent upswings, the commodity is still trading under the previously-broken 50-day moving average and the 38.2% Fibonacci retracement, which means that as long as there is no comeback above them, higher prices of light crude are not likely to be seen.

Nevertheless, the buy signal generated by the Stochastic Oscillator can encourage oil bulls to test the above-mentioned resistances before we see another move to the south.

If we see such price action and crude oil verifies the earlier breakdown, oil bears will receive an additional negative argument that will increase the probability of one more downswing to our downside target.

From today’s point of view, we see that the situation developed in tune with our assumptions and crude oil verified the earlier breakdown under the previously-broken 50-day moving average.

Despite yesterday’s upswing, oil bulls didn’t manage to test the 38.2% Fibonacci retracement, which suggests that their forces could already be exhausted and another bigger move to the south is just ahead of us.

If this is the case and the sellers extend yesterday’s losses, black gold will likely hit a fresh July low and test the support zone created by the lower borders of rising trend channels (marked with the black ellipse) in the coming days.

Finishing today’s alert, it is also worth noting that yesterday’s downswing materialized on higher volume than Friday’s upswing, which may be the first symptom that oil bears gathering strength before the next move to the downside.

Summing up, profitable short positions continue to be justified from the risk/reward perspective as the short-term outlook remains bearish, favoring the sellers and lower prices of crude oil.

Trading position (short-term; our opinion): profitable short positions with a stop-loss order at $71.34 and the next downside target at $66 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts