Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

The beginning of the week brought a long-awaited breakout above several bearish lines that blocked the road northwards from many weeks. Everything looks pretty encouraging - especially if you are a bull. For sure everything?

Let’s examine the charts below (charts courtesy of http://stockcharts.com).

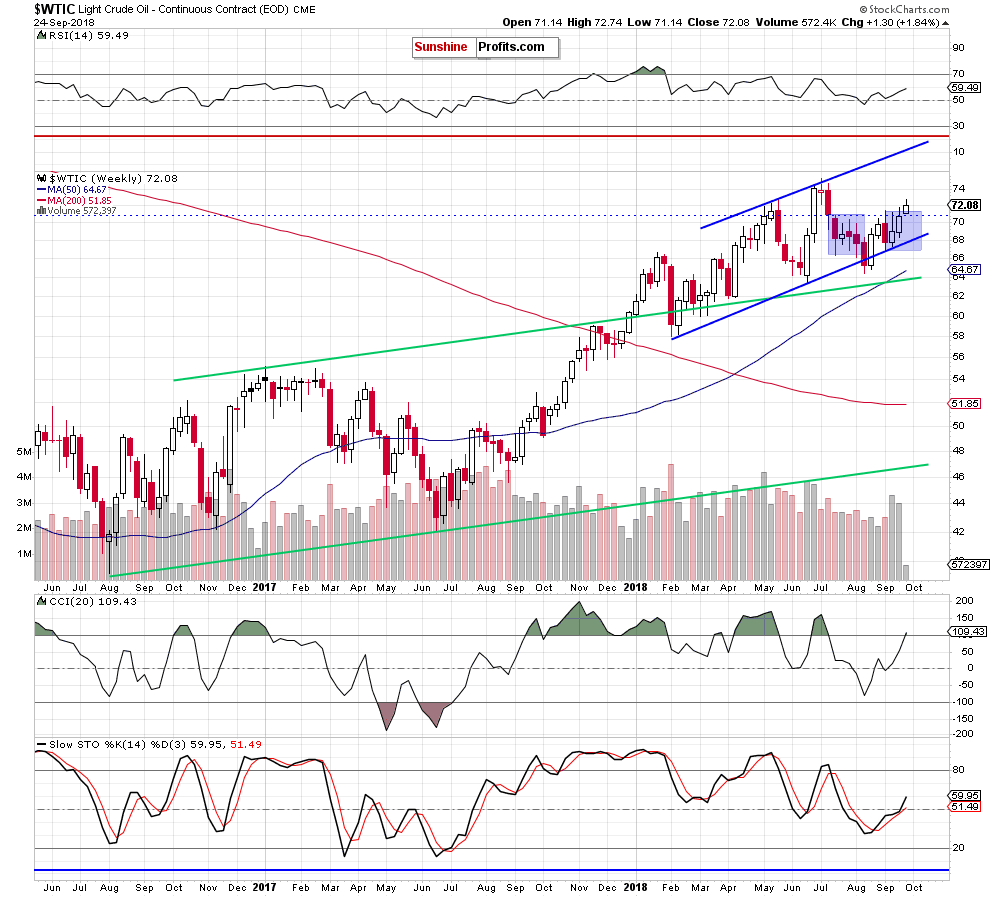

Technical Picture of Crude Oil

The first thing that catches the eye on the medium-term chart is a breakout above the upper border of the second blue consolidation (between early September peak of $71.40 and low of $66.86).

Although this is a positive development, we should keep in mind that the week has just begun, and this signal will change into bullish if the price of black gold closes Friday sessions above the upper line of blue consolidation.

Why is it so important? Because if you look closely at the above chart, you will notice that during the last week the price has also risen above the consolidation for a while, but as it turned out it was only a temporary improvement.

Additionally, the short-term chart suggests that the way to the north may not be open as wide as it may seem at the first sight. Let’s take a look below to know more details.

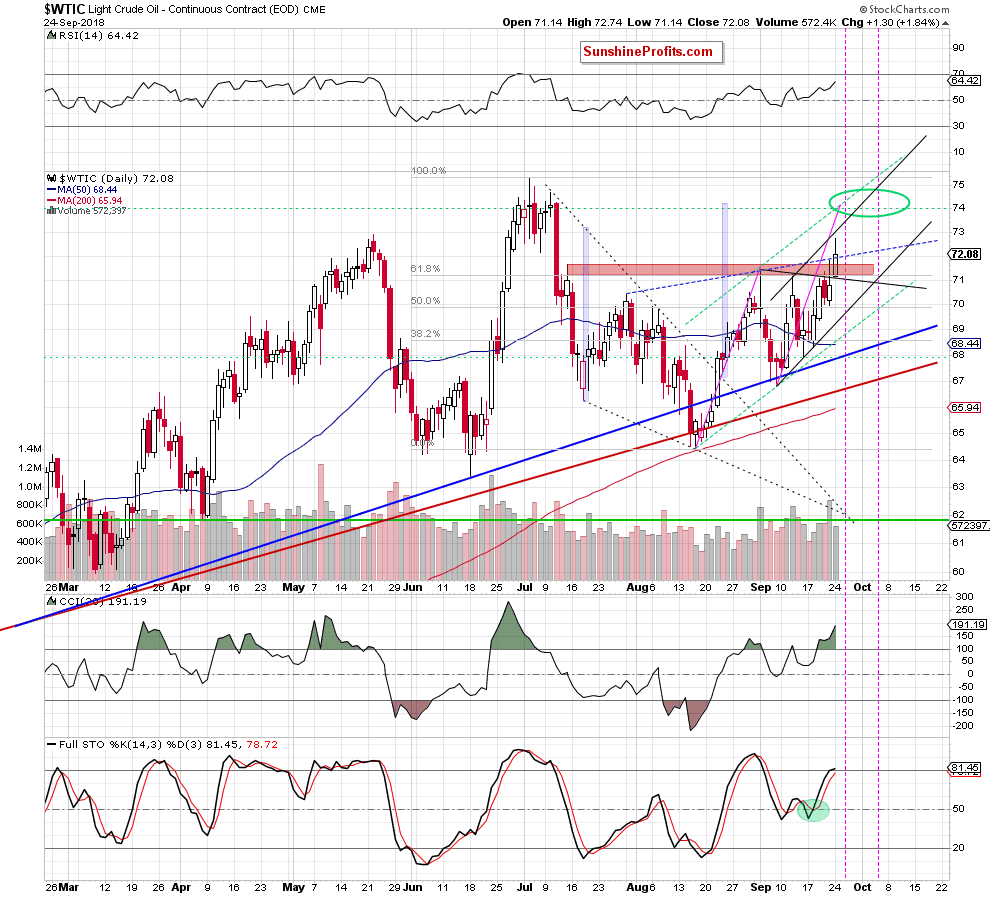

From this perspective, we see that light crude climbed not only above the upper border of the black triangle and the red resistance zone, but also closed the day slightly above the blue dashed line.

As you know from our previous alerts, it is a neck line of the reverse head and shoulders pattern, which was activated by yesterday’s upswing. Such price action suggests that higher prices (even a fresh 2018 peak based on the size of potential move to the upside and the height of the formation) are just around the corner.

Nevertheless, when we focus on the volume, we clearly see it was smaller than earlier, which raises some doubts about the involvement of the buyers in yesterday's growth – especially when we factor in a quite big upper shadow of Monday’s candlestick.

Additionally, not far from yesterday’s levels, oil bulls will have to face the upper line of the very short-term black rising trend channel. On top of that, the intersection of the upper and lower arms of the black dashed triangle will take place in the very near future, increasing the probability of reversal in the following days (basing on the Triangle Apex Reversal Pattern).

When we take a closer look at the above chart, we can also notice that there is a bearish divergence between the Stochastic Oscillator and the price of crude oil, which also suggests that changes in the direction of the move during upcoming sessions should not surprise us.

What does all this mean for us? In our opinion, waiting at the sidelines for a confirmation whether yesterday's upswing is a real breakout or only a fakeout is the best and the safest investment decision for the moment of writing this alert. We will keep you informed should anything change.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts