Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thursday’s session brought a fresh November low and a drop under the barrier of $50. Although oil bulls managed to trigger a rebound and invalidated the earlier breakdowns before the session closure, some disturbing technical factors remain in the cards.

What do we mean by that? Let's analyze the charts below (charts courtesy of http://stockcharts.com).

In our Oil Trading Alert posted on Tuesday, we wrote the following:

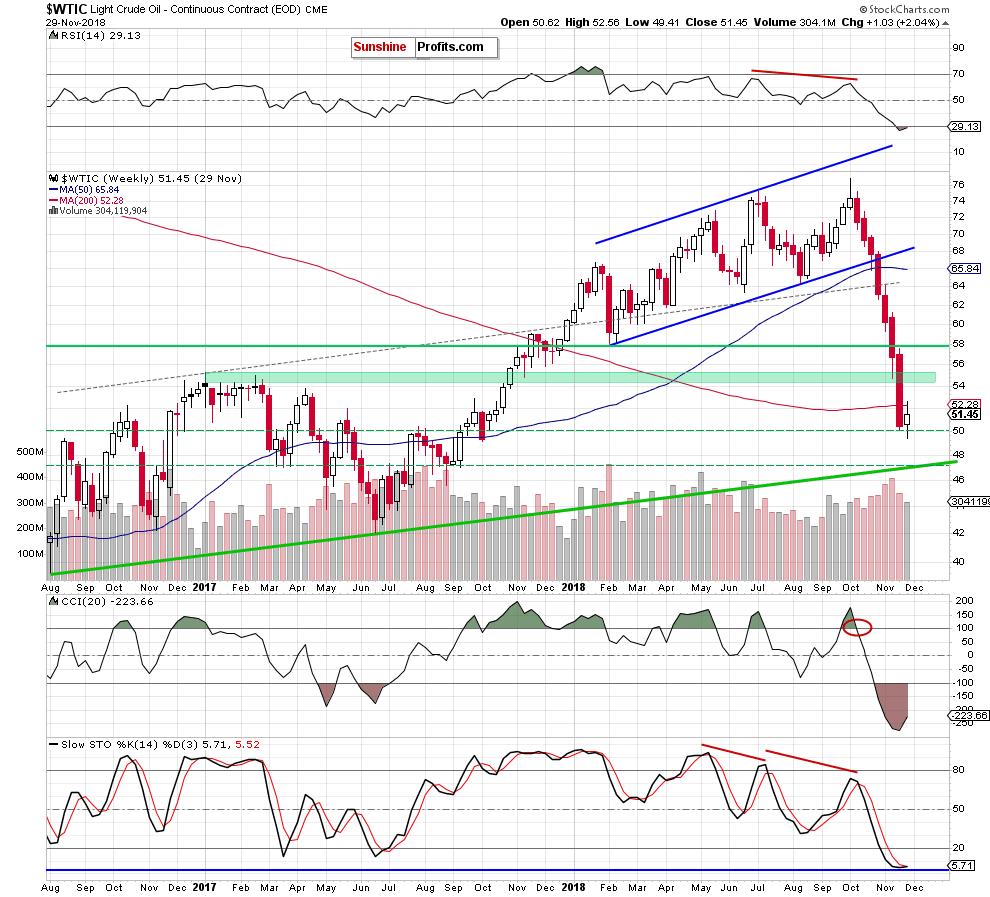

(…) crude oil bounced off the barrier of $50 during yesterday’s session and closed the day above $51. Although this may look encouraging, we should keep in mind that the price of black gold increased to the previously-broken 200-week moving average and pulled back, closing the day below it.

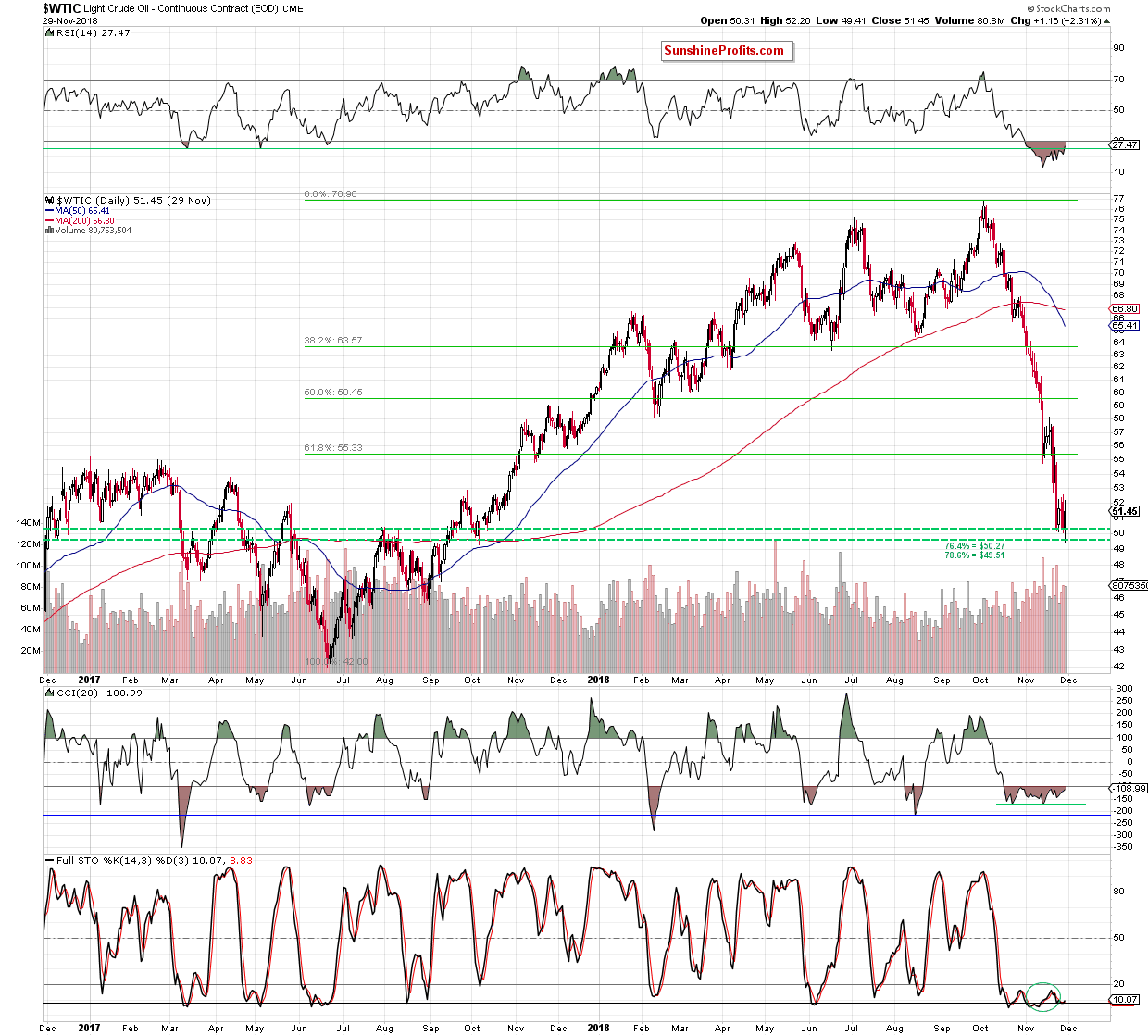

Such price action suggests that we could see nothing more than a verification of the earlier breakdown under this support. If this is the case, the price of light crude will likely move lower once again and test the recent lows, the barrier of $50 or even the support area created by the 76.4% and the 78.6% Fibonacci retracements (marked on the daily chart (…) with the green horizontal dashed lines) in the following days.

From today’s point of view, we see that the situation developed in line with the above scenario and oil bears pushed the commodity lower once again, hitting a fresh November low of $49.41 during yesterday’s session.

Although crude oil bounced off the session’s low quite quickly, invalidating the earlier breakdown under the previous lows, the barrier of $50 and the above-mentioned Fibonacci retracements, we should keep in mind that black gold is still trading not only under this week’s peak, but also below the 200-week moving average, which stopped the buyers in recent days.

Taking this fact into account and combining it with the lack of the buy signals, we think that further improvement and higher prices of light crude will be more likely and reliable if we see a comeback above this major short-term resistance. Until this time, another test of the barrier of $50 and the above-mentioned supports can’t be ruled out.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. As always, we’ll keep you - our subscribers - informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts