Trading position (short-term; our opinion): Long positions (with the stop-loss order at $65.10 and the next upside target at $73.47) are justified from the risk/reward perspective.

During the last two sessions, oil bulls showed their prowess, which resulted in the erasure of almost entire last week's downward move and the return to the major short-term resistance zone. Is it enough to go higher? Are there any technical factors that can help them during the next few days?

Let’s examine the charts below (charts courtesy of http://stockcharts.com).

Technical Picture of Crude Oil

Quoting our Wednesday’s alert:

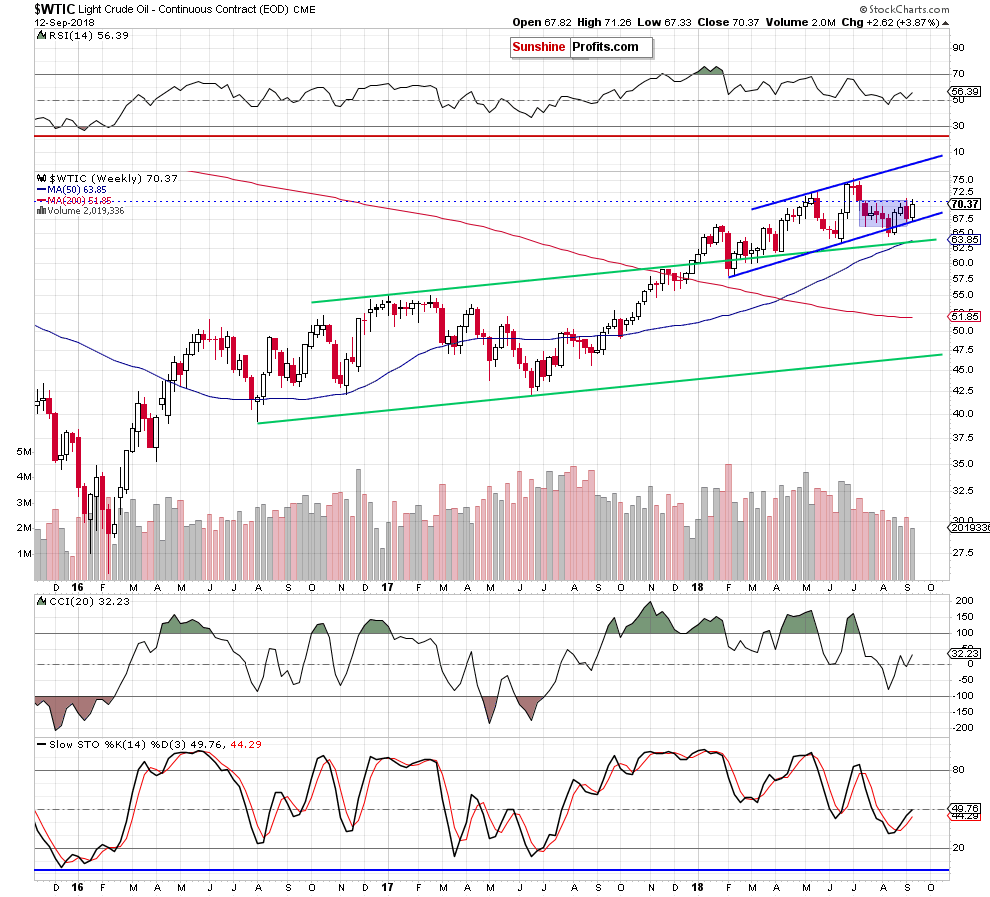

(…) crude oil bounced off the blue support line and the 61.8% Fibonacci retracement during yesterday’s session.

(…) Tuesday’s upswing was quite sharp and materialized on sizable volume (higher than the one we could observe in previous days during downswings), which increases the probability that oil bulls will fight for higher levels in the coming days.

This scenario is also reinforced by an invalidation of the earlier breakdown under the 50-day moving average and a buy signal generated by the Stochastic Oscillator.

So, how high could the price of black gold go?

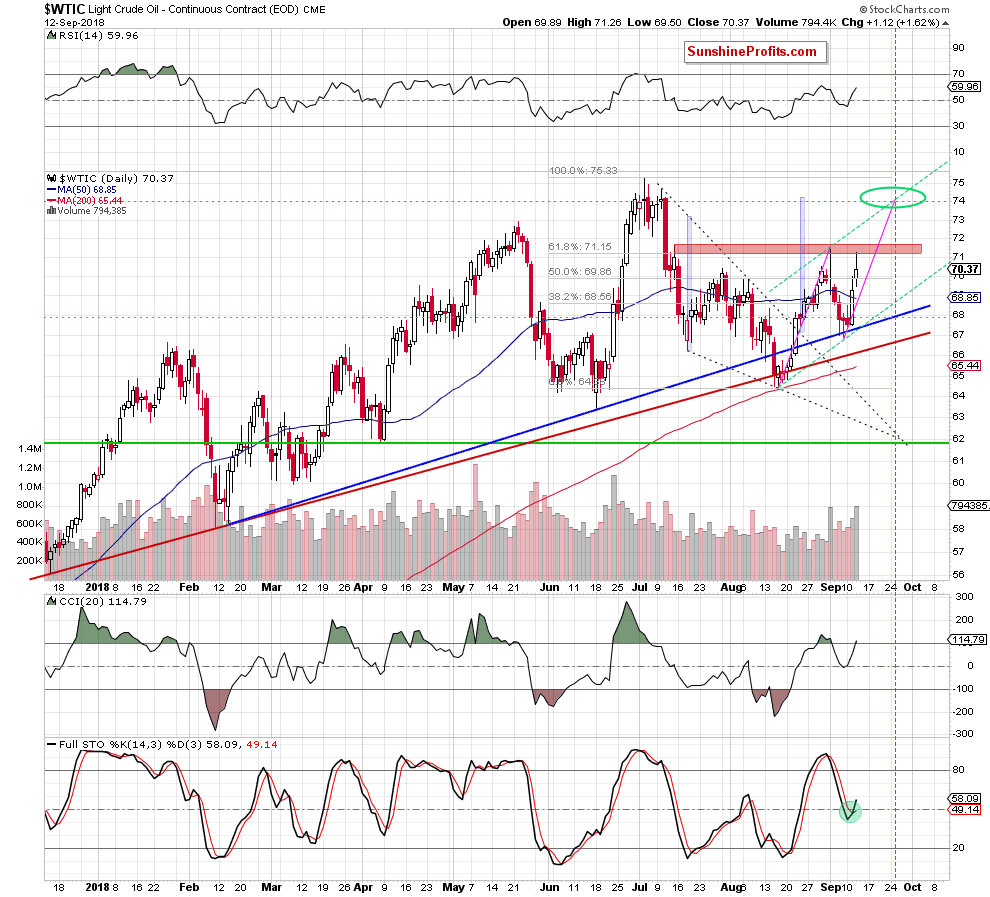

In our opinion, the first upside target will be the red resistance zone (created by the 61.8% Fibonacci retracement, the mid-July and the Sept highs), which stopped oil bulls in the previous week.

From today’s point of view, we see that black gold extended gains (as we had expected) and reached the above-mentioned first upside target. Despite this improvement, the red resistance zone activated oil bears, who triggered a pullback that took the commodity under $71 in the following hours.

Thanks to this downswing, we saw the second unsuccessful attempt to break above the red resistance zone (marked on the daily chart) and the upper border of the blue consolidation (seen on the weekly chart), which raises our vigilance and orders careful observation of this area during the next sessions.

Nevertheless, on the other, we should keep in mind that light crude closed yesterday’s session above the barrier of $70 and the buy signal generated by the Stochastic Oscillator (daily and weekly) remains in the cards, suggesting that higher prices of the commodity are still ahead of us – especially when we factor in all pro-growth technical factors (a breakout above the upper border of the black dotted triangle or a potential reverse head and shoulder formation) about which we wrote yesterday.

Summing up, long positions continue to be justified from the risk/reward perspective as crude oil closed Wednesday’s session above the barrier of $70, which in combination with the buy signals generated by the Stochastic Oscillators (daily and weekly) and other pro-growth technical factors suggests that we’ll likely see another attempt to go higher in the following days.

Trading position (short-term; our opinion): Long positions (with the stop-loss order at $65.10 and the next upside target at $73.47) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts