Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Wednesday, crude oil gained 1.70% and approached the major short-term resistance zone for the third time. Will the well-known proverb: “third time lucky” work in favor of the buyers? Or maybe it will encourage their rivals to act…

Let’s examine the charts below (charts courtesy of http://stockcharts.com).

Technical Picture of Crude Oil

In our Wednesday’s alert, we wrote the following:

(…) yesterday’s upswing materialized on bigger volume than Monday’s drop and the Stochastic Oscillator re-generated the buy signal, suggesting that another attempt to move higher may be just around the corner.

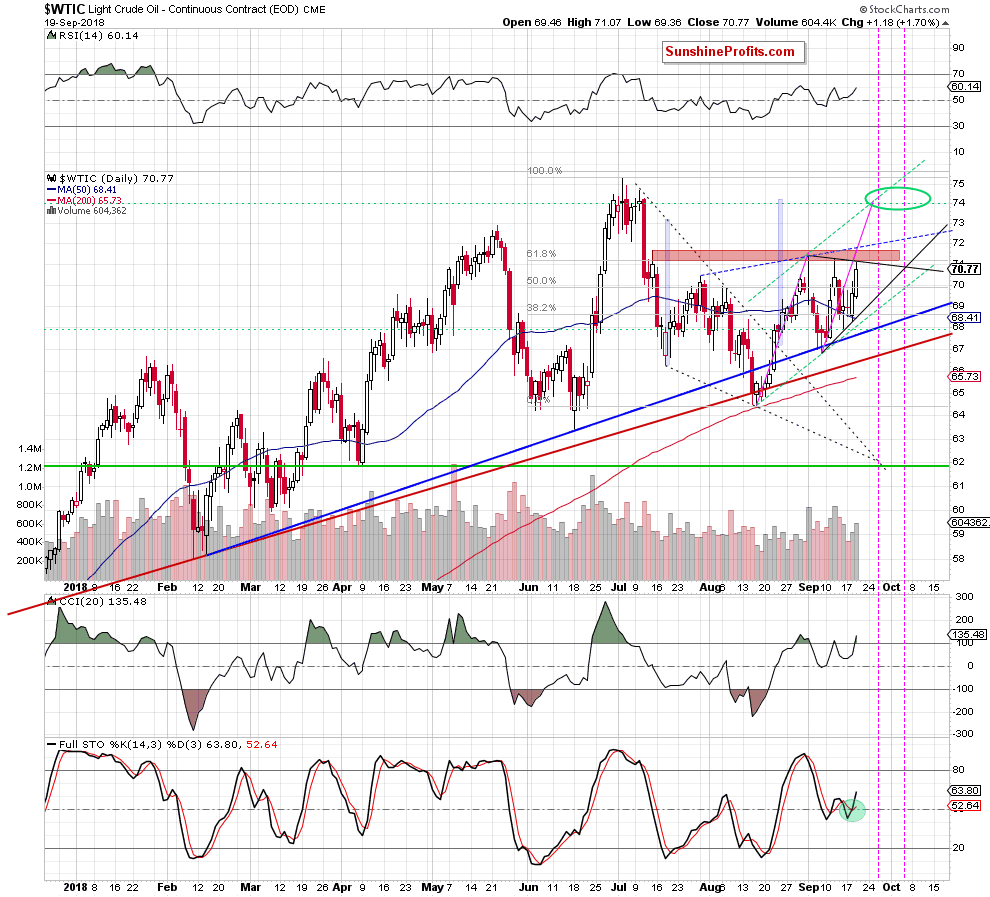

From today’s perspective, we see that the situation developed in tune with our assumptions and the price of light crude increased once again, almost touching the major resistance zone marked with red.

Thanks to this upswing, the commodity also increased to the very short-term back resistance line based on the previous highs, which is the upper border of the black triangle (the lower border of the formation is created by the black support line based on the recent lows). All the above, suggests that another bigger move will be more likely and reliable only if crude oil climbs above all these resistances.

Such situation doesn’t look encouraging from the bulls’ point of view – especially when we factor in the fact that yesterday’s intraday high was lower than September 12 peak, which was also lower than the September 4 high. Three lower peaks in a row suggest that bulls may lose their strength and the next move to the south is just around the corner.

Taking all the above into account, we think that closing our long positions and taking profits off the table (as a reminder, we opened them when crude oil was trading at around $67.90) is the best decision at the moment.

Nevertheless, if oil bulls show strength and manage to push the price of black gold above the neck line of the potential reverse head and shoulders pattern, we’ll likely re-open long positions on the following day. As always, we’ll keep you - our subscribers - informed should anything change.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts