Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Tuesday, oil bulls pushed the commodity higher (crude oil gained 0.57%), but what does it really mean for the price of black gold in the coming days?

Let’s analyze the very short-term changes and try to find out to this question (charts courtesy of http://stockcharts.com/).

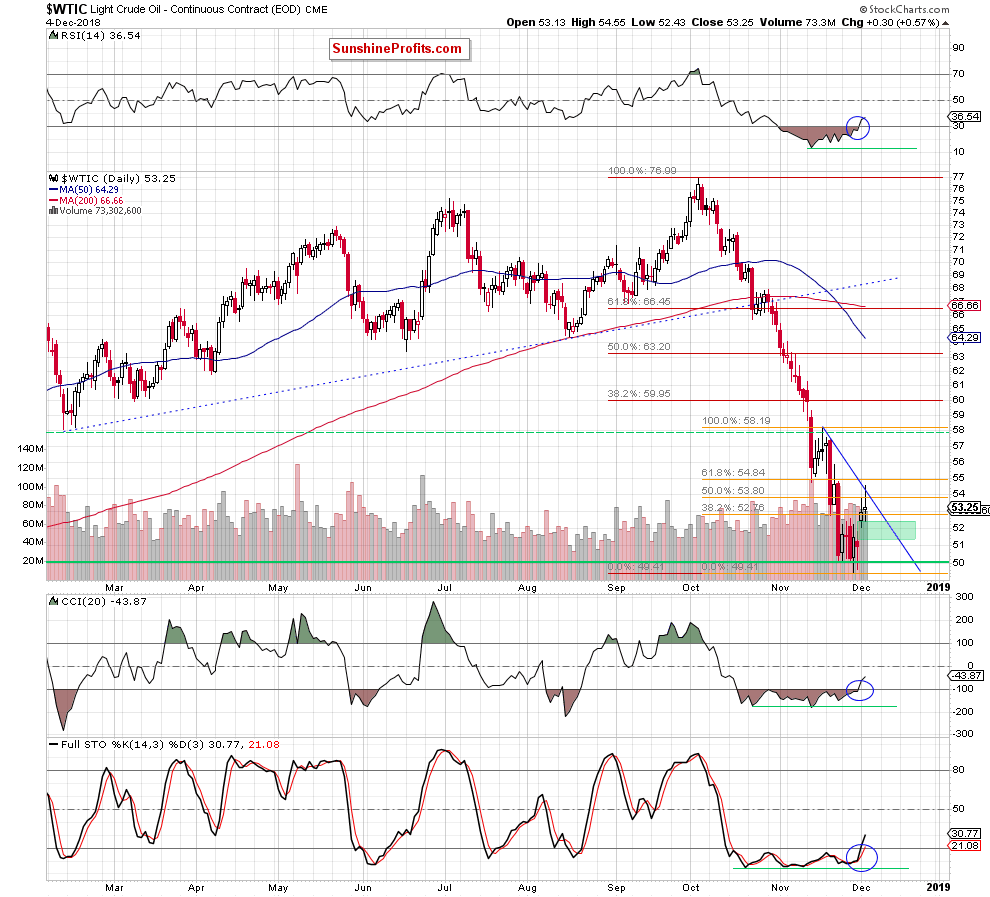

Today’s alert will be quite short as basically nothing changed in the short term. On the daily chart, we see that although crude oil moved higher during yesterday’s session, the blue resistance line based on recent highs stopped the buyers, triggering a pullback.

Thanks to this drop, the commodity invalidated the earlier tiny breakout above this resistance and the 50% Fibonacci retracement (for the second time in a row), which shows that as long as there is no successful breakout above these resistances higher prices of black gold are not likely to be seen – especially when we take into account all technical factors about which we wrote in our last alert. Therefore, if you haven’t had the chance to read yesterday’s alert, we encourage you to do so today - it’s up-to-date:

Time for Higher Prices of Crude Oil?

As always, we’ll keep you - our subscribers - informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts