Trading position (short-term; our opinion): Short positions with a stop-loss order at $70.11 and the initial downside target at $62.85 are justified from the risk/reward perspective.

The price of crude oil declined early yesterday, only to move back up before the end of the session finally closing almost 0.5% higher. What are the implications of such reversal? Is the decline already over?

In short, there are no implications because reversals should be confirmed by significant volume and the one that accompanied yesterday’s “reversal” was relatively low. In fact, it was the lowest volume that we’ve seen this month. Big volume during a reversal means that there was a fierce battle between buyers and sellers and that the former won. This is what would make the outlook so bullish – if the bears had given their best and were still unable to trigger a decline, then the odds are that the overpowering strength of the bulls will keep pushing prices higher. Nothing like that happened yesterday. Instead, the market was still rather undecisive and this means that what we wrote previously remains generally up-to-date.

Technical Analysis of Crude Oil

Let's examine the chart below (charts courtesy of http://stockcharts.com).

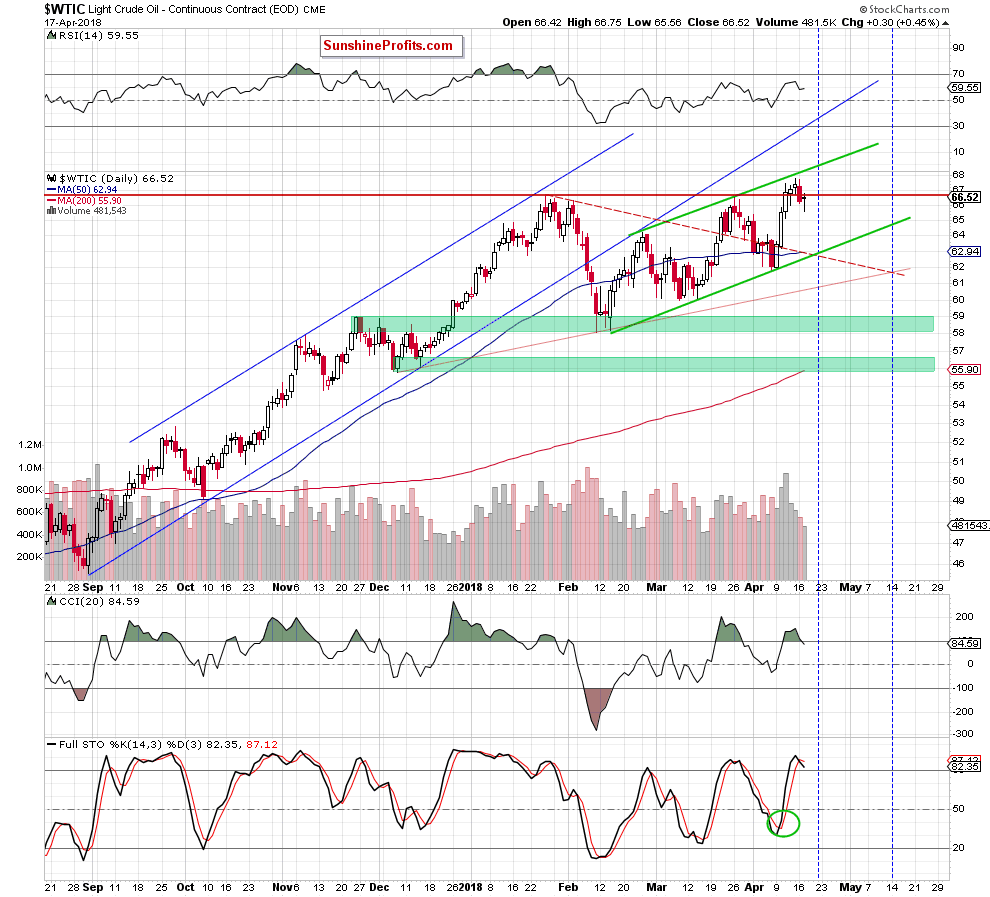

Looking at the daily chart, we see that the overall situation in the very short term hasn’t changed much as crude oil remains not only under the upper border of the green rising trend channel, but also below the previously-broken January peak.

Additionally, the sell signals generated by the indicators continue to support oil bears and lower prices of black gold.

Nevertheless, yesterday’s American Petroleum Institute’s report showed a surprising decrease in crude oil inventories (by 1 million barrels to 428 million barrels) and a reduction in oil product stocks (showed a drop of 2.5 million barrels in gasoline inventories, while distillate stocks fell by 854,000 barrels), which could trigger one more upswing later in the day – especially if the government’s data confirms these numbers.

On the other hand, there are often divergences between the API estimates and the official figures from the Energy Information Administration, which means that as long as there is no breakout above the upper line of the green rising trend channel, short positions continue to be justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts