Trading position (short-term; our opinion): Short positions with a stop-loss order at $70.96 and the initial downside target at $63.64 are justified from the risk/reward perspective.

Although black gold moved a bit higher during yesterday’s session, the overall situation in the very short term doesn’t spoil any side of the oil market as crude oil is still trading in a narrow range (smaller than $3) between the April high and the early 2018 peaks. Who will take control in the coming days?

Let's take a look at the charts below (charts courtesy of http://stockcharts.com).

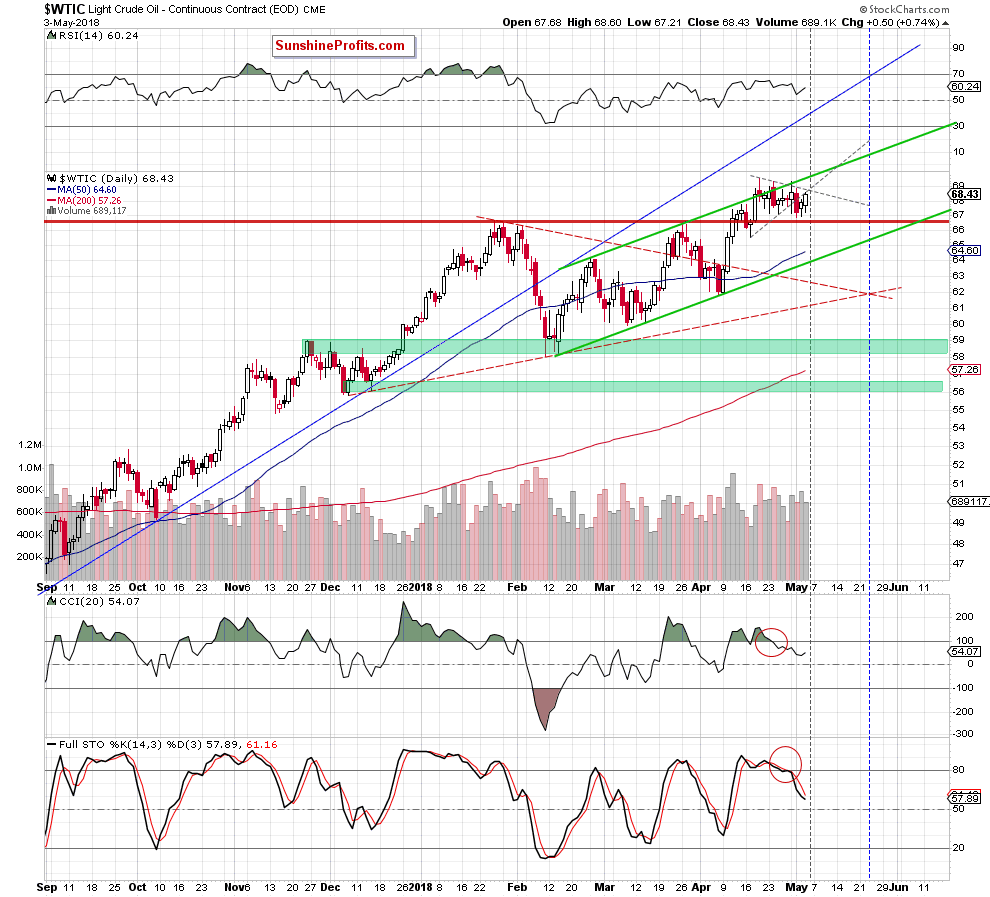

Looking at the daily chart, we see that although oil bulls pushed the commodity higher, light crude remains under the grey dashed line (the lower border of the grey triangle), which in combination with the smaller volume during yesterday’s session and the sell signals generated by the daily indicators, means that what we wrote in our last Oil Trading Alert is up-to-date also today:

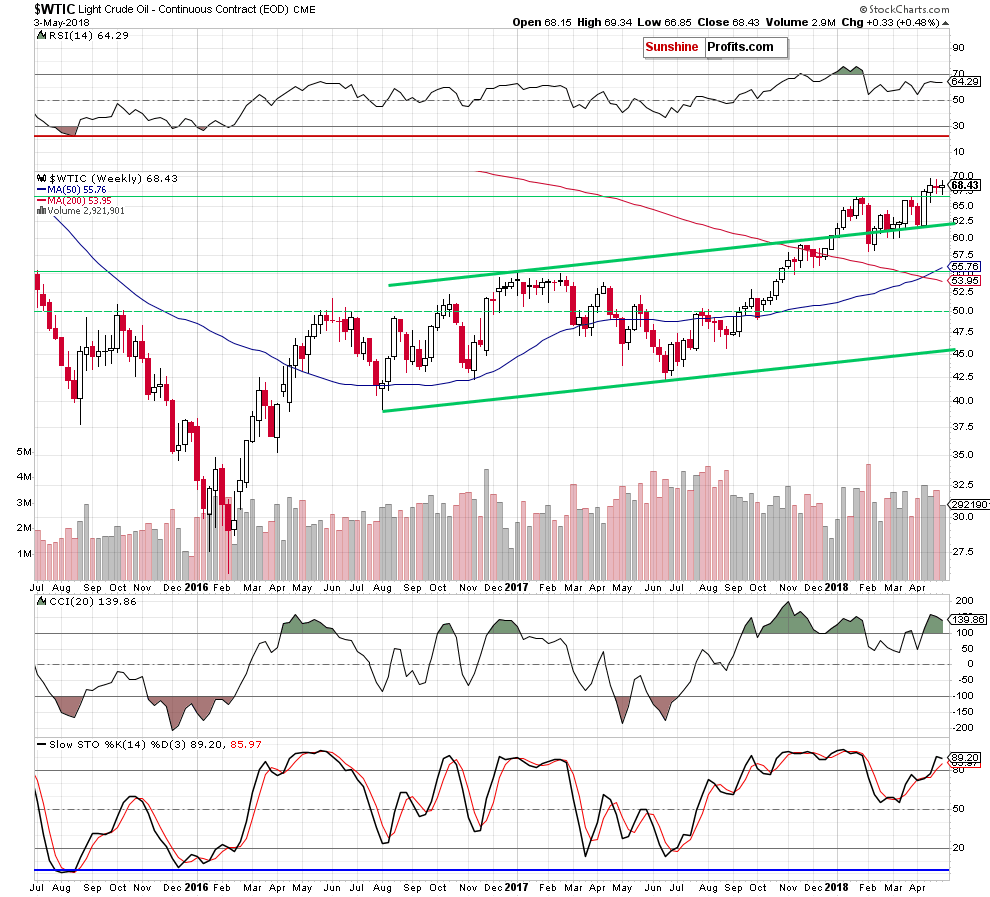

(…) black gold is trading in a narrow range (smaller than $3) between the April high and the early 2018 peaks. Such behavior of the commodity indicates uncertainty among investors about the direction of the next bigger move, which is clearly seen on the weekly chart below, where the recent price action is going to create another doji candlestick.

Returning, however, to the daily chart… we see that although oil bears approached the early 2018 peaks on Tuesday, raising hopes for a breakthrough, their yesterday's attack on this area ended with another failure.

Such behavior raises some concerns about their strength and the possibility of initiating a bigger decline in the very near future - especially when we take into account the fact that they have quite a lot of favorable factors on their side (we wrote more about them in our Tuesday’s alert).

Similar lack of power we could observe around the barrier of $60 at the beginning of March, where crude oil tested this support for almost two weeks. Back then, their opponents also didn’t have too many arguments on their side (apart from the previously broken upper border of the green rising trend channel) and yet they managed to push back the attack of sellers and took black gold to a fresh 2018 high.

Will we see something similar in the coming days? Size of volume, which accompanied yesterday’s increase suggests that oil bulls will at least try to go higher later in the day. If this is the case, we may see a test of the upper border of the grey triangle (marked with dashed lines on the daily chart) or even the recent highs and the upper border of the green rising trend channel (seen on the daily chart).

Such price action would be in line with the sideway trend concept (in which the price moves up and down until the breakout or breakdown) and the pro-bearish scenario that assumes a reversal during tomorrow’s session (based on the triangle apex reversal pattern about which we also wrote on Tuesday).

Taking the above into account, we decided to give the bears one more chance to show off their strength in the coming days (having the strong resistances marked on the long- and medium-term charts of the WTIC:UDN ratio in mind). Nevertheless, if they disappoint us once again, we’ll consider closing short positions.

As always, we’ll keep you - our subscribers - informed should anything change.

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $70.96 and the initial downside target at $63.64) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts