Trading position (short-term, our opinion; levels for crude oil’s continuous futures contract): No positions are currently justified from the risk/reward point of view.

Crude oil continues to trade near the $72 price level. The market rebounded from last Tuesday’s local low of $65.01, but it keeps on struggling after reaching the resistance level of the previous local lows around $71-72.

Yesterday’s U.S. API Weekly Crude Oil Stock release has been at -4.728M vs. the expectations of -3.433M. This figure shows how much crude oil, gasoline and distillates stock is available in storage. So, a bigger than expected decline in inventories implies greater demand and is bullish for oil prices. However, the overall uncertainty ahead of today’s FOMC Statement release (2:00 p.m. Eastern Time) led to a more sideways trading action – not only for oil, but also for stocks and the precious metals.

Oil Still at $72 Price Level

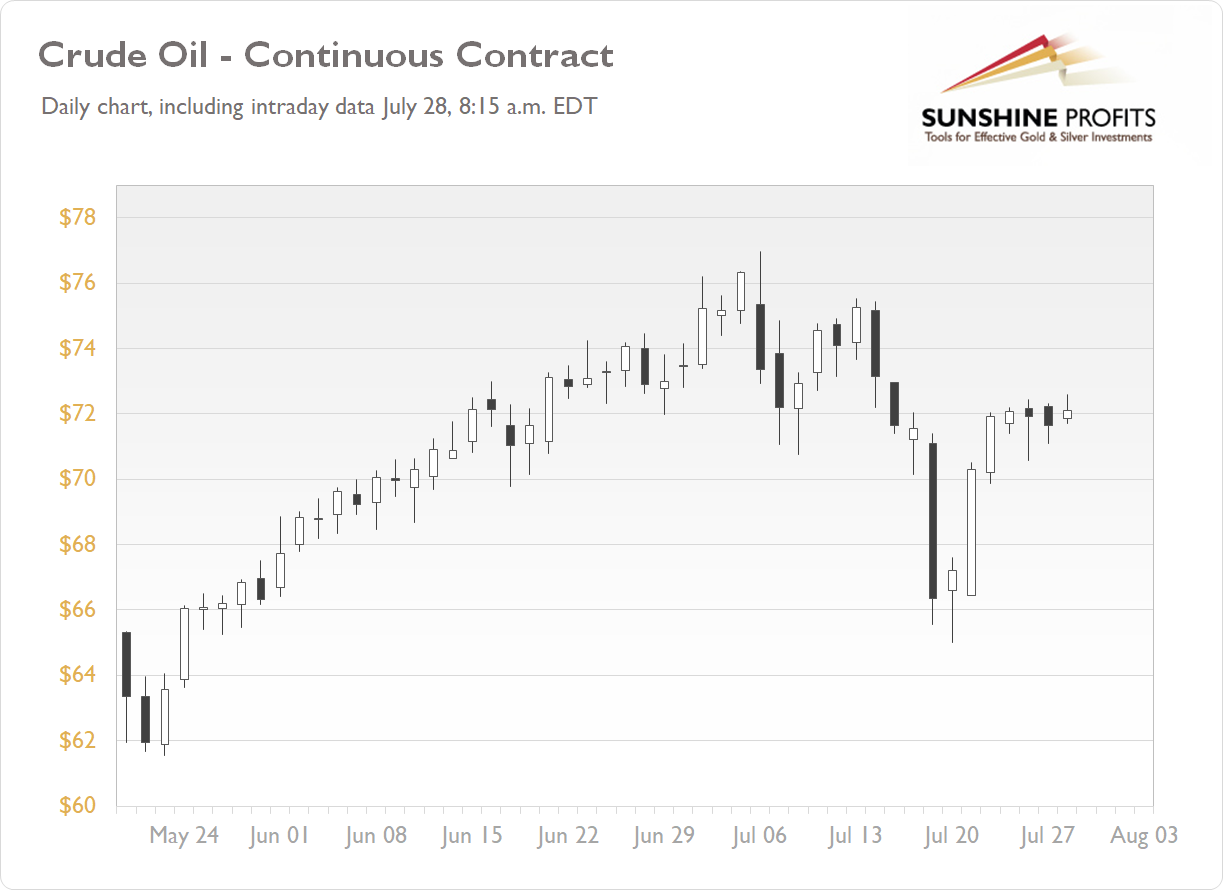

The market broke below the technical support level of $70-72 recently, and then it reached $65. Afterward, we’ve seen a quick rally back, but, so far, it looks like a short-term upward correction within a downtrend. Oil is trading along its late June’s local lows of about $72, as we can see on the daily chart (the graph includes today’s intraday data):

Struggling at Resistance Levels

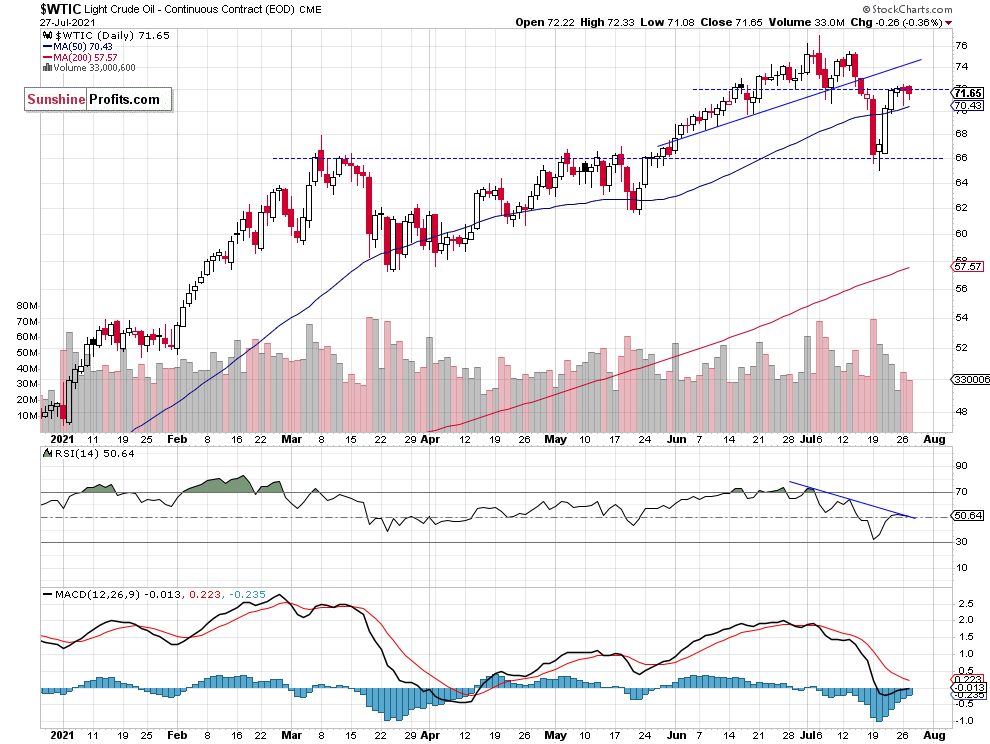

The market continues trading below its over month-long upward trend line after bouncing back from the support level at $65-66. The previous local lows and the abovementioned broken trend line are acting as resistance levels, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Let’s take a look at the daily chart of the United States Oil Fund ETF (USO). It pretty much resembles the Crude Oil chart. The price is at the broken upward trend line and the resistance level is at around $51, marked by the previous local highs:

Conclusion

On Thursday we closed our profitable long position (with an entry at $68.50-69.00) at the market price of $71.70 (a gain of $2.70-3.20). Oil has been trading near the resistance level of $72 since then, but there have been no confirmed negative signals so far. Therefore, no positions are justified from the risk/reward point of view.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for crude oil’s continuous futures contract): No positions are currently justified from the risk/reward point of view.

Thank you.

Paul Rejczak,

Oil Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care