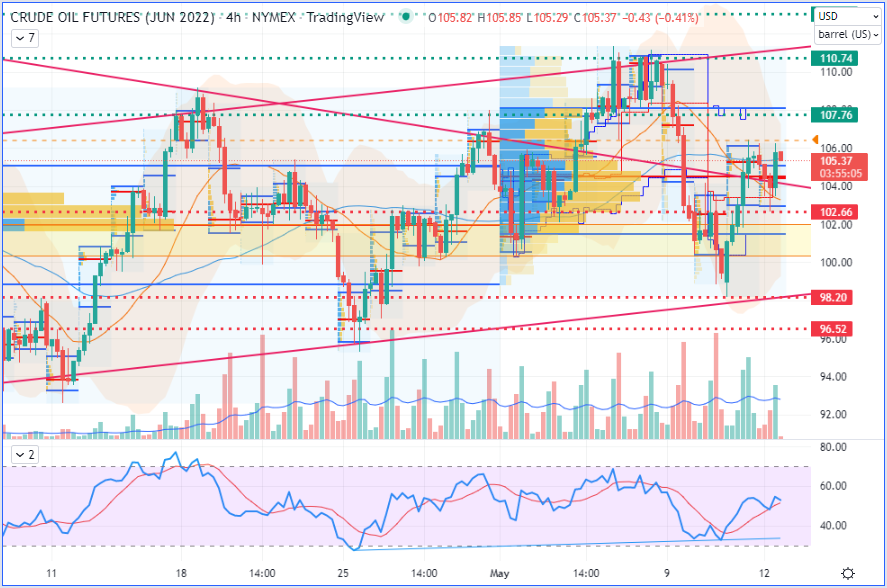

Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- WTI Crude Oil [CLM22] Long around the $100.28-101.99 support area (yellow band) with stop just below $96.52 and targets at 107.76, 110.74 & 113.07.

Trade status update: entry triggered – stop lifted on Wednesday just below 98.20 – stop to be lifted just below $102.66 now, turning it into a stop-win (above breakeven).

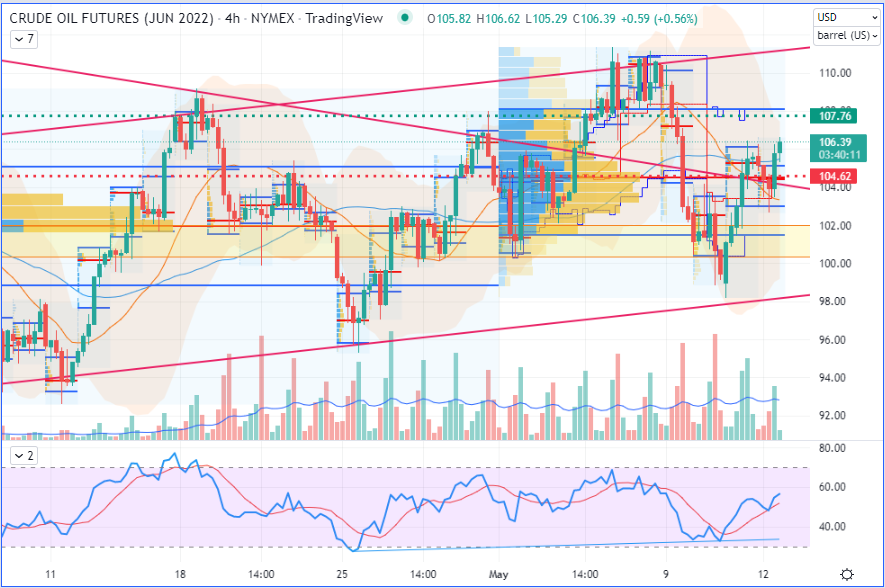

EDIT: As I am writing these few lines, the market just spiked above yesterday’s high ($106.44), so right now I am dragging my stop up again, just below $104.62 (as shown in the very last 4H chart).

WTI Crude Oil (CLM22) Futures (June contract, daily chart)

WTI Crude Oil (CLM22) Futures (June contract, 4H chart)

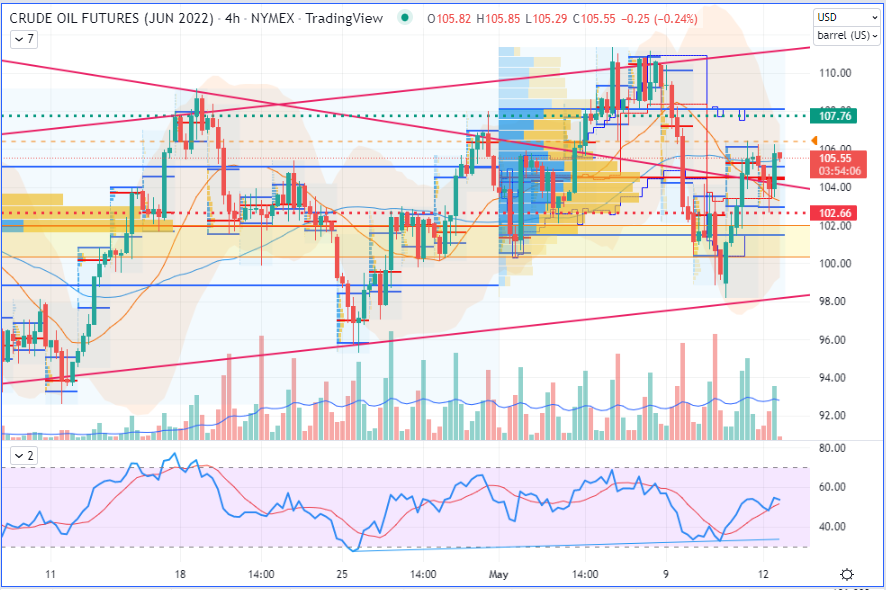

As usual, I have left previous stops (red dotted lines) and targets (green dotted lines) on the charts, so here are cleaner views of them with just the dragged stop and the next (1st) target:

WTI Crude Oil (CLM22) Futures (June contract, daily chart)

WTI Crude Oil (CLM22) Futures (June contract, 4H chart)

WTI Crude Oil (CLM22) Futures (June contract, 4H chart) – Newest stop level!

Read more: Article about one of my risk management methods.

That’s all, folks, for today. Have a nice day and happy trading!

As always, we’ll keep you, our subscribers well informed.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist