Trading position (short-term; our opinion): Short positions (with the stop-loss order at $77.23 and the initial target at $71.27) are justified from the risk/reward perspective.

Crude oil rallied substantially earlier this week, but not yesterday. The price of black gold moved lower, invalidating the previous breakout above the July intraday high. Invalidations of breakouts are generally bearish phenomena. But was it also the case this time?

In short, yes. Let’s take a look at the chart for details.

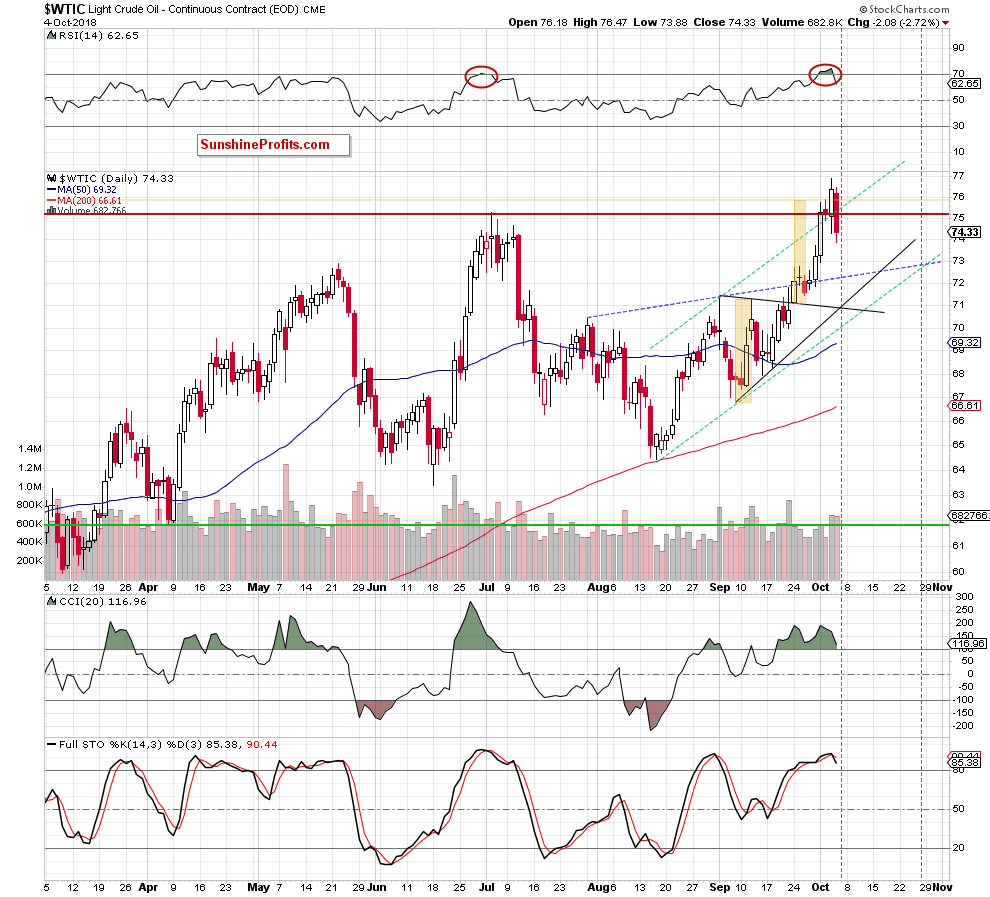

The price of crude oil declined substantially, and it invalidated more than the breakout above the July intraday high. It also moved back below the rising green resistance line. What is more important, crude oil just invalidated the small breakout above the 61.8% Fibonacci retracement level that’s based on the entire 2014 – 2016 decline.

Both: the retracement, and the decline that it’s based on are very important, which makes the resistance important as well.

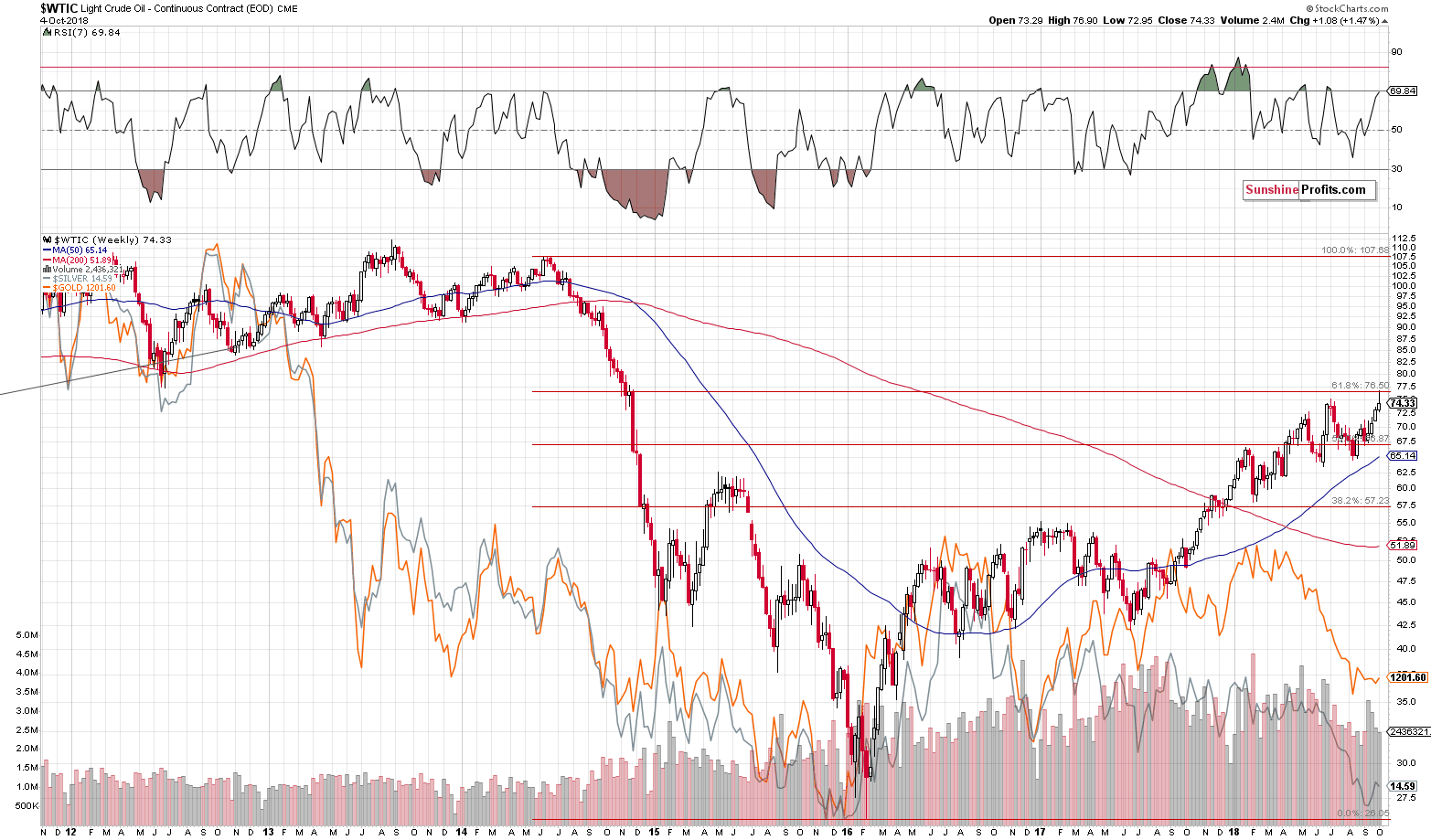

The weekly version of the RSI indicator moved to 69.84, which is close enough to the 70 level to be viewed as a sell signal. The daily RSI was above 70 and just moved back below it, thus confirming the bearish implications. The same goes for the Stochastic indicator, which just flashed a sell signal, while being above 80.

The last two times we saw a similar combination of signals from indicators was in early July and a quite sizable decline followed. This time, we have an additional bearish confirmation from the long-term chart, so a short position appears to be justified.

Summing up, the situation in crude oil deteriorated based on yesterday’s decline and in light of numerous bearish signs, it seems that opening speculative short positions is currently justified from the risk to reward point of view.

Trading position (short-term; our opinion): Short positions (with the stop-loss order at $77.23 and the initial target at $71.27) are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts