Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

Yesterday's oil trading doesn't give much reason either to the bulls or the bears to celebrate. By itself, it really doesn't. Viewed from a bit longer perspective however, we're able to judge the oil price prospects going forward. Let's see how we see the odds for the next move placed right now.

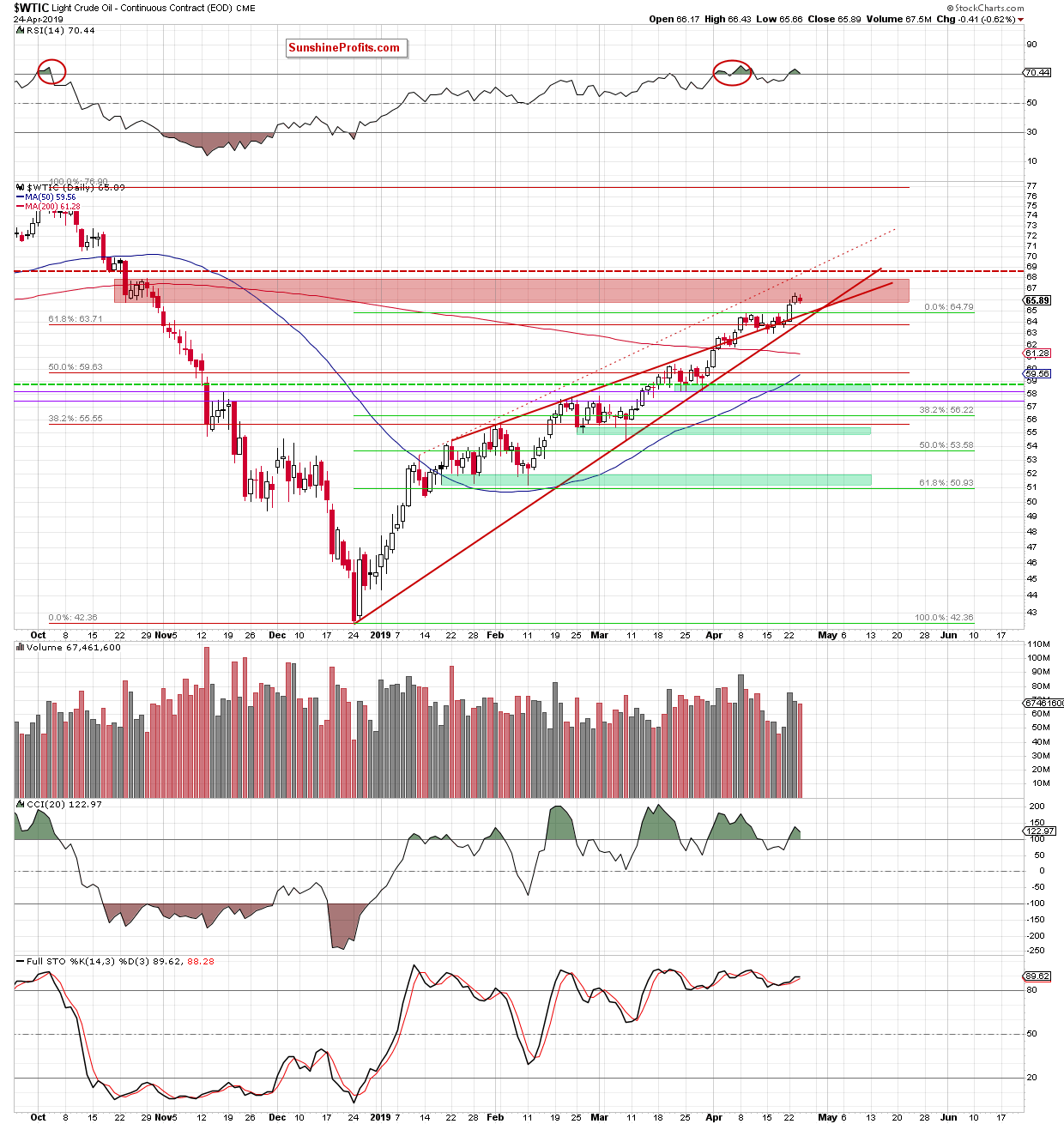

Let's take a closer look at the chart below (chart courtesy of http://stockcharts.com).

Yesterday's session was marked with a slight decline. Crude oil price has remained at the lower border of the red resistance zone. Earlier today, the oil price has made an upswing, yet still trades below Tuesday's highs at the moment of writing these words. The red resistance zone still remains a major obstacle for the bulls to overcome.

Yesterday's volume doesn't add more clarity to the picture by itself. However, the forming bearish divergences between the daily indicators and the oil price, they do shed more light. Namely, they support the bearish case for oil.

Summing up, the red resistance zone is still to be counted with. It provides resistance to any potential price upswing. With the daily indicators forming bearish divergences, they continue to support the sellers. Lower oil prices remain probable and the short position justified from the risk-reward point of view.

Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist