Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

The currency market situation continues to have a substantial impact on the crude oil price, and therefore, we'll start today's Oil Trading Alert with an analysis.

In yesterday's analysis, we've dissected the USD Index's breakout, but at the same time, yesterday, we have detected something truly perplexing.

Namely, the USDX invalidated its breakout, which is clearly a bearish sign. Quite visibly, the USDX was above the declining resistance line, but it failed to hold these gains. In July, a failure to rally above resistance meant another big downturn, which translated into higher crude oil prices.

So, the question is, will the USDX and crude oil have the same fate in the near future? Well, not necessarily.

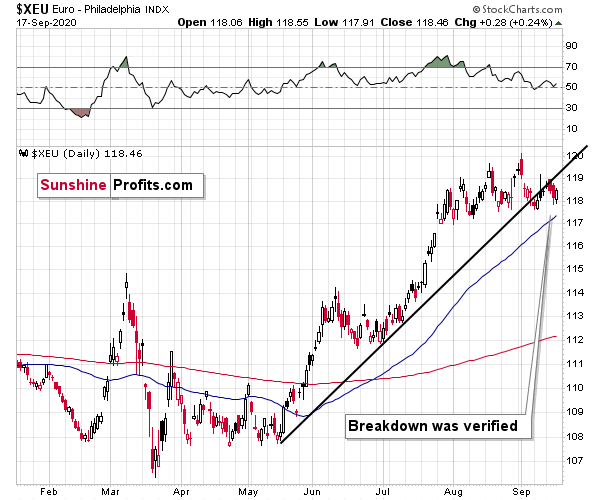

The USD Index represents a weighted average of several currency exchange rates. The biggest weight (over 50%) is attributed to the euro exchange rate, and the second biggest weight is attributed to the yen exchange rate. Let's see how the situation looks in both currencies.

The euro is after a breakdown and a verification thereof. It is a very bearish situation, and bullish one for the USD Index and. Because of that, at least in the short run, it is bearish for gold.

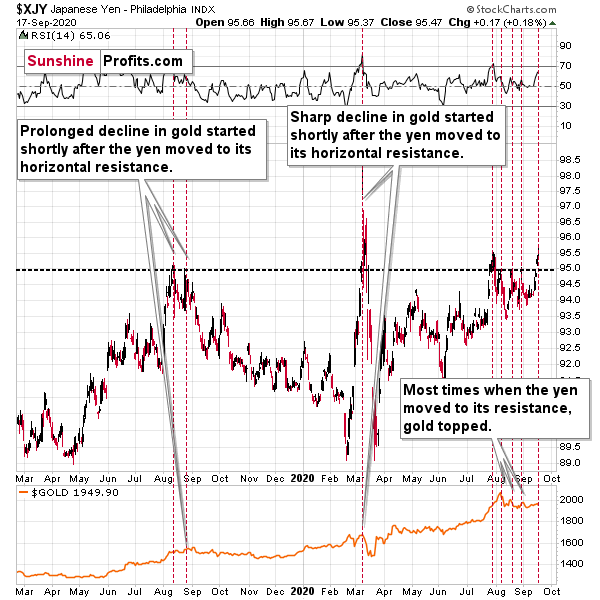

And what about the Japanese yen?

Turns out, as far as the implications are concerned, the situation is not that different. However, the direct reason for it is.

As you can see on the Japanese yen index chart above, for the past 1.5 years, it topped shortly and reversed its course whenever it tried to rally above the 95 levels.

The Japanese currency's implication can potentially invalidate the breakout once again. Therefore, history tends to rhyme, after all.

Given the advice that the individual currency exchange rates provide us with, should we really expect the USD Index's breakout invalidation to cause lower values? Not really. The individual currency exchange rates are more "basic", and their outlooks prevail the index chart that is essentially based on them.

In other words, the validity of the bearish implications of USDX's invalidation is suspicious.

The result is that the bearish outlook for crude oil didn't really change, even though we admit that it is not as bearish as it was before the USDX's breakout's invalidation.

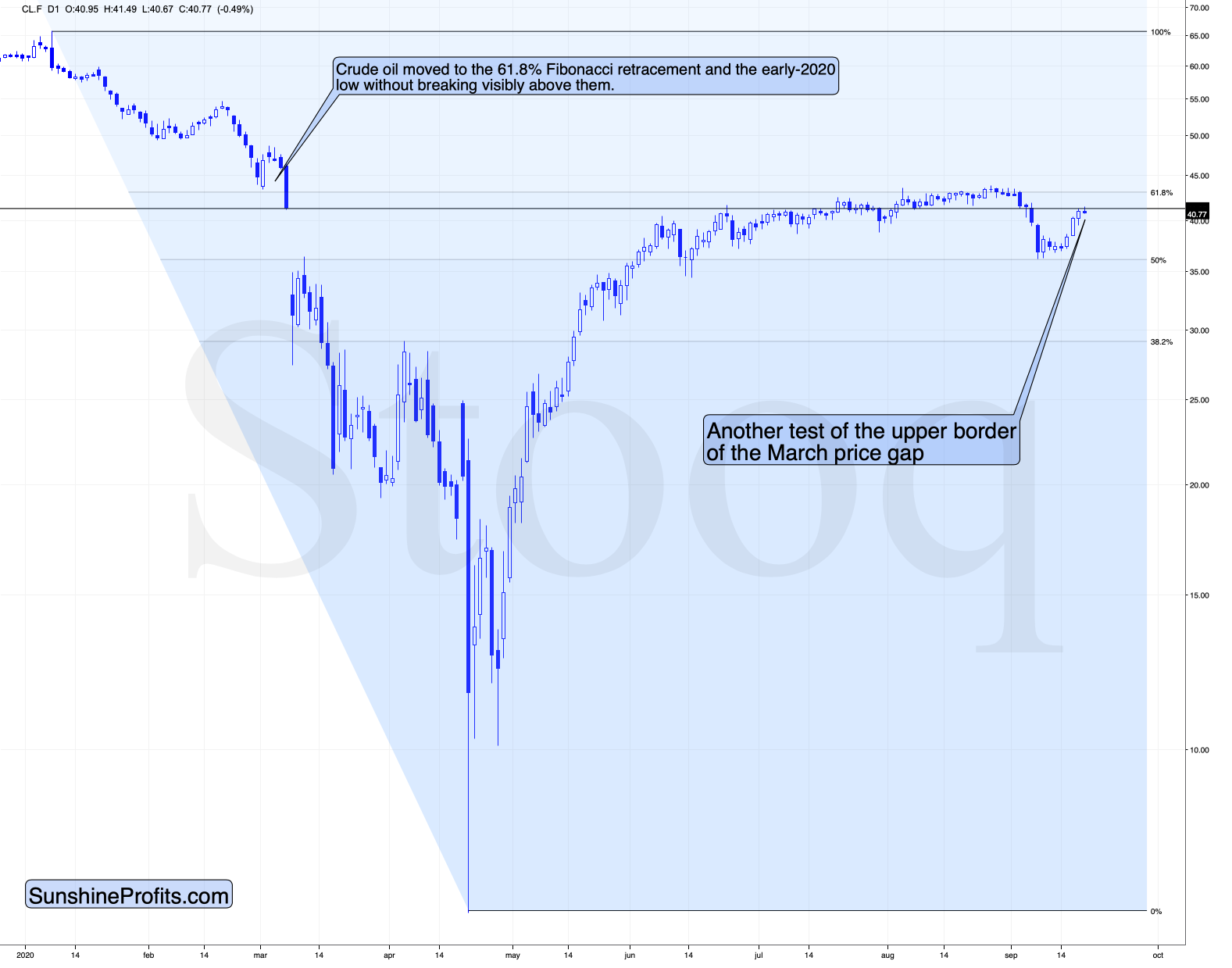

Crude oil is once again testing the upper border of the massive March price gap. Until it breaks above this level, the early-March lows, and the 61.8% Fibonacci retracement, the outlook becoming bullish is simply not possible.

Having in mind what we wrote about the USD Index today, the above is unlikely to happen.

To sum things up, in the upcoming weeks, the outlook for crude oil remains to be bearish, and the most recent upswing couldn't change that at all.

As always, we'll keep you - our subscribers - informed.

Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

In the case of the futures contracts that are more distant than the current contract, we think that adding the premium (difference between the July and other contracts) to both: stop-loss and initial target prices is justified.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager