Trading position (short-term; our opinion): Short positions (with a stop-loss order at $54 and the initial downside target at $45.80) are justified from the risk/reward perspective.

On Wednesday, the price of crude oil moved higher, but the major resistance zone and the key resistance line continue to keep gains in check. Will this fact encourage oil bears to push the commodity lower in the coming days?

Crude Oil’s Technical Picture

Let’s take a closer look at the charts below and check the technical picture of the commodity (charts courtesy of http://stockcharts.com).

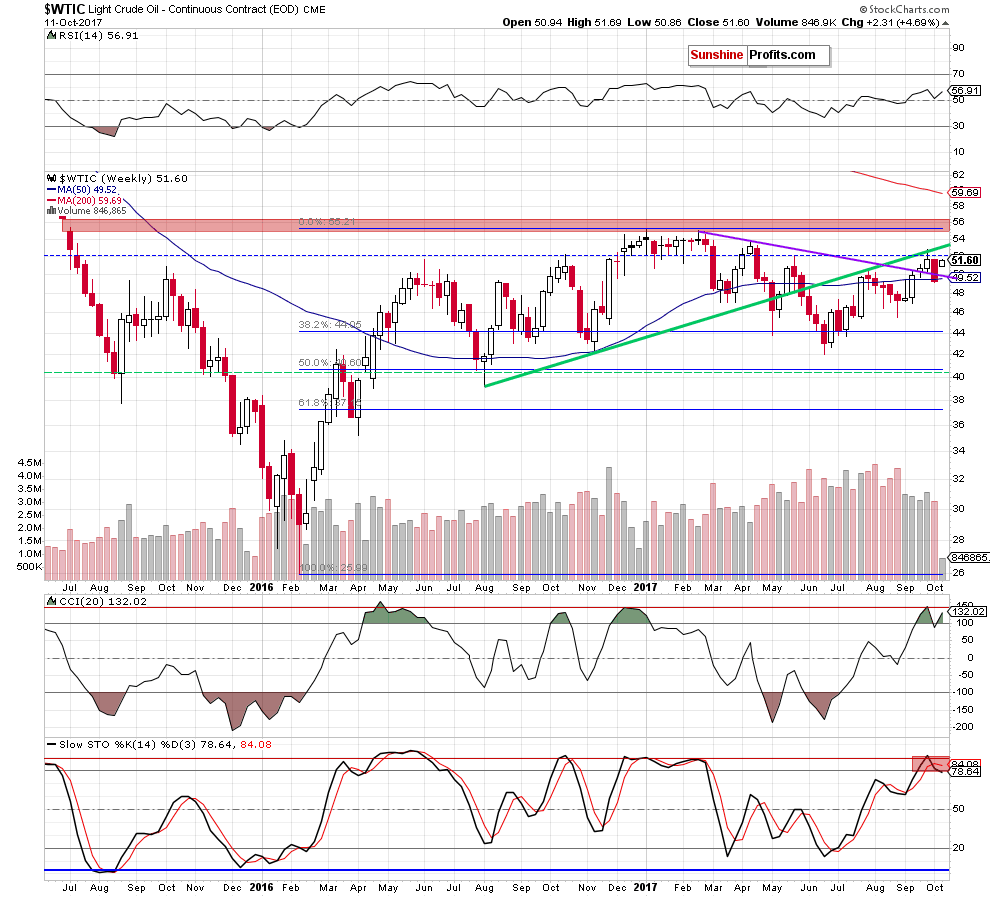

Looking at the medium-term chart, we see that although crude oil moved higher, the long-term green resistance line continues to keep gains in check. Additionally, black gold is still trading under the May and September highs, which together with the sell signal generated by the Stochastic Oscillator (and the current position of the CCI) suggests that another move to the downside is just around the corner.

This scenario is also reinforced by the current situation in the WTIC:UDN ratio, which we described more broadly in yesterday's alert. Let's recall the technical picture of crude oil from the non-USD perspective.

Non-USD Picture of Crude Oil

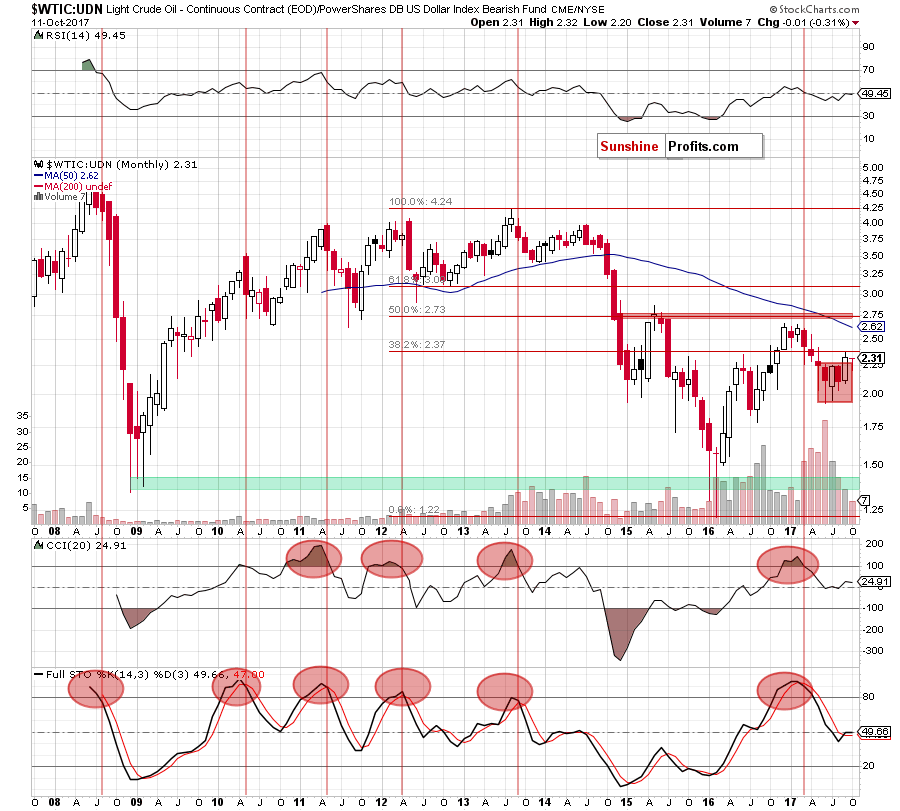

(…) As a reminder, UDN is the symbol for the PowerShares DB US Dollar Index Bearish Fund, which moves in the exact opposite direction to the USD Index. Since the USD Index is a weighted average of the dollar's exchange rates with world's most important currencies, the WTIC:UDN ratio displays the value of crude oil priced in "other currencies".

Looking at the long-term chart, we see that although the ratio broke above the upper border of the red consolidation in the previous month, the 38.2% Fibonacci retracement stopped oil bulls, triggering a pullback at the end of October.

Taking this fact into account and combining it with the medium-term picture below, we think that lower prices of crude oil are still ahead of us. Let’s take a look at the weekly chart.

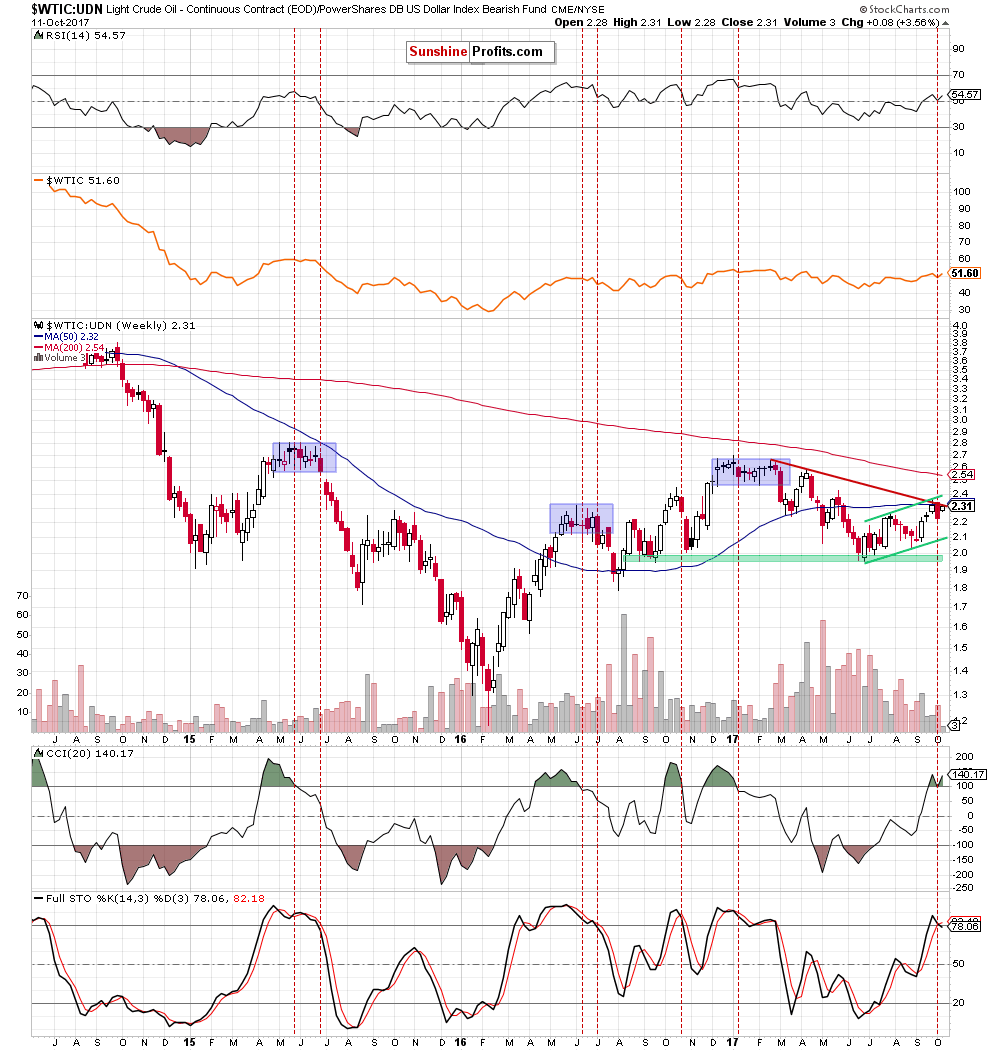

On the above chart, we see that the combination of the red declining resistance line based on February and April highs, the 50-week moving average and the upper border of the green rising trend channel stopped oil bulls and encouraged their opponents to act. Additionally, the CCI and the Stochastic Oscillator generated the sell signals, increasing the probability of further declines in the coming week(s).

Why? As you see on the chart, many times in the past the sell signals generated by the medium-term indicators preceded bigger downward moves (or even huge – just like in 2015 or earlier this year), which suggests that the history will likely repeat itself once again and we’ll see another move to the downside later in October.

This scenario is also reinforced by the very short-term picture of the ratio.

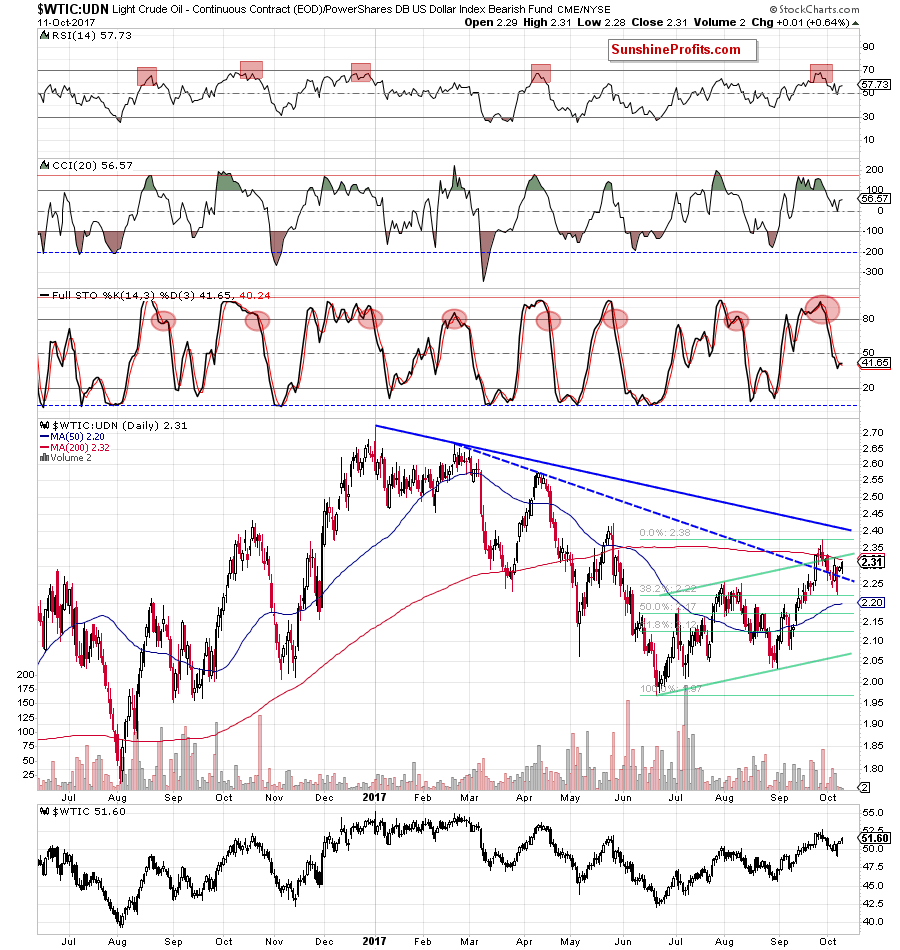

From this perspective, we see that the ratio invalidated the earlier breakout above the 200-day moving average and the upper border of the green rising trend channel, which suggests lower prices in the coming week (…)

What does it mean for crude oil priced in U.S. dollars? In our opinion, another move to the downside in the ratio will trigger one more move to the south in crude oil. Therefore, we think that short positions continue to be justified from the risk/reward perspective.

Summing up, short positions continue to be justified from the risk/reward perspective as crude oil remains under the resistance area created by the May and August highs and the long-term green resistance line, which stopped oil bulls at the end of July and also at the end of the previous month. The pro bearish scenario is also reinforced by the current situation in the WTIC:UDN ratio, which suggests that lower prices of crude oil are just ahead of us.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $54 and the initial downside target at $45.80) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts