Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

Things have barely moved in the crude oil market in recent weeks. We’ve entered into a quite a turbulent month! Demand worries, a rise in COVID-19 infections, Trump being positive on the virus, then released from the hospital, USD fluctuations, and the U.S Election season in its full swing all tumultuously affect the black gold price. The worldwide crude oil demand has been weaker and weaker for weeks now. Furthermore, an additional decline is expected, which only serves as an additional bearish catalyst for the entire situation.

We’re expecting even more market volatility, given that right now, the crude oil price probably won’t rise higher from the current figure. With the most recent USDX breakout and its invalidation, it was understandable that the currency market will continue to put pressure on the crude oil price. Consequently, crude oil continues to edge lower, and the USDX continues to rally with positive impulses.

If you’ve just signed up for our premium Oil Trading Alerts, for a better context, please read our analyses from September 18th and September 21st for more details.

The USDX moved a bit lower, while crude oil declined at the same time. Quite a bearish combination of events, as previously, crude oil only mirrored the USDX’s performance. In alignment with our expectations so far, the USDX rally triggered a decline in the black gold price.

Afterward, crude oil took a breather, just as the USDX did. And now, it is evident that crude oil continues to decline even without USD Index’s help, which turns out to be an extremely bearish progression.

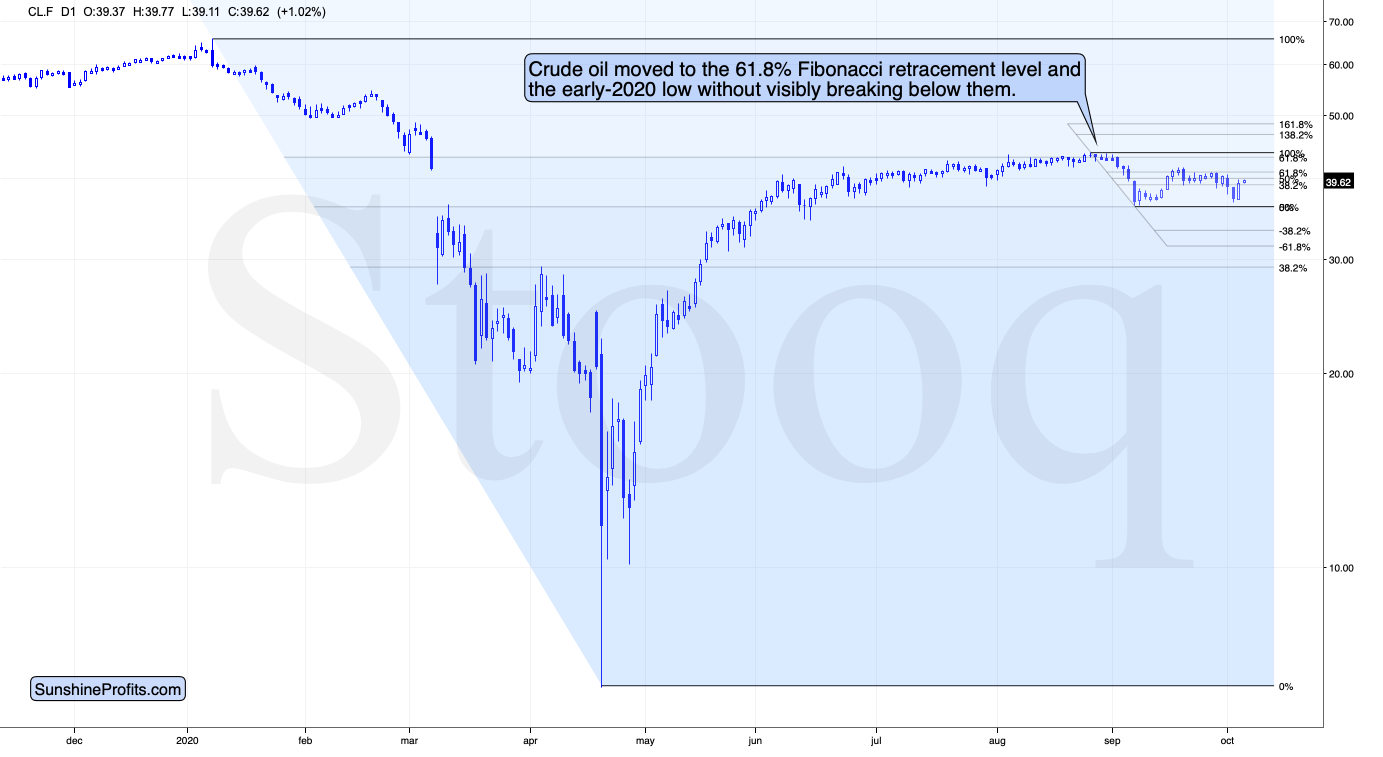

Our predictions from previous weeks turned out to be accurate. Crude oil could not move above the 61.8% Fibonacci retracement and the upper border of the huge March price gap.

This means that the medium-term rally that started back in April has most likely ended and that the next big move will be to the downside. The bearish link between the USD Index and crude oil confirms it.

Once crude oil breaks below the September lows (which could happen shortly), the decline would likely accelerate.

It’s true that crude oil didn’t manage to do so yet, but it’s also important to note that despite USD Index’s correction, crude oil managed to rally for only two trading days (including today’s pre-market trading. This means that the upswing is likely just a breather before the decline continues.

To summarize, for the upcoming weeks, the outlook for crude oil stays bearish, and the most recent upswing did not change that at all.

As always, we’ll keep you, our subscribers well informed.

Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

In the futures contracts that are more distant than the current contract, we think adding the premium (the difference between the July and other contracts) to both: stop-loss and initial target prices is justified.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager