Trading position (short-term; our opinion): Short position with a stop-loss order at $60.22 and the initial downside target at $50.38 in crude oil is justified from the risk/reward perspective.

Yesterday’s session could seem boring on the surface. To some but not to us. The powerful combination of technical forces at play for so long. It seems to be taking over, one at a time. Crude oil looks stumbling and this is encouraging to the bears. How far will they be able to go? Would the U.S.-China trade deal anxiety and the Fed’s policy stance provide the impetus?

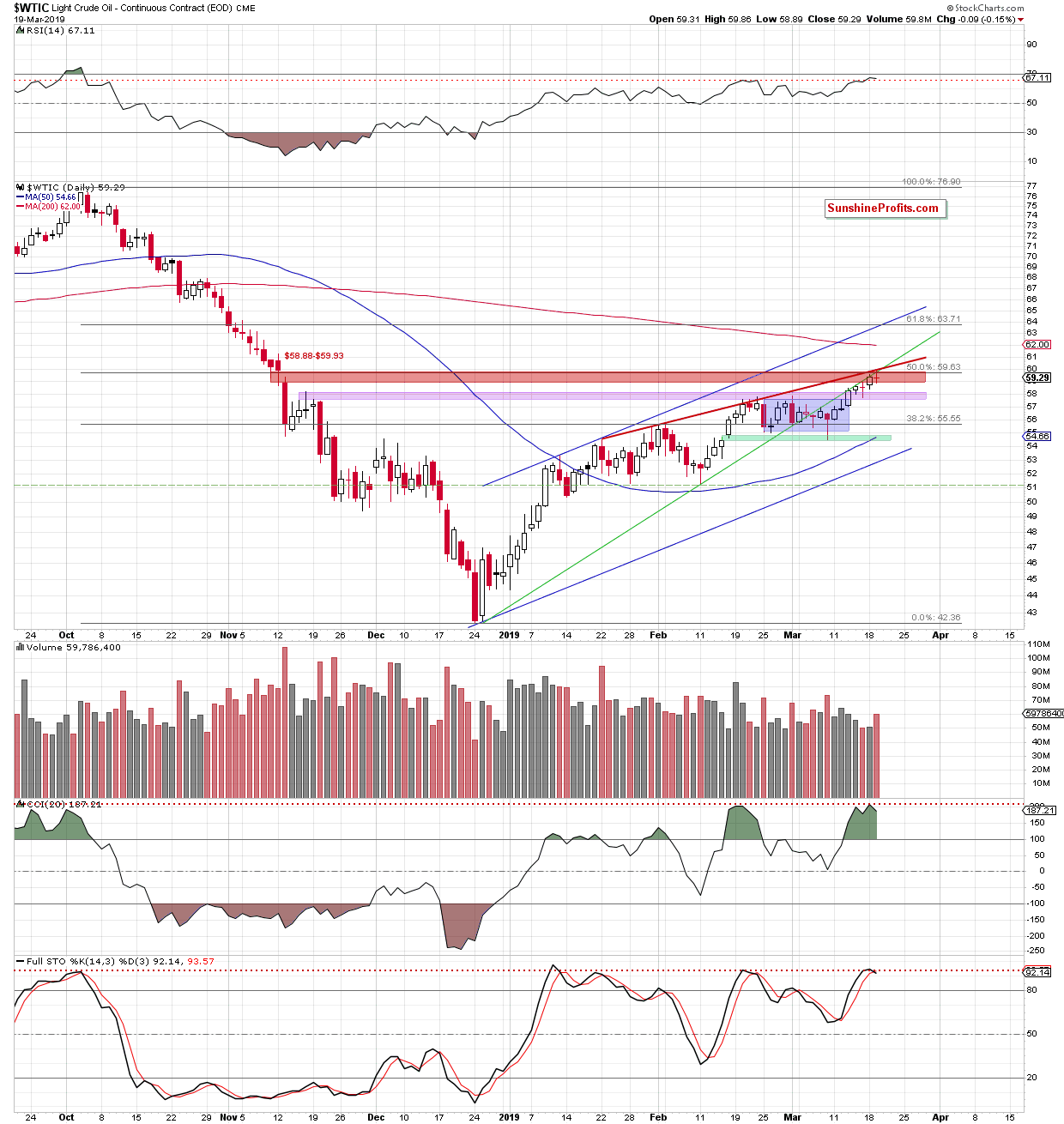

Let’s take a closer look at the chart below (chart courtesy of http://stockcharts.com).

More of the same. Crude oil is hanging precariously in the balance. It may seem that yesterday’s doji wouldn’t give us much to talk about but the opposite is true. The hidden gem is not in the candle itself but in the volume. It belongs among the higher ones when viewed from the perspective of last few sessions. It indicates increasing selling interest that has met insufficient buying power to take the oil price any higher. This is a subtle bearish sign.

Coming back to the candle and how it fits into the overall technical picture, we see that yesterday was the fifth day in a row of consecutive unsuccessful attempts to break above the broken rising medium-term green line.

There is also the major medium-term resistance area created by the 50% Fibonacci retracement (based on the entire October-December downward move), the upper border of the red resistance zone (the November price gap) and the rising red resistance line based on January and February peaks. These all continue to keep gains in check.

The Stochastic Oscillator just issued its sell signal, giving oil bears further reason to act. Indeed, black gold changes hands at around $58.75 at the moment of writing these words.

Connecting the dots, we continue to believe that the space for increases is very limited and reversal is nigh.

Trading position (short-term; our opinion): Short position with a stop-loss order at $60.22 and the initial downside target at $50.38 in crude oil is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist