Trading position (short-term; our opinion): Small (half of the regular size) short positions (with a stop-loss order at $61.13 and the initial downside target at $52) are justified from the risk/reward perspective.

Earlier today, crude oil futures extended yesterday gain and hit a fresh November peak. Will crude oil follow them later in the day? How high could black gold go in the coming days?

Crude Oil’s Technical Picture

Before we try to answer these questions, let’s examine the technical picture of crude oil (charts courtesy of http://stockcharts.com).

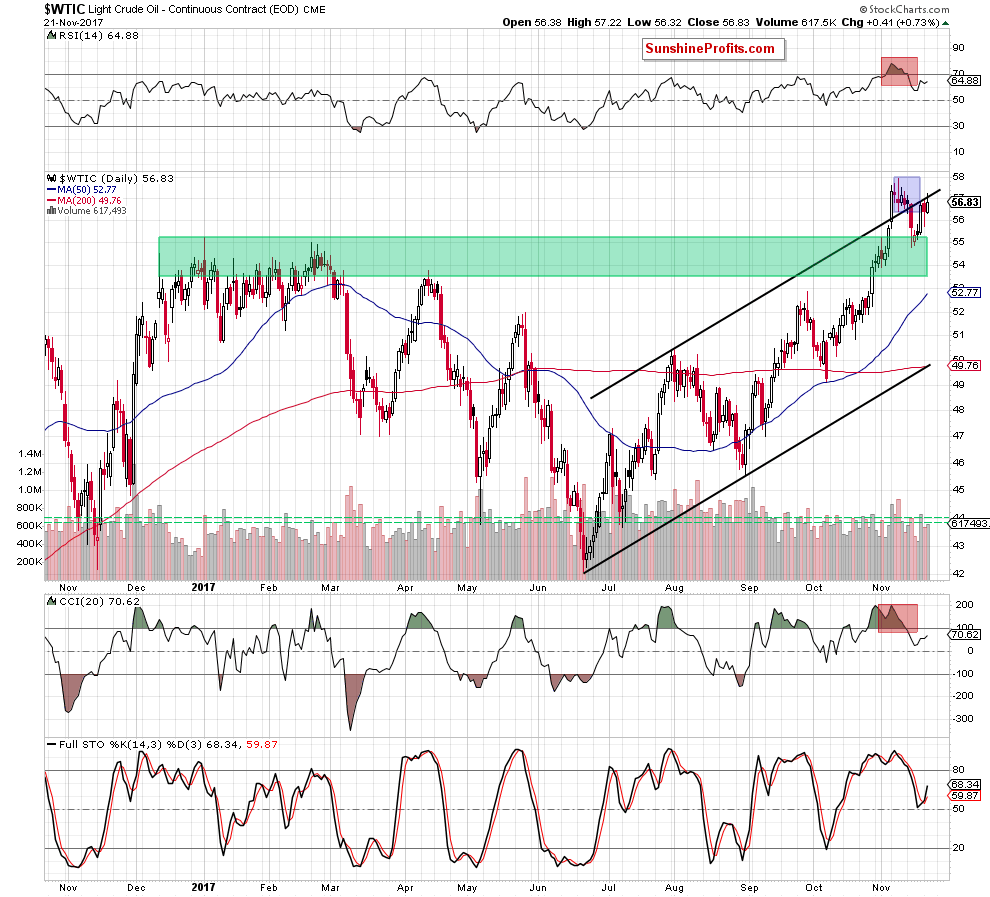

Based only on yesterday closing price we could write that nothing changed as crude oil closed the day under the previously-broken upper border of the black rising trend channel and the earlier November peaks.

Nevertheless, earlier today, oil bulls pushed crude oil futures higher, which resulted in a climb above the November 8 peak. Additionally, the Stochastic Oscillator generated a buy signal yesterday, preparing us for such price action and suggesting that black gold could increase slightly one more time.

Why we wrote slightly? Let’s take a closer look at the charts below.

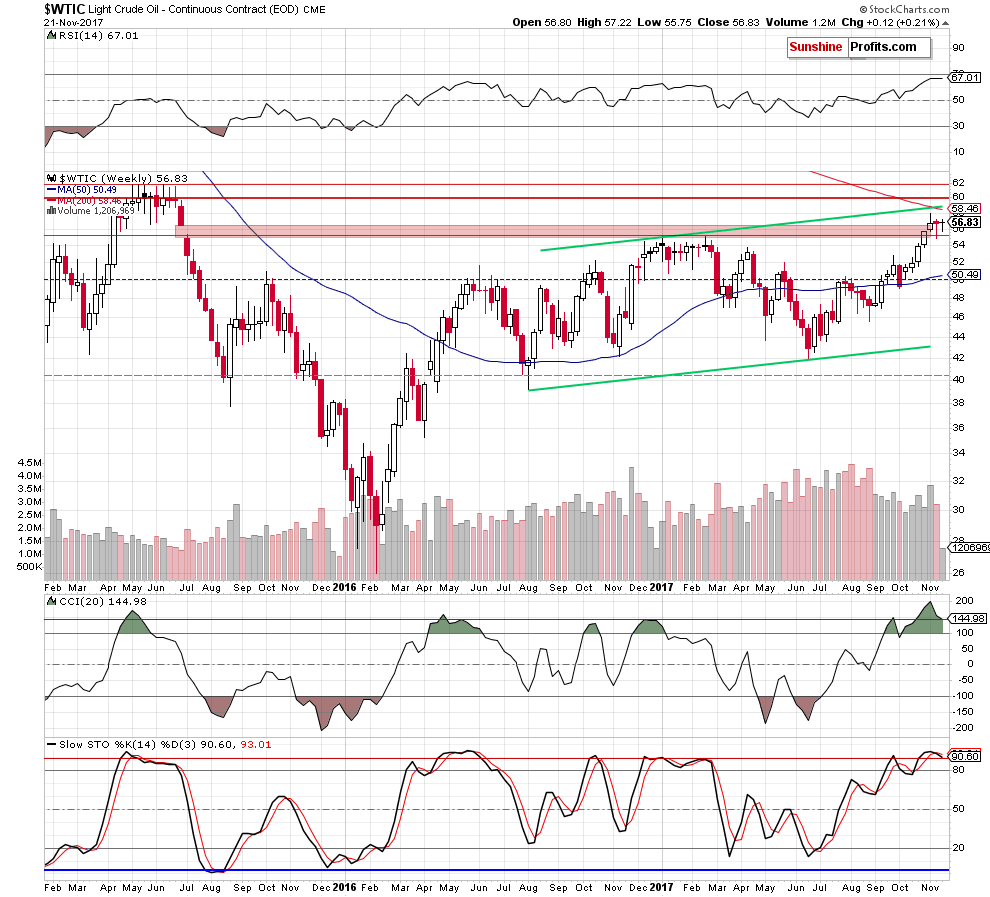

As you see on the weekly chart, not far from current levels we can notice an important resistance zone created by the upper border of the green rising trend channel and the 200-week moving average (currently around $58.46-$59), which continues to block the way to higher levels.

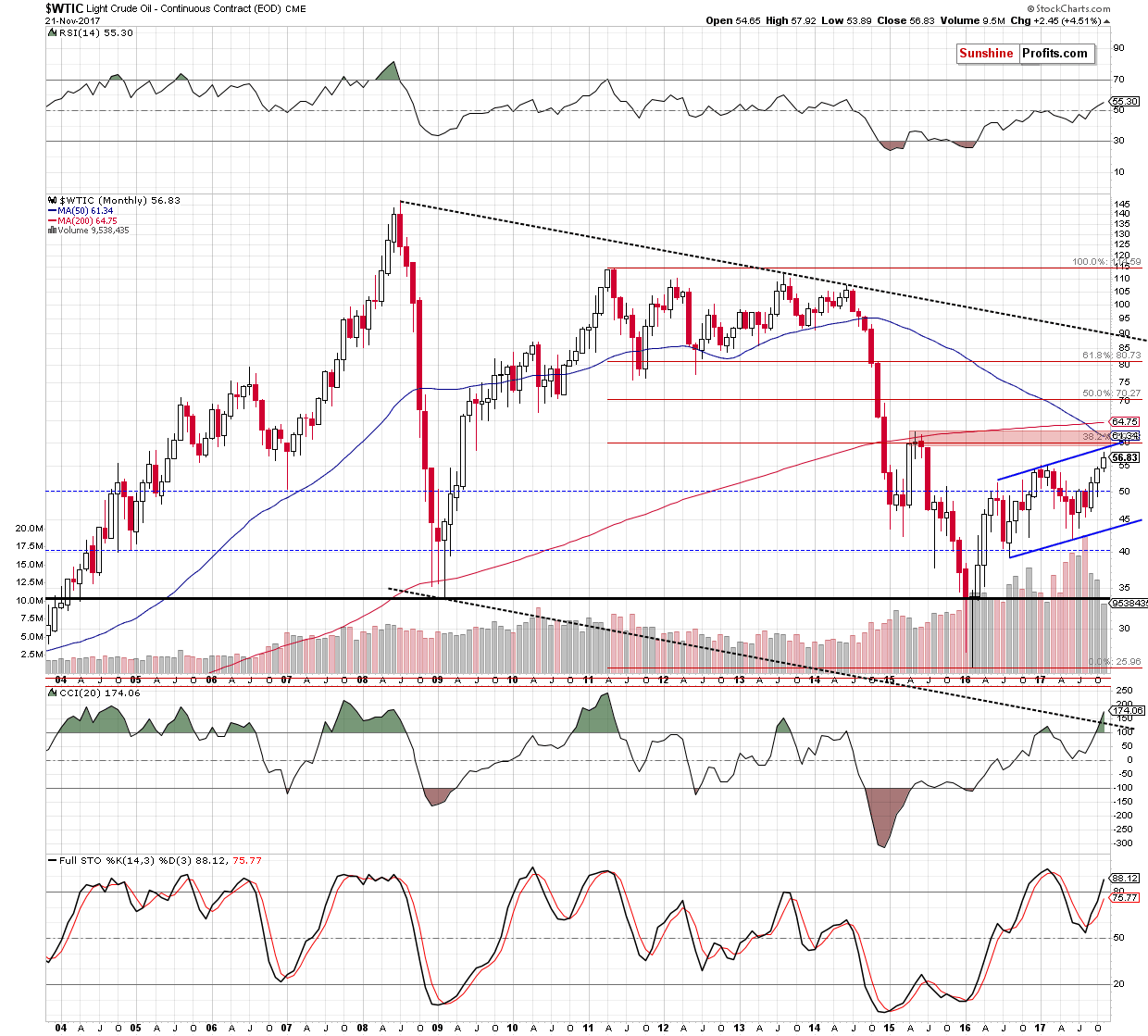

Additionally, when we zoom out our picture ant take a look at the monthly chart, we will see another solid resistance zone created by the 38.2% Fibonacci retracement, the barrier of $60, the 50-month moving average and May 2015 highs.

Therefore, in our opinion, even if light crude follows futures and moves a bit higher from current levels, the way to the north seems to be solidly closed, suggesting that another reversal and lower prices of black gold are still ahead of us.

Summing up, short positions continue to be justified from the risk/reward perspective as crude oil remains under very important resistance zones.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Small (half of the regular size) short positions (with a stop-loss order at $61.13 and the initial downside target at $52) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

On an administrative note, the markets in the U.S. will be closed on Thursday and we expect the trading activities to be limited on Friday as well. Consequently, there will be no regular Oil Trading Alerts on Thursday and Friday. However, if something urgent happens, we will provide you with a quick alert anyway. The alerts will be posted normally beginning on Monday, November 27.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts