Trading position (short-term; our opinion): Full speculative short position in crude oil with a stop-loss order at $70.22 and the initial downside target at $60.12 is justified from the risk/reward perspective.

In our previous Oil Trading Alerts, we wrote how bearish the outlook for the black gold was and we emphasized that it might have been better to be a day or two too early with opening a short position than to be just an hour or two late. Friday’s session showed why this was indeed the case. Crude oil took a dive and erased the entire week of gains in just a few hours. Those, who followed our suggestion to get back on the short side of the market on June 13th are already sitting on a profitable position. However, what’s done is done and the key question is that the decline is already over or are we going to see even lower crude oil prices in the near future.

In short, the latter seems much more likely. Let’s take a look why.

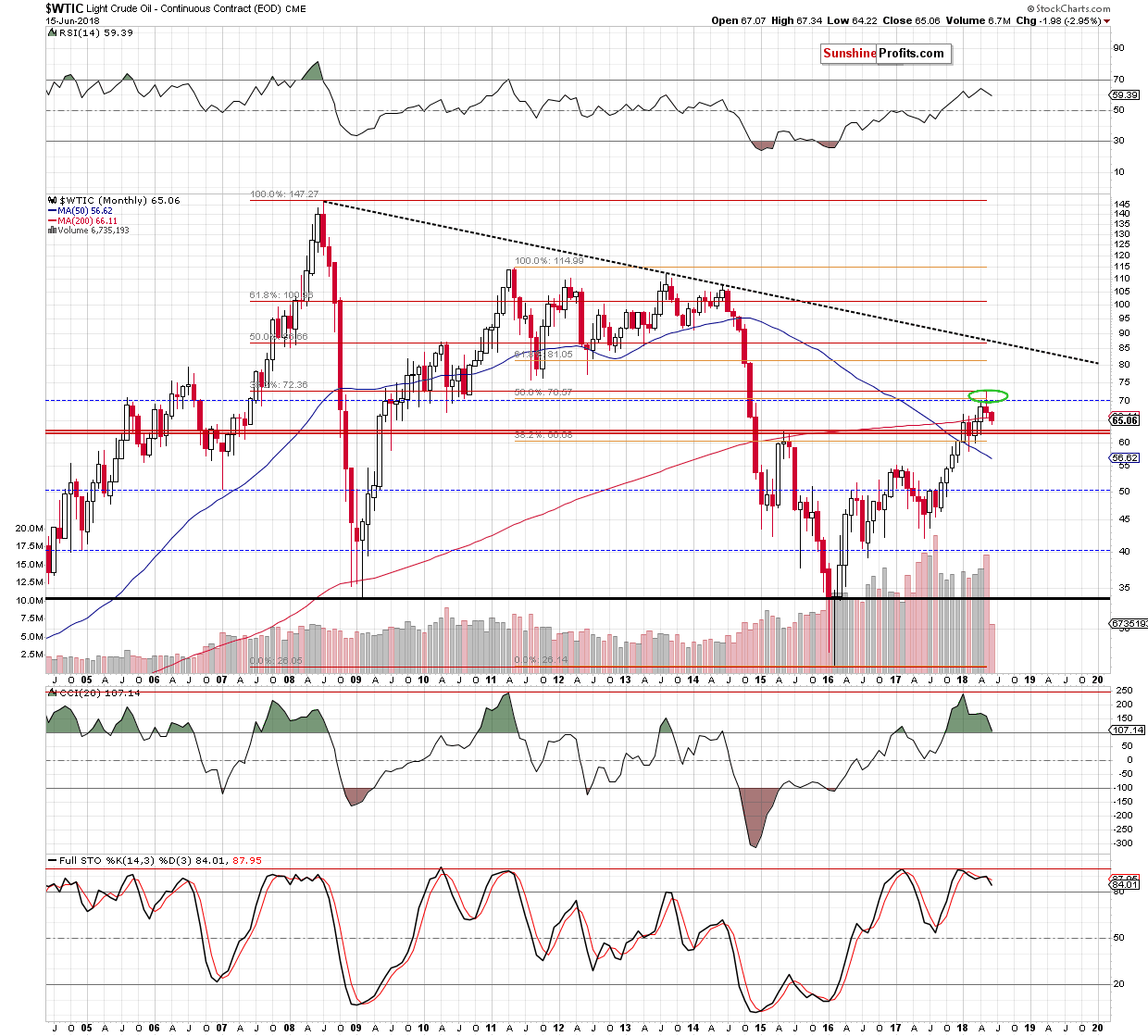

The key reason is the monthly reversal candlestick that formed in May on huge volume. This candlestick implies that crude oil should decline at least in June. So far, that’s what happened, but since the month is not over yet, the decline could be much bigger.

Moreover, it seems quite likely that the slide that follows such a profound reversal will be much bigger than just the $2 decline (approximately) that we’ve seen so far this month. This is especially the case that we’ve seen a profound sell signal from the Stochastic indicator and CCI appears to be ready to provide its own signal later this month as it moved very close to the 100 level. A move below it would be a bearish confirmation.

Let’s zoom in to check if what happened last week changes any of the above.

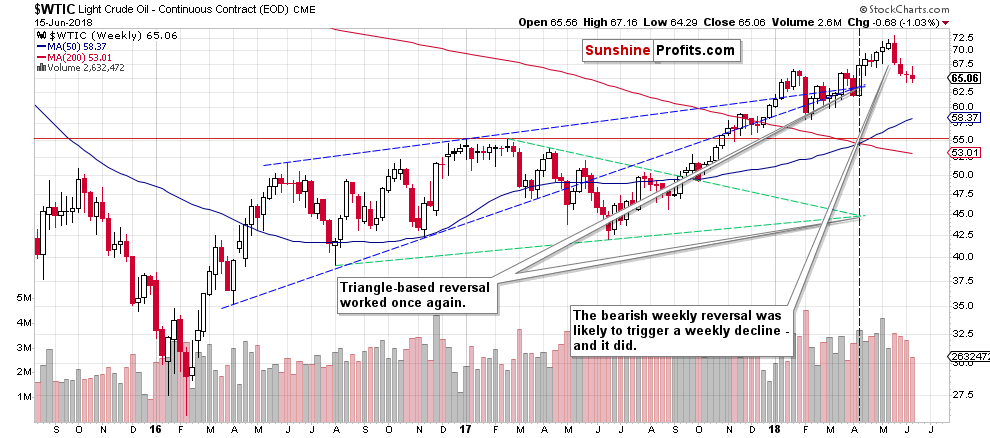

Last Monday and on the preceding Friday, we commented on crude oil’s weekly chart in the following way:

As we indicated earlier, crude oil has almost formed a bullish reversal candlestick. It’s clearly visible on the above chart, but the week is not over yet, so a lot could happen today. At the time of writing these words, crude oil is down by 33 cents, which means that if it closed at these prices, we would still have a weekly bullish reversal. The week would actually end in the red, but the reversal would have bullish implications anyway.

Crude oil ended the day 21 cents lower, which means that it moved 12 cents higher since we wrote the above. Therefore, the bullish implications of the above were not invalidated. There is, however, one factor that one needs to consider when estimating the strength of the bullish signal.

The volume.

The volume was not very low, but it was not huge, and it was not big on a relative basis. In fact, it was average and lower than what we had seen in the previous two weeks. What does it mean? It means that the true implications of the reversal are quite weak. Sure, we may get a few days of higher prices, but it’s not very likely – definitely nothing worth betting on. It seems more likely that we’ll get some kind of bearish signs shortly, for instance in the form of a rally on weak volume that could make us re-enter the short positions that we had profitably closed several days ago.

That’s exactly what happened last week. Crude oil moved higher, but not much higher and the volume was rather weak, so we re-entered the short position very close to the resistance level.

Crude oil declined significantly on Friday, which caused the weekly candlestick to look like a bearish shooting star. This may be confusing, because these patterns are bearish shooting stars when they follow a rally. When they follow a decline, this pattern is an “inverted hammer” candlestick and it has bullish implications. More precisely, it would have bullish implications if – again – it was accompanied by huge volume. Since that was not the case, the implications are not bullish.

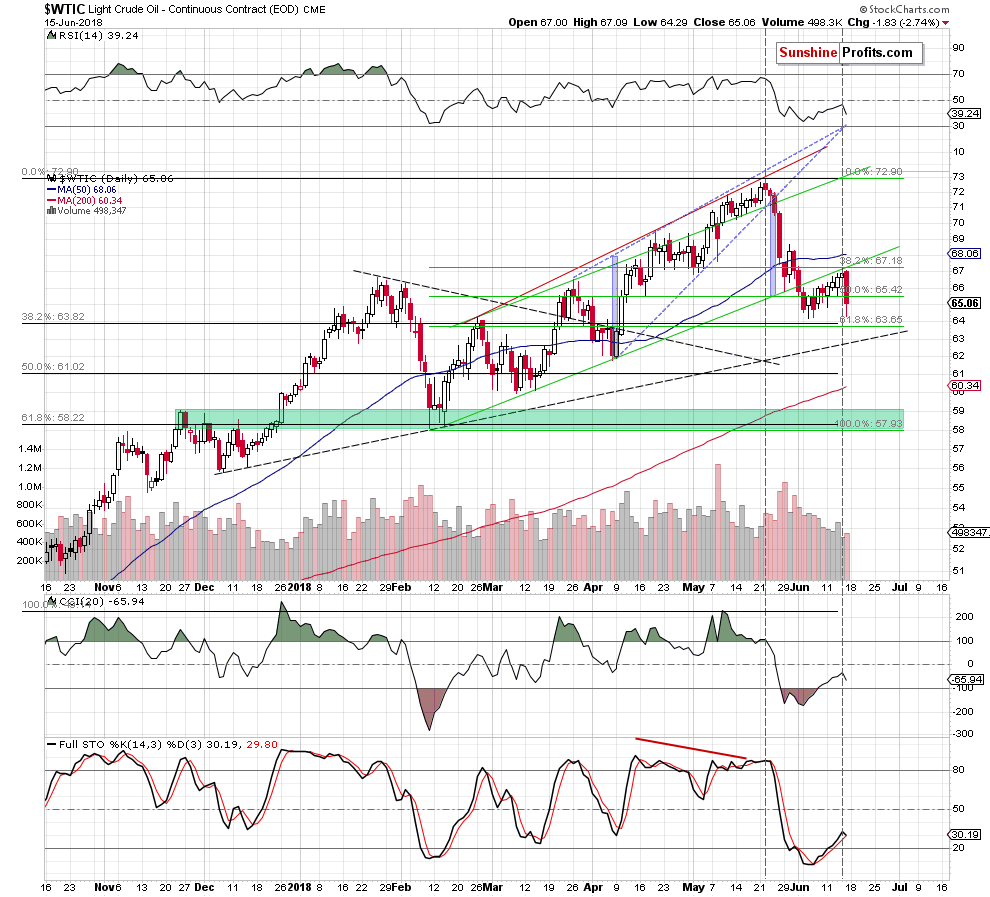

The volume on which crude oil declined on Friday was rather weak (or it’s a data error from Stockcharts), but if if this is the case, it doesn’t imply anything. The late-May decline started with daily declines that were accompanied on volume that was not huge either. The volume increased as the price moved lower and seeing it high for a few days in a row was (like it was the case in February) a sign of an upcoming corrective upswing. Applying this to the current case doesn’t have bullish implications for the short term. Conversely, it appears that the decline has only started and it’s about to gain momentum.

Summing up, the short-term top is most likely in and crude oil appears ready to decline further. The downswing seems to be starting, not ending.

Trading position (short-term; our opinion): Full speculative short position in crude oil with a stop-loss order at $70.22 and the initial downside target at $60.12 is justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts