Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

After we've published yesterday's analysis, crude oil moved slightly higher, but at the time of writing the following, it's more or less at the same trading levels from about 24 hours ago. To put it differently, little has changed on the crude oil chart, as the details below will point out.

Given the fact that the situation remained unchanged, our analysis from yesterday, September 16th remains up-to-date:

At last, crude oil moved a bit higher, so you might be asking yourself if the trend has reversed or is this just a pause before the moves continue.

In short, we think the latter is much closer to the truth.

The fact remains that in a global and hyperconnected economy such as today, no market can sustain a complete independence of the rest of the world. Crude oil, as the most versatile marketplace commodity, is not excluded from that reality.

Namely, the two markets that the black gold often looks up to the most are stocks and currencies. In today's analysis, we'll focus on the latter.

The black gold upswing has been relatively modest and parallels with a similar pause in the USD Index. To validate this, let's take a look at the following charts for more details.

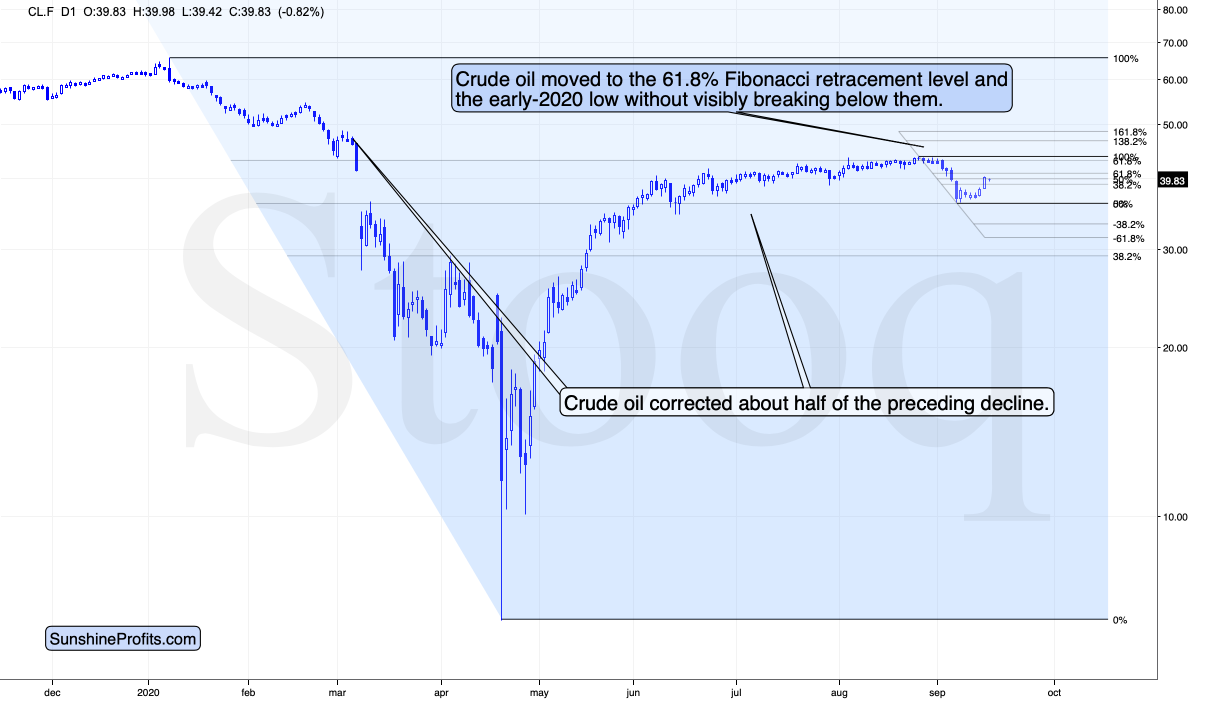

Crude oil has corrected after the most recent decline, a higher which resembles the brief early-March pop-up higher that preceded one of the sharpest declines that we saw over the past decades. The preceding decline's size was broadly similar as well, which only adds to the likelihood of this rally becoming a slide.

And regarding the USD Index? Well, in recent times, the USDX and crude oil moved in the opposite directions.

In particular, this month's decline in crude oil corresponded to USD's rally.

Therefore, if the USD Index is breaking higher, the crude oil market will likely move lower soon.

And it does!

The USD Index just moved above its declining medium-term resistance line, which means its outlook has improved. It will improve much further if the USDX can maintain these gains and if the breakout is confirmed. Yesterday was the first close above the resistance line, so if we see two more (including tomorrow's weekly close), the breakout will finally be confirmed. That will have significant implications not only on the USDX itself but also on the markets that it influences, including crude oil.

Let's not forget that the aforementioned happened right after crude oil failed to rally above the 61.8% Fibonacci retracement (based on the 2020 decline) and the early-2020 lows. The strong resistance stayed on - despite the positive influence that the general stock market should have had on the black gold. This means that the current move lower does indeed "has legs" - and it's not just a brief breather.

Summing up, for the next several weeks, the outlook for crude oil remains bearish, and the most recent upswing didn't change that at all. The breakout in the USD Index served as a critical bearish confirmation.

As always, we'll keep you - our subscribers - informed.

Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

In the case of the futures contracts that are more distant than the current contract, we think that adding the premium (difference between the July and other contracts) to both: stop-loss and initial target prices is justified.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager