Trading position (short-term; our opinion): Full (150% of the regular size of the position) short position with the stop-loss order at $74.10 and the next downside target at $68.51 is justified from the risk/reward perspective.

Although oil bulls triggered a rebound during Friday’s session, their opponents defended the previously-broken support/resistance level and caused a pullback. Is this a preview of further declines in the coming week?

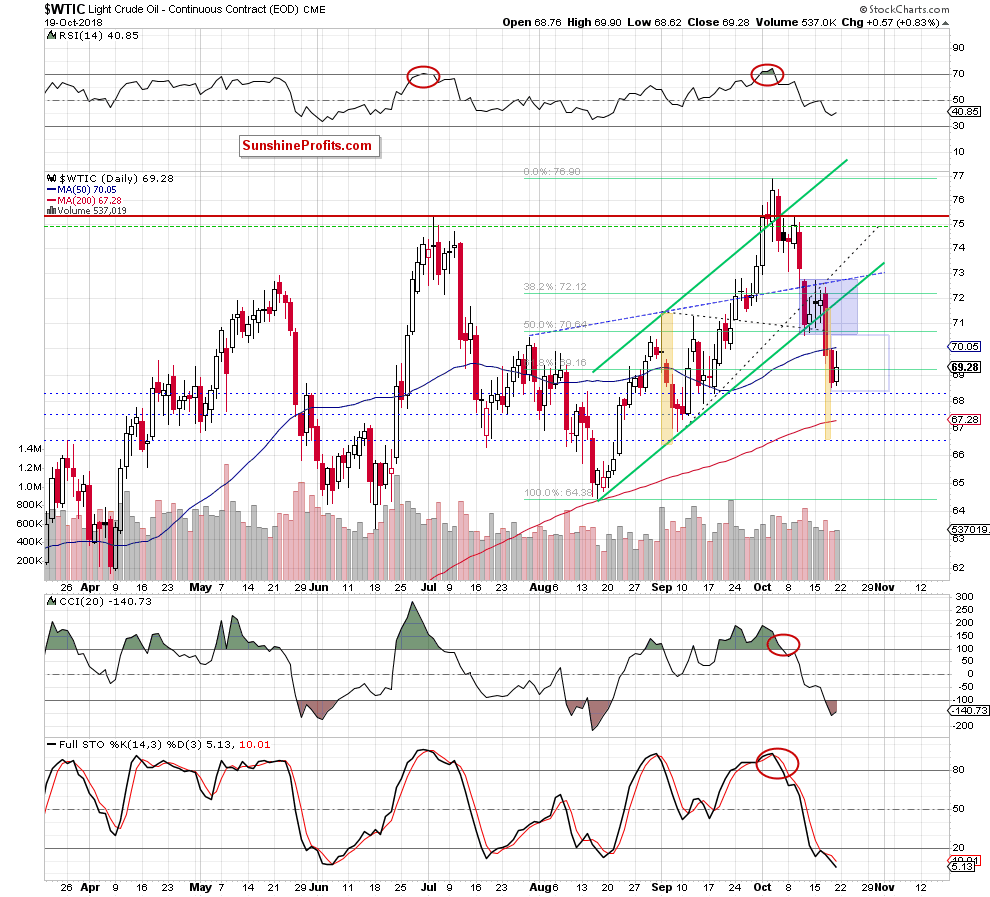

Let’s take a look at the chart below (charts courtesy of http://stockcharts.com).

Looking at the daily chart, we see that crude oil rebounded a bit and climbed to the previously-broken 50-day moving average and the 61.8% Fibonacci retracement on Friday. Despite this move, the commodity pulled back before the session’s closure and finished the day slightly above the retracement, but below the moving average.

Such price action looks like a verification of the earlier breakdown, which together with the lack of the buy signals suggests that another attempt to move lower is just around the corner.

Connecting the dots, we believe that we’ll see a realization of the pro-bearish scenario about which we wrote in our Thursday’s Oil Trading Alert:

(…) How low could light crude go in the coming days?

In our opinion, the next downside target will be around $68.51, where the size of the downward move will correspond to the height of the blue consolidation. Nevertheless, taking into account the breakdown under the lower border of the green rising trend channel, it seems that we could see a decline to around $67.55 (to lows created around September 10, 2018) or even to around $66.55, where the size of declines will be equal to the height of the green channel.

Summing up, profitable short position continues to be justified from the risk/reward perspective as crude oil verified the earlier breakdown, increasing the likelihood of further deterioration in the coming week.

Trading position (short-term; our opinion): Full (150% of the regular size of the position) short position with the stop-loss order at $74.10 and the next downside target at $68.51 is justified from the risk/reward perspective. As always, we’ll keep you - our subscribers - informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts