Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Looking at the crude oil’s behavior in the last days is hard to excite. Let’s be honest, it's even hard to count on a faster heartbeat as the price of black gold has been oscillating around $ 2 for almost a week. What must happen (from technical point of view) to finally trigger some action?

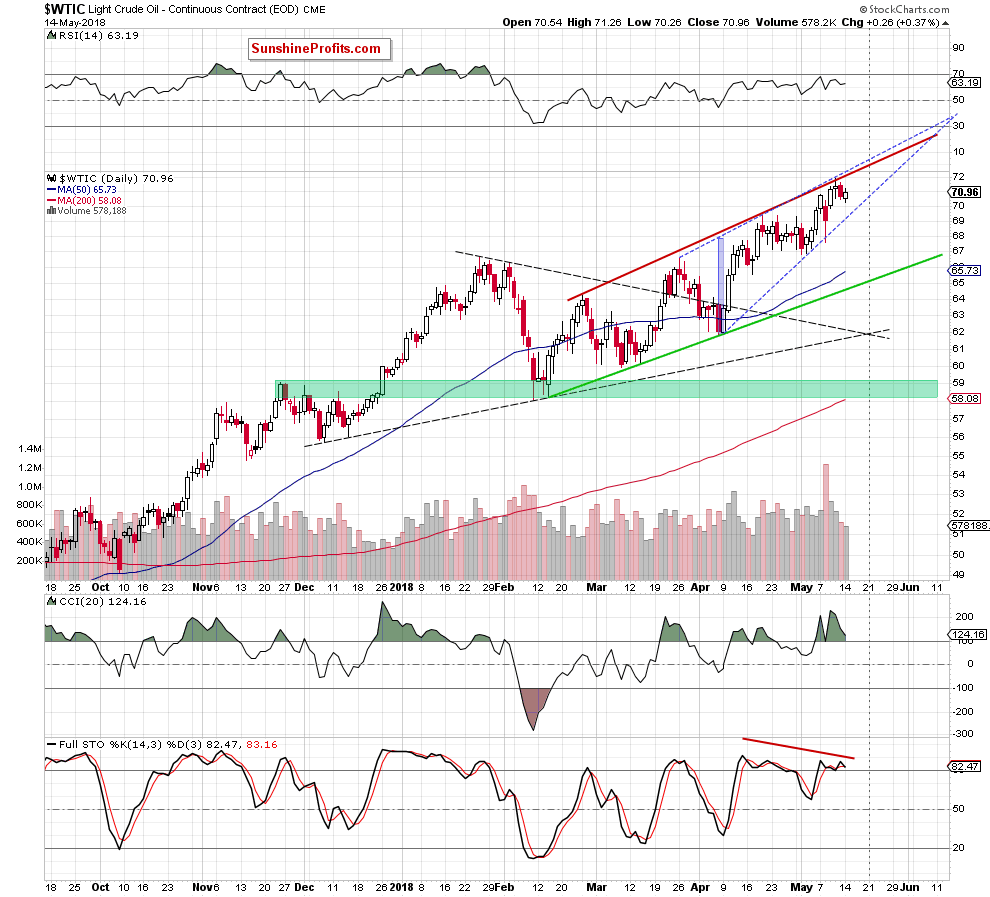

Let's take a closer look at the daily chart below (charts courtesy of http://stockcharts.com).

Looking at the above chart, we see that during yesterday’s session the price of the commodity extended losses after the market’s open, but then rebounded, erasing around 40% of the earlier decline.

Is this positive event? In our opinion, not really, because declining volume (for almost a week) suggests that investors have started to turn away from crude oil. This means that as long as we do not see a breakthrough light crude may still fluctuate in a fairly narrow price range inside the blue rising wedge.

Therefore, we believe that as long as there is no breakout above the upper border of the formation or a breakdown below the line of the wedge, another bigger move is not likely to be seen (until this time we will likely not decide to open any positions).

Nevertheless, taking into account bearish divergences and the current levels of the indicators (the CCI and the Stochastic Oscillator remains in their overbought areas almost since the beginning of the month), it seems that oil bears should finally show their claws in the coming week (maybe after reports on crude oil inventories).

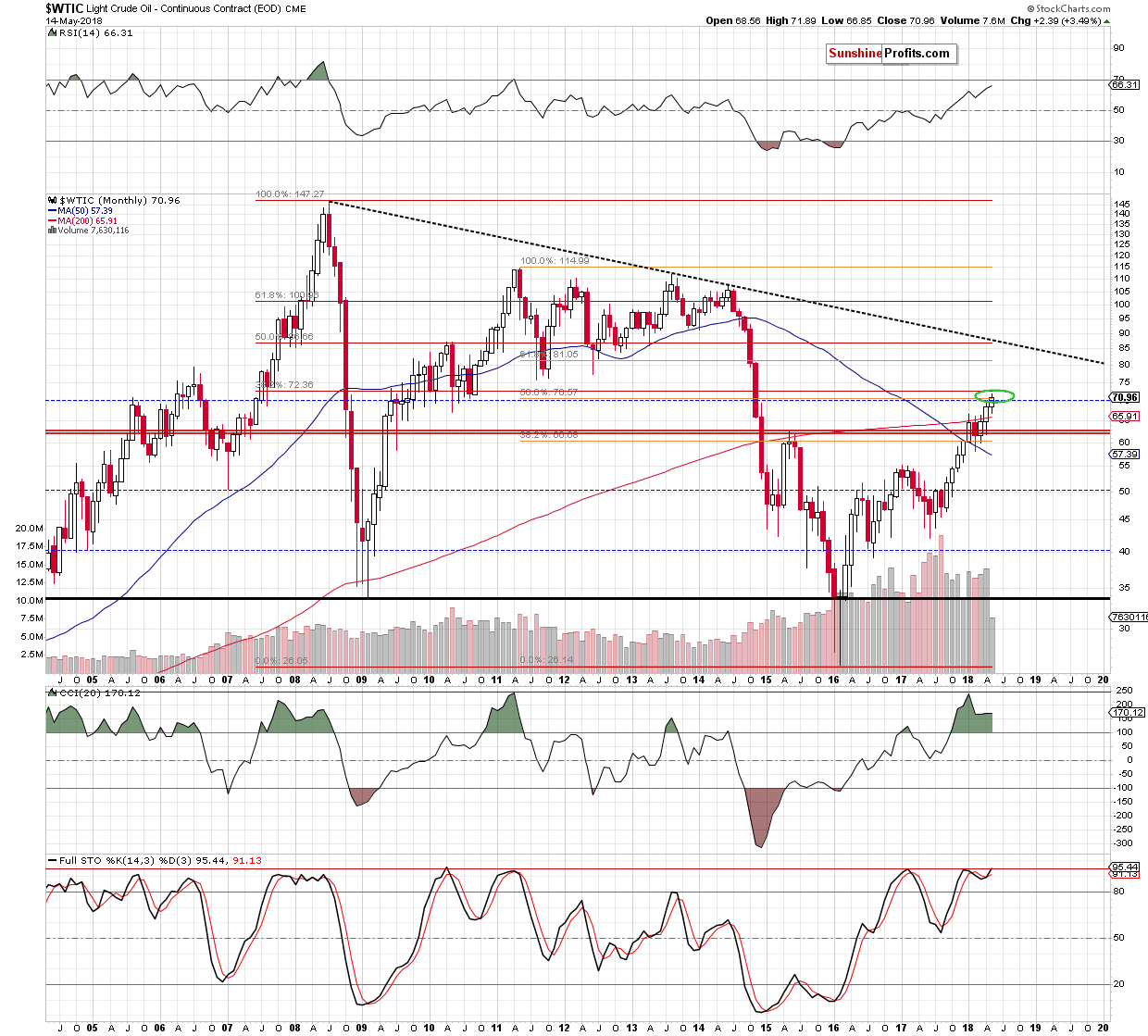

Why bears not bulls? Because the way to the north is currently blocked by the major resistance zone created by the 50% Fibonacci retracement based on the 2011-2016 downward move and the 38.2% Fibonacci retracement based on the entire 2008-2016 decline (we marked it with the green ellipse on the long-term chart below), which continues to keep gains in check since the beginning of the month.

Summing up, the overall situation in the very short term is too unclear to justify opening any positions now. However, if we see a breakdown under the lower border of the blue rising wedge, we’ll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts