Trading position (short-term; our opinion): Small (half of the regular size) short positions (with a stop-loss order at $61.13 and the initial downside target at $52) are justified from the risk/reward perspective.

Although the OPEC and non-OPEC producers agreed to maintain the output cut until the end of 2018 yesterday, the price of crude oil didn’t soar to fresh highs. Instead the commodity closed another day under the previously-broken short-term support/resistance line. Does it mean that the agreement extension was already priced in?

Crude Oil’s Technical Picture

Let’s examine the technical picture of crude oil (charts courtesy of http://stockcharts.com).

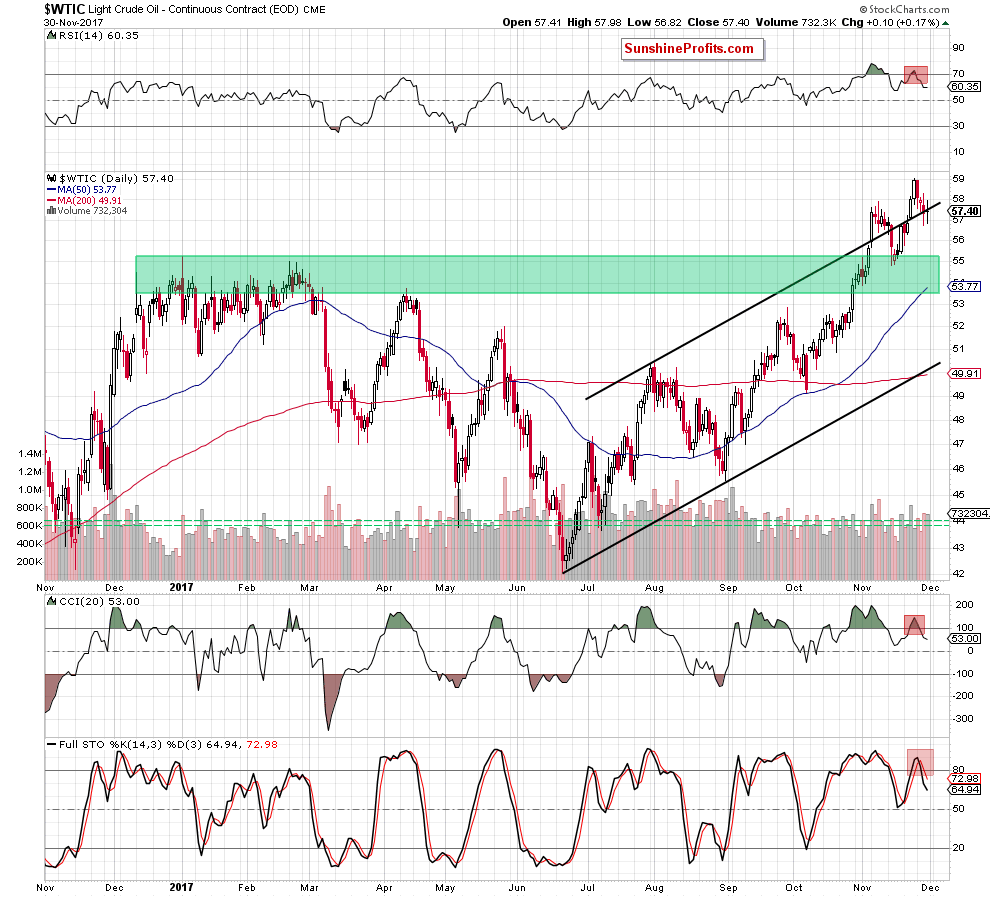

Looking at the daily chart, we see that yesterday’s session was very similar to what we saw on Wednesday. Black gold wavered around the major short-term support/resistance line, but finally closed the day below it, which confirms that crude oil invalidated the earlier breakout above this line. Taking this bearish event into account and combining it with the sell signals generated by all the daily indicators, we think that further declines are just ahead of us.

Nevertheless, this pro-bearish scenario will be even more likely and reliable if light crude closes today’s session and the whole week under $58.27. Why there? Let’s take a closer look at the weekly chart below to find out.

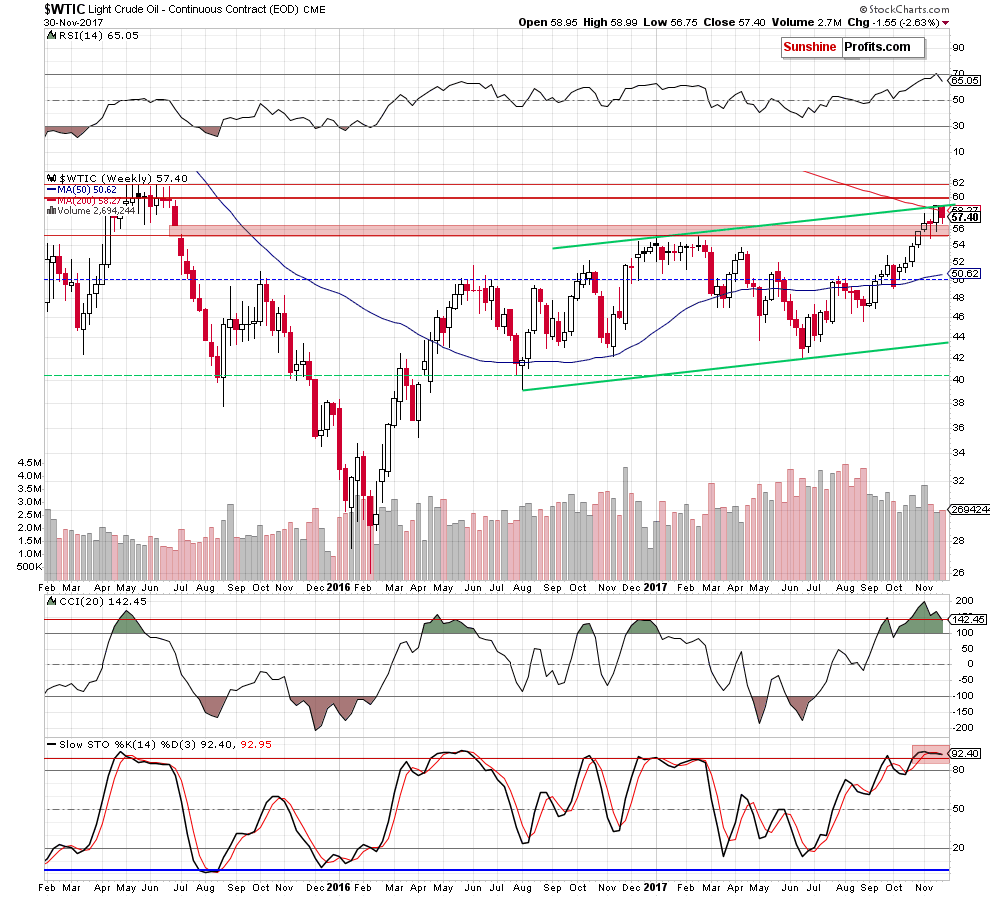

From the medium-term perspective, we see that at this level is currently the previously-broken 200-week moving average. This means that if crude oil closes this week’s candlestick below it, we’ll see an invalidation of the earlier breakout and oil bears will receive another reason to act in the coming week. At this point it is also worth noting that such price action is very likely as the sell signals generated by the RSI and the Stochastic Oscillator remain in place.

How low could crude oil go if oil bears show their strength? In our opinion, light crude extends losses from current levels, we’ll see (at least) a drop to around $54.81-$55.24, where the January peak and the mid-November lows are.

Summing up, short positions continue to be justified from the risk/reward perspective as crude oil invalidated the earlier breakout above the upper border of the black rising trend channel and remains under the 200-week moving average, which increases the probability of further declines in the coming days.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Small (half of the regular size) short positions (with a stop-loss order at $61.13 and the initial downside target at $52) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts