Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

Crude oil moved higher this week, so the question that you might be asking yourself (and us) is likely whether this changes anything. In particular, does it make the outlook bullish, or at least less bearish than it was before.

In short, it doesn’t.

Crude oil has been trading sideways for a few months now, and the current upswing is the continuation of this pattern. The 61.8% Fibonacci retracement level held as important resistance and the same goes for the early-March low.

The current move higher is yet another attempt to take crude oil above these levels, but we don’t think that it will be successful. We base this not only on the above-mentioned resistance, but also on the situation in the USD Index.

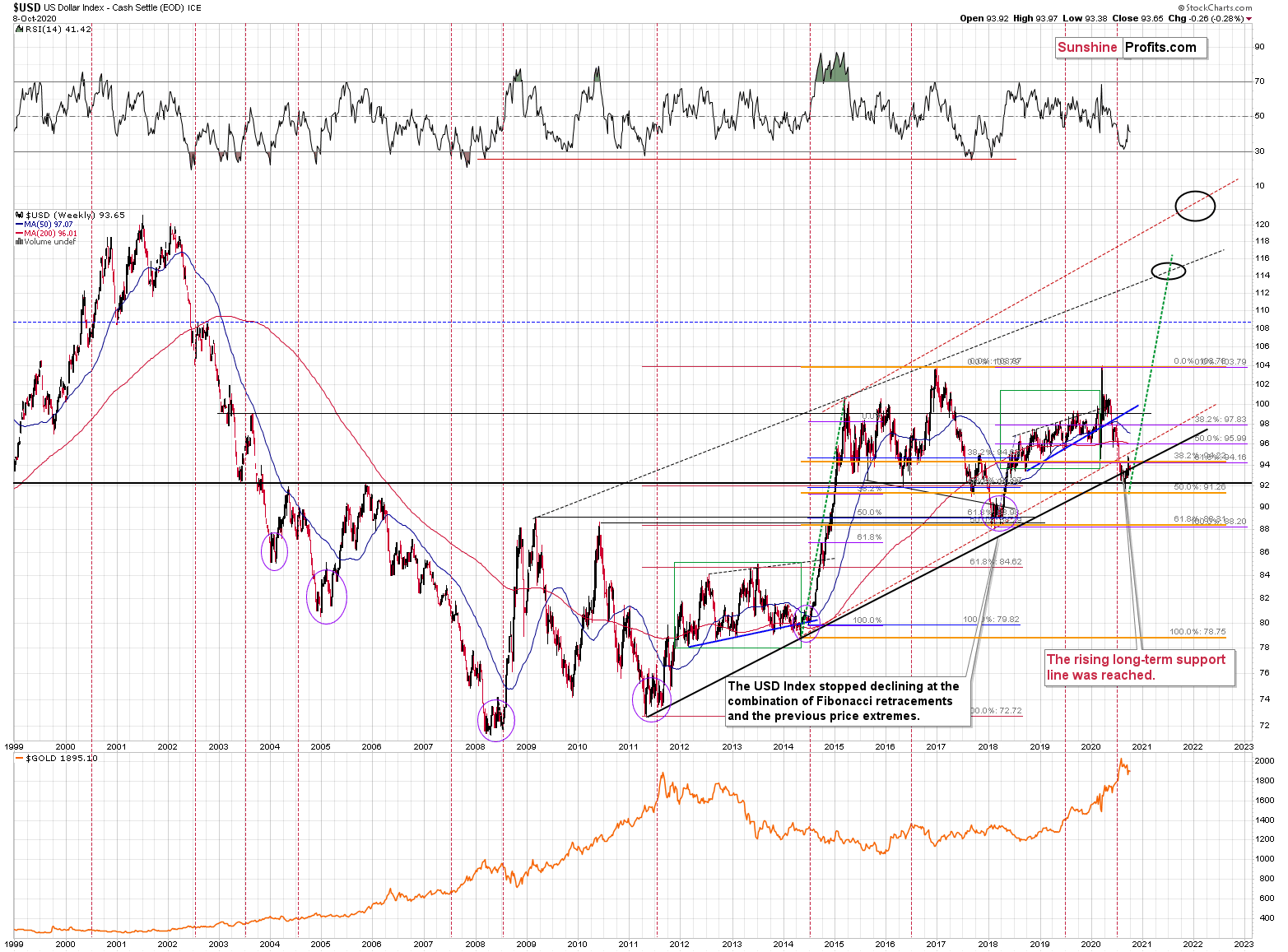

The U.S. currency moved in the opposite way to crude oil in the recent past, so it seems quite likely that a move higher in the former would lead to a move lower in the latter.

And the outlook for the USD Index remains bullish.

The USD Index is after a major breakout and it pulled back after the breakout. The breakout was not invalidated, which means that the bullish trend didn’t change.

The situation on USD’s long-term chart didn’t change either. As we elaborated in Monday’s extensive analysis, the USD Index tends to form important, relatively broad bottoms close to the middle of the year. That’s exactly what happened also this year. The USD index already invalidated its small breakdown below the rising long-term support line, which means that it is very likely to rally in the next several weeks.

This week’s decline (including today’s pre-market movement) doesn’t change the above. Therefore, the bullish outlook remains intact. And the implications for crude oil remain bearish.

To summarize, for the upcoming weeks, the outlook for crude oil stays bearish, and the most recent upswing did not change that at all.

As always, we’ll keep you, our subscribers well informed.

Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

In the futures contracts that are more distant than the current contract, we think adding the premium (the difference between the July and other contracts) to both: stop-loss and initial target prices is justified.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager