Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

Yesterday, we subtly hinted at the shifting balance of power between the oil bulls and bears. Indeed, the bulls took a breather yesterday. In light of today’s upswing so far, how much has (or has not) changed actually? Friday’s closing price will provide more clues and we want you to be ready for the scenarios even earlier. Now.

Let’s take a closer look at the char below (charts courtesy of http://stockcharts.com).

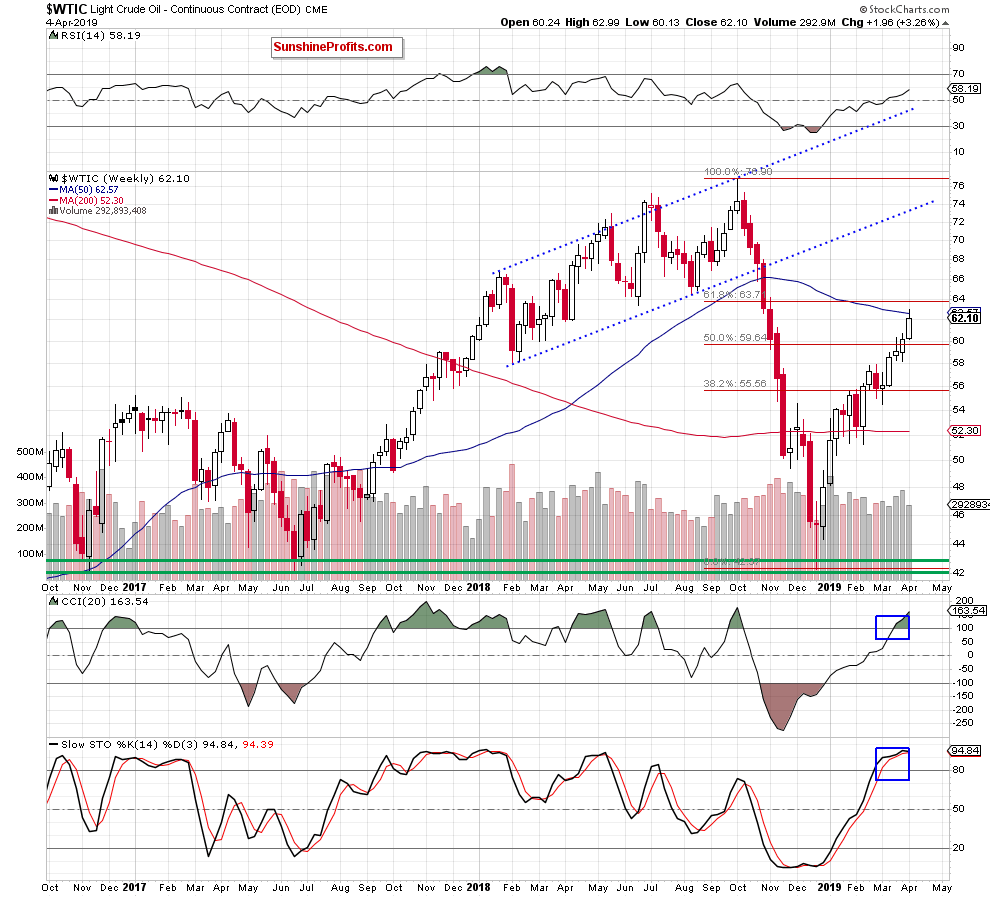

Starting with the weekly perspective, we see that crude oil is still trading below the 500-week moving average. It means that the tiny breakout we’ve seen earlier in the week still looks like it’ll be invalidated (at the moment of writing these words, crude oil trades at around $62.40).

Please also note the elevated readings of the weekly indicators. It’s not unreasonable to expect them to translate into sell signals in the coming week.

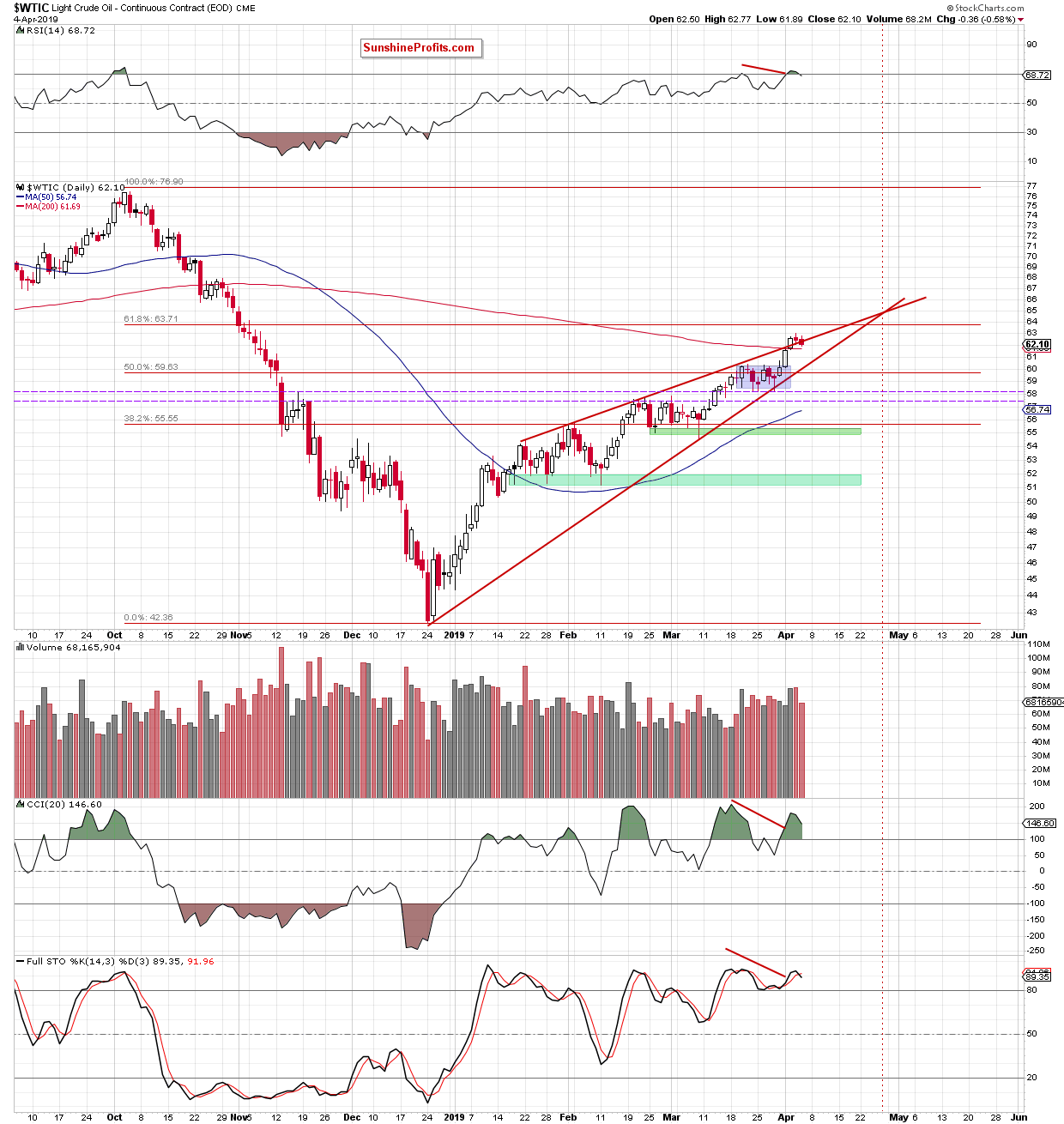

Looking at the daily picture, the highlight of yesterday’s session was an invalidation of the breakout above the previously-broken upper border of the red rising wedge.

There are also the bearish divergences between daily indicators and the price of black gold in place. They have translated into sell signals in the RSI and the Stochastic Oscillator, which increases the likelihood of further deterioration in the coming week

.

Such price action will however be more likely only if the commodity closes today’s session (and the whole week) below the previously-broken 200-day moving average, i.e. solidly back inside the red rising wedge.

How low could the price of black gold go then? The first downside target would be the lower border of the red rising wedge, then the purple horizontal support lines (the previously-broken February and March 2019 and mid-November 2018 peaks) and the upper green support zone created by the late -February and early-March lows.

Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist