Trading position (short-term; our opinion): Short position with a stop-loss order at $60.22 and the initial downside target at $50.38 in crude oil is justified from the risk/reward perspective.

After yesterday’s day of gains, we see crude oil prices wavering today. Can it translate into a reversal and decline? What are the pieces to the puzzle that we should look at now? Let’s present the technical picture as we see it now.

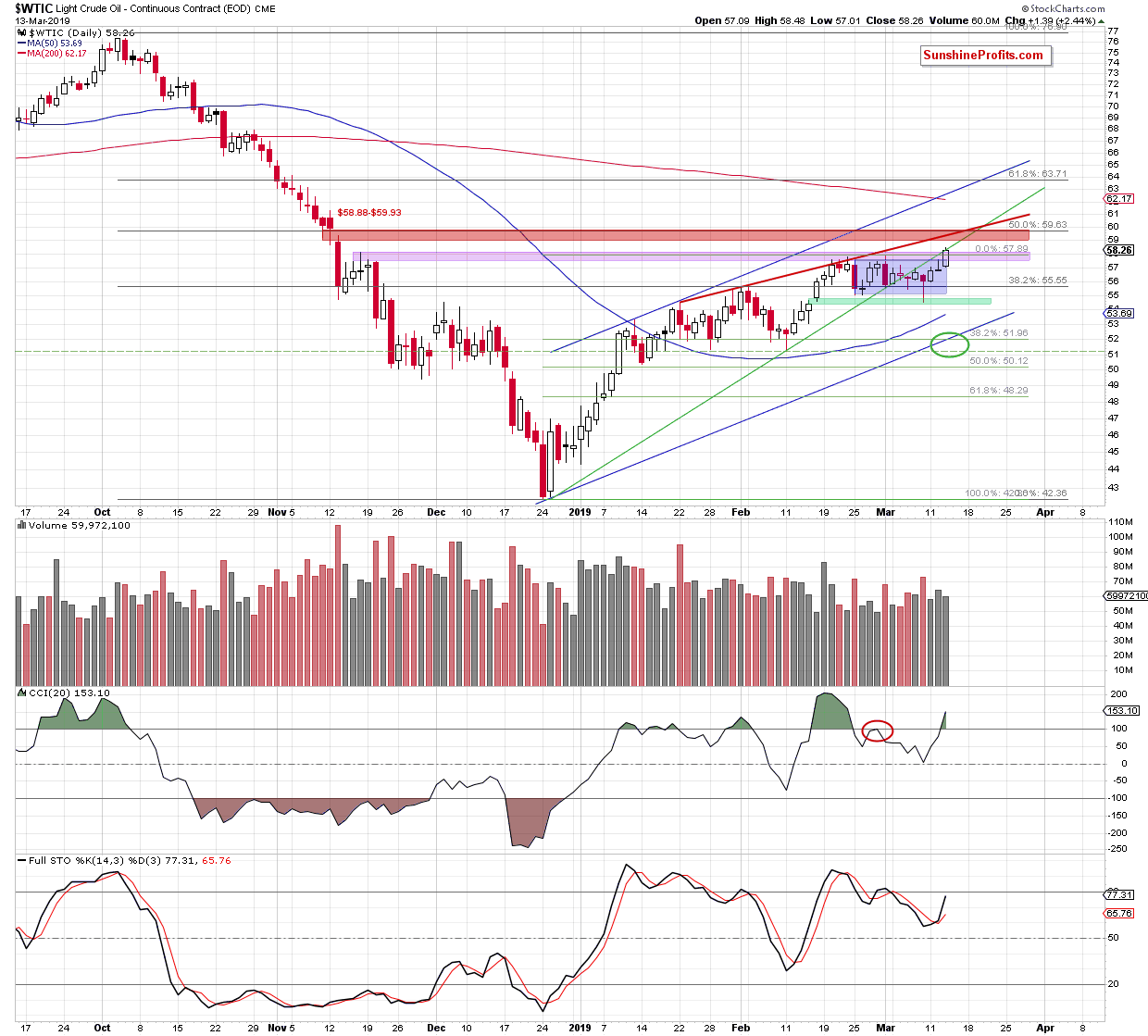

We’ll start with a closer look at the chart below (chart courtesy of http://stockcharts.com).

Yesterday’s session brought us another day of crude oil price gains, marking a fresh March peak. While not minuscule, the accompanying volume was still lower than the day before. The jury is still out but we lean towards the bearish implications thereof.

However, black gold is still trading below the previously broken rising green support line and the rising red resistance line. These have stopped the buyers several times earlier this year. Additionally, the area is reinforced by the red resistance zone that marks a price gap situation analogical to the green support zone.

As long as there is no breakout above the strong combination of resistances, the short position remains justified from the risk-reward point of view. The fact of lower volume may translate into another downward price reversal any time soon, once the bears return to the trading floor in earnest.

Trading position (short-term; our opinion): Short position with a stop-loss order at $60.22 and the initial downside target at $50.38 in crude oil is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist