Trading position (short-term; our opinion): Small (half of the regular size) short positions (with a stop-loss order at $61.13 and the initial downside target at $52) are justified from the risk/reward perspective.

Although the EIA report showed that crude oil inventories fell more-than-expected in the previous week, the data also revealed a much bigger-than-estimated increase in gasoline and distillates supplies. In this environment, light crude lost 2.88% on Wednesday and moved away from the upper line of the rising trend channel. Will we see further deterioration in the coming days?

Yesterday, the Energy Information Agency showed that U.S. crude oil inventories fell by 5.6 million barrels, but despite this positive news the report also showed that gasoline inventories rose by 6.8 million barrels (well above expectations for rise of 1.7 million barrels) and distillate stockpiles increased by almost 1.7 million barrels, missing expectations for a draw of 967,000 barrels. Additionally, U.S. crude oil production rose by 25,000 barrels per day in the previous week, which raised worries that rising U.S. output would dampen OPEC’s efforts to balance the oil market. Will these fears push the price of the commodity lower in the coming days?

Crude Oil’s Technical Picture

Before we answer this question, let’s examine the technical picture of crude oil (charts courtesy of http://stockcharts.com).

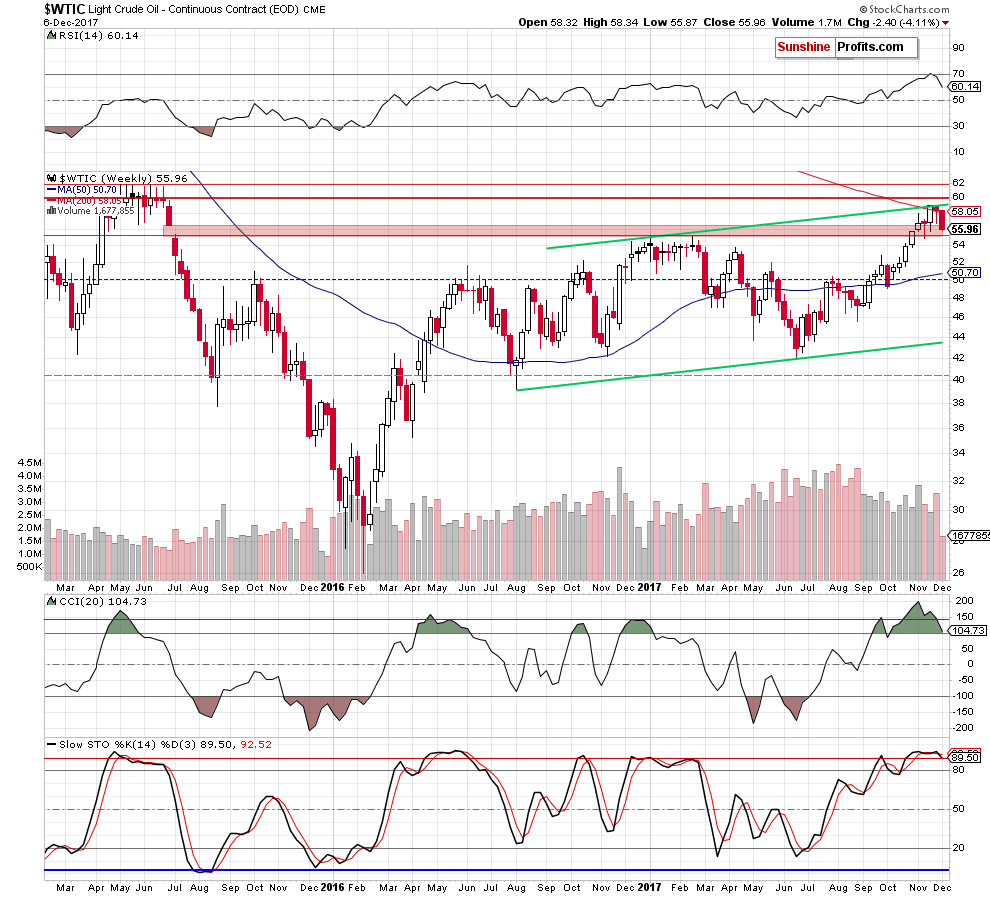

From the medium-term perspective, we see that crude oil extended losses below the 200-week moving average, which resulted in a comeback under the upper border of the red gap. In our opinion, this is a negative event, which increases the probability of an invalidation of the earlier breakout above the gap in the near future – especially when we factor in the fact that the Stochastic Oscillator re-generated the sell signal, giving oil bears another reason to act.

Nevertheless, similarly to what we wrote in many previous alerts, such negative developments, which we could notice during the trading week, would be more reliable and turn into bearish only if we see a weekly closure under important supports/resistances. In this case, the signal will be more valuable for oil bears, if black gold closes this week below $54.90. If we see such price action, light crude will not only drop under the red gap, but will also invalidate the breakout above the January and February peaks.

Will oil bears manage to push the commodity so low? Let’s examine the daily chart and look for more negative clues.

Before we focus on the very short-term changes, we would like to quote several sentences from our yesterday's alert:

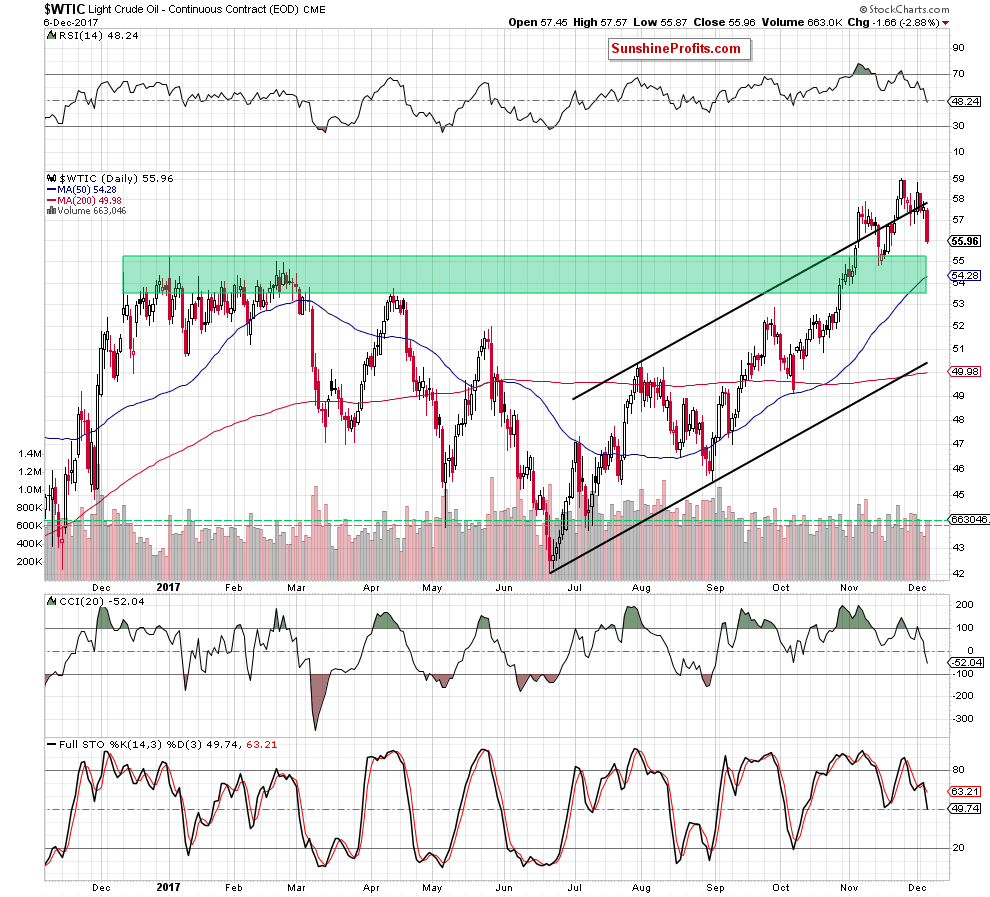

(…) black gold closed yesterday’s session under the upper border of the short-term rising trend channel. Such price action looks like a verification of the Monday breakdown, which doesn’t bode well for oil bulls and higher prices of black gold in the coming days.

Additionally, the size of volume, which accompanied yesterday “increase”, was smaller than day earlier, which together with the sell signals generated by the RSI and the CCI suggests that the comeback of oil bears is just a mater of time (most likely a short period of time).

From today’s point of view, we see that the situation developed in tune with our assumptions and we didn’t have to wait long for oil bears. Thanks to their action, light crude declined sharply on quite big volume (compared to what we saw in previous days), which suggests that we’ll see a test of the first downside target from our Monday alert:

(…) How low could crude oil go if oil bears show their strength in the coming weeks? In our opinion, if light crude extends losses from current levels, we’ll see (at least) a drop to around $54.81-$55.24, where the January peak and the mid-November lows are. If this support area is broken, the way to lever levels will be open.

Crude Oil and Its Ratios

Finishing today’s alert, please keep in mind that the pro bearish scenario is also reinforced by the broader picture of crude oil, negative divergences between the WTIC:UDN ratio and the price of crude oil priced in the U.S. dollars (we wrote more about these issues in our Monday Oil Trading Alert) and the current situation in the oil-to-oil stock ratio about which you could read yesterday (if you haven’t had the chance to read Wednesday alert, we encourage you to do so today).

Summing up, short positions continue to be justified from the risk/reward perspective as crude oil extended losses under the upper line of the black rising trend channel, the 200-week moving average and the upper border of the red gap seen on the weekly chart. The pro-bearish scenario is also reinforced by the current situation in our ratios (about which you could read on Monday and also on Wednesday), which increases the probability of further declines in the coming week(s).

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Small (half of the regular size) short positions (with a stop-loss order at $61.13 and the initial downside target at $52) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts