Trading position (short-term; our opinion): None positions are justified from the risk/reward perspective.

On Thursday, crude oil verified the earlier breakdown under the support zone, which opened the way to the previously-broken barrier of $60. Will oil bears be strong enough to push the commodity below it in the coming days?

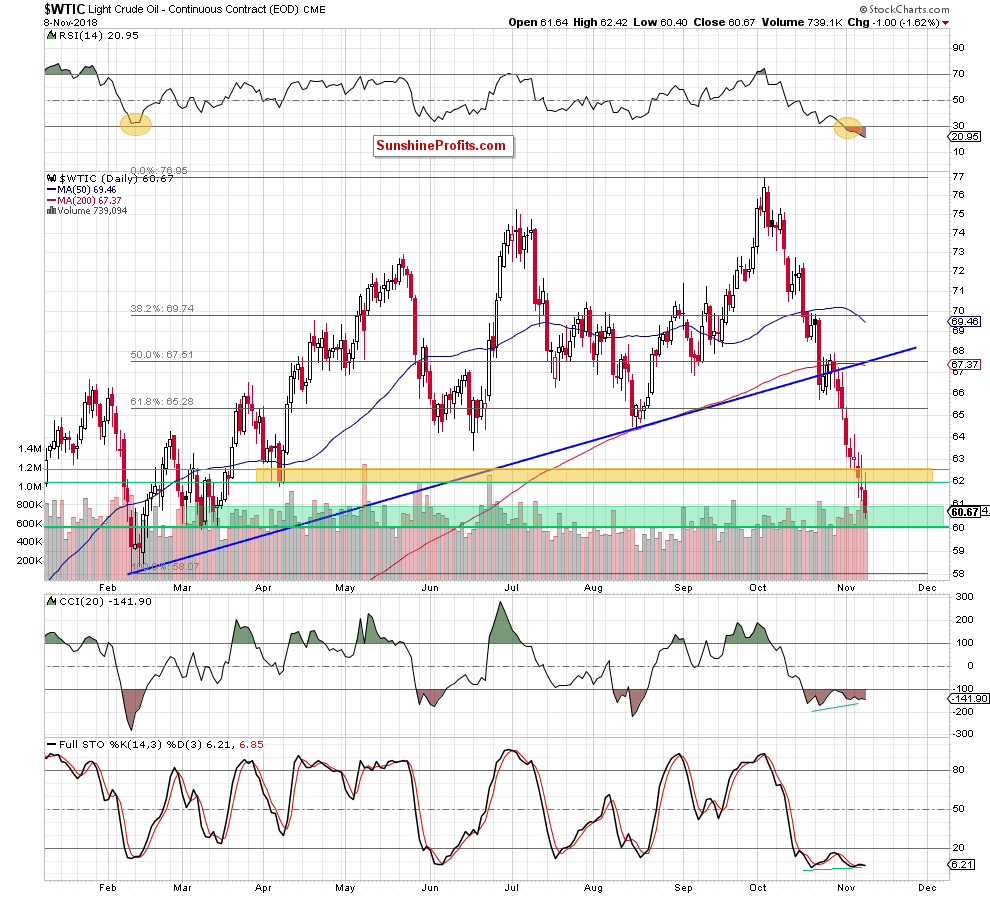

Let’s take a look at the chart below (charts courtesy of http://stockcharts.com).

Looking at the daily chart, we see that crude oil increased a bit after Thursday’s market’s open, but the previously-broken yellow zone stopped the buyers, triggering another move to the downside.

Thanks to this decline the price of black gold slipped to the green support zone, which means that our yesterday’s commentary on the commodity remains up-to-date also today:

(…) the buyers lost their last technical support, which increases the probability that we’ll see a test of the green support zone or even the barrier of $60 (the lower line of this support area) in the coming days.

Nevertheless, earlier today, crude oil futures slipped under the barrier of $60, which suggests that light crude will likely follow them after today’s markets’ open.

How low can black gold go if the above-mentioned barrier fails to withstand the pressure of the sellers? Let’s take a look at the medium-term chart.

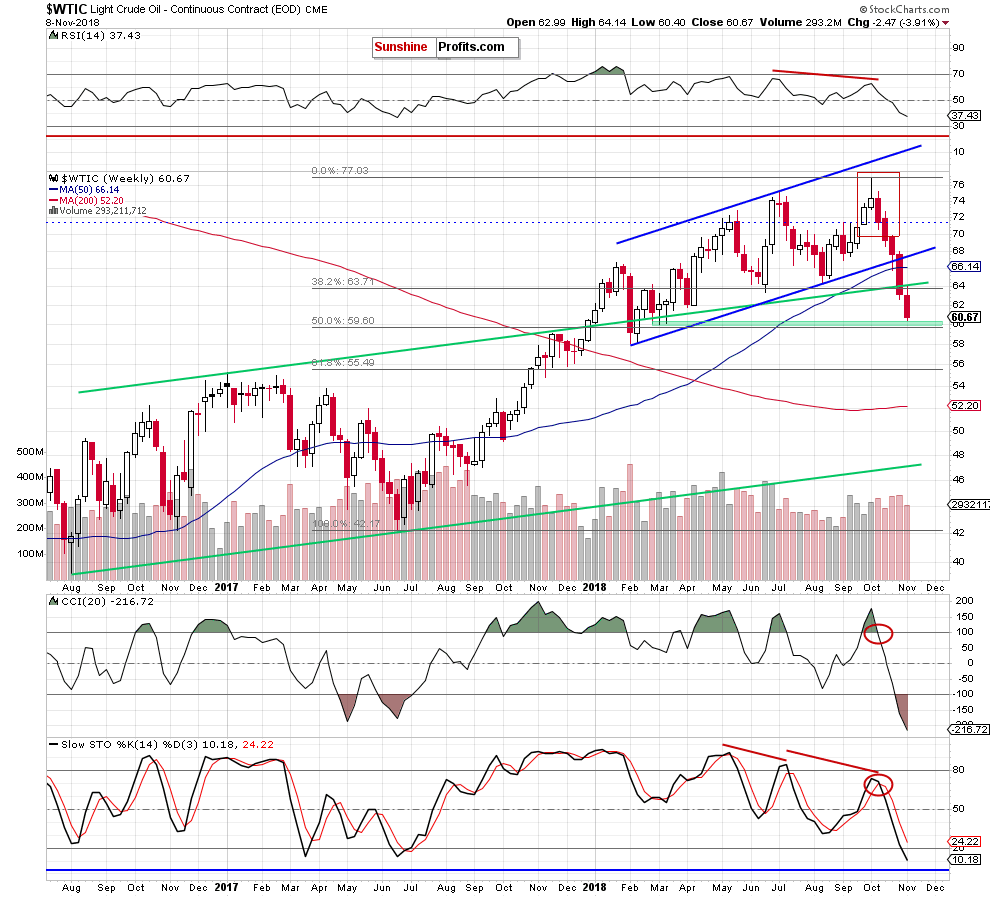

From this perspective, we see that if the commodity extends losses, the next downside target will be the green support area created by the March low and the 50% Fibonacci retracement around $59.60-$59.95. However, if this zone is broken, oil bears will likely test February lows around $59.

Trading position (short-term; our opinion): none positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts