Trading position (short-term; our opinion): Short positions (with the stop-loss order at $68.15 and the initial downside target at $56.57) are justified from the risk/reward perspective.

On Monday, black gold moved a bit higher, but the major short-term resistance continues to keep gains in check. What does it mean for the short-term technical picture of the commodity?

Crude Oil’s Technical Picture

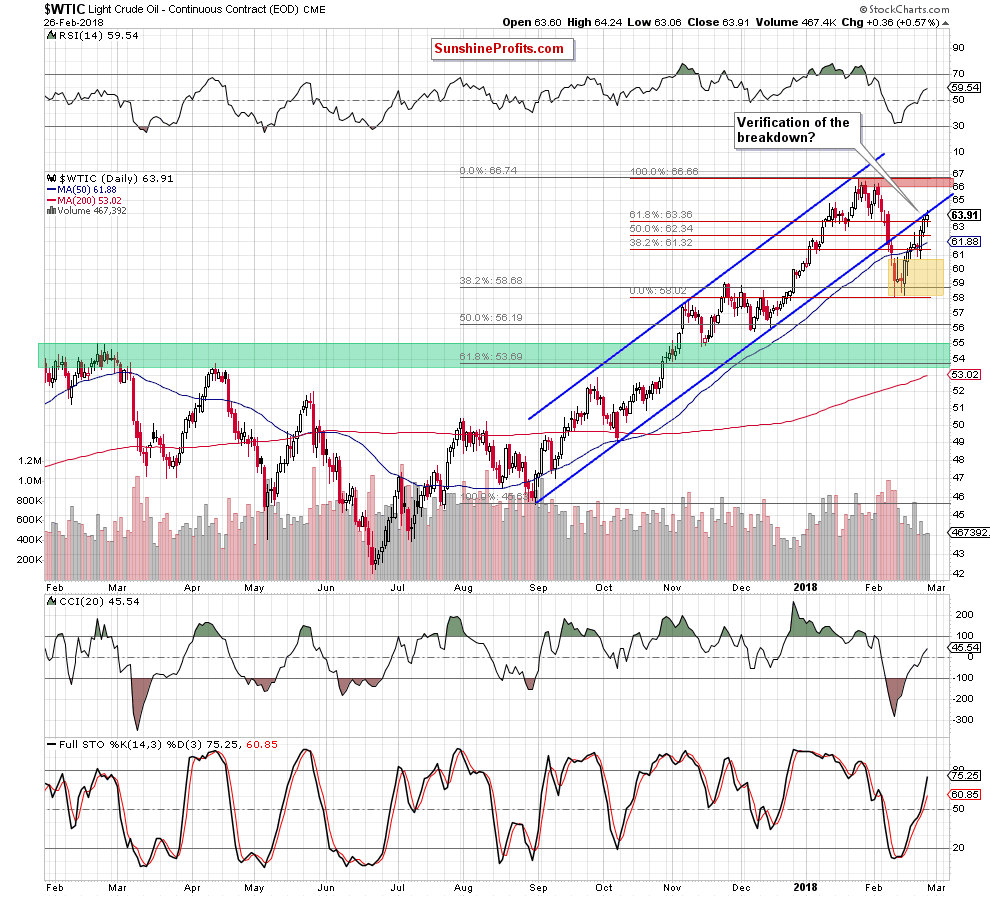

Let's take a look at the chart below (charts courtesy of http://stockcharts.com).

From today’s point of view, we see that although crude oil moved slightly higher yesterday, the ovrall situation in the short term hasn’t changed much as the previously-broken lower border of the blue rising trend channel continues to keep gains in check.

Such price action looks like a verification of the earlier breakdown, whih means that what we wrote yesteday remains up-to-date also today:

(…) This scenario is also reinforced by the volume, which accompanied recent increases. As you see on the charts, last week’s upward move materialized on visibly lower volume (compared to what we saw a week earlier) – (…), which increases doubts about the strength of the demand side and suggests that reversal is just around the corner.

If this is the case and black gols declines from current levels, we’ll see a downward move to at least February lows. However. whe we factor in the sell signals generated by the weekly indicators, it seems that crude oil could go even lower in the coming month.

Finishiing today’s alert please keep in mind what we wrote on Friday about pro-bearish fundamental facors:

Fundamental Factors and Black Gold

In our opinion, the pro-bearish scenario is also reinforced by the fundamental factors. Yesterday’s EIA data showed that the U.S. output remains above 10 million barrels per day, which keeps domestic production on track to meet the earlier estimate for an increase to 11 million barrels per day in late 2018. If American drillers will not let down, the U.S. will overtake Russia in crude oil production and become the largest global supplier. Such development will likely not please Saudi Arabia and may thwart OPEC efforts to reduce black gold’s stockpiles, increasing worries over another crude oil glut. In such an environment oil bulls could have problems keeping the price not only above $60, but also above the psychological barrier of $50.

Analyzing the current situation in the markets, we also came to the conclusion that the bulls will likely gain an additional enemy in the near future - the strengthening dollar.

(…) Relationship Between Crude Oil and U.S. Dollar

Summing up, taking all the above-mentioned factors into account, we believe that short positions continue to be justified from the risk/reward perspective. As always, we’ll keep you - our subscribers - informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts