Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

Two days down, two days up. Judging by both moves’ magnitude, one would be tempted to declare the market in a clearly bullish mode. Judging the situation objectively, we see some gathering clouds on the horizon. When and where, that’s the subject of today’s analysis.

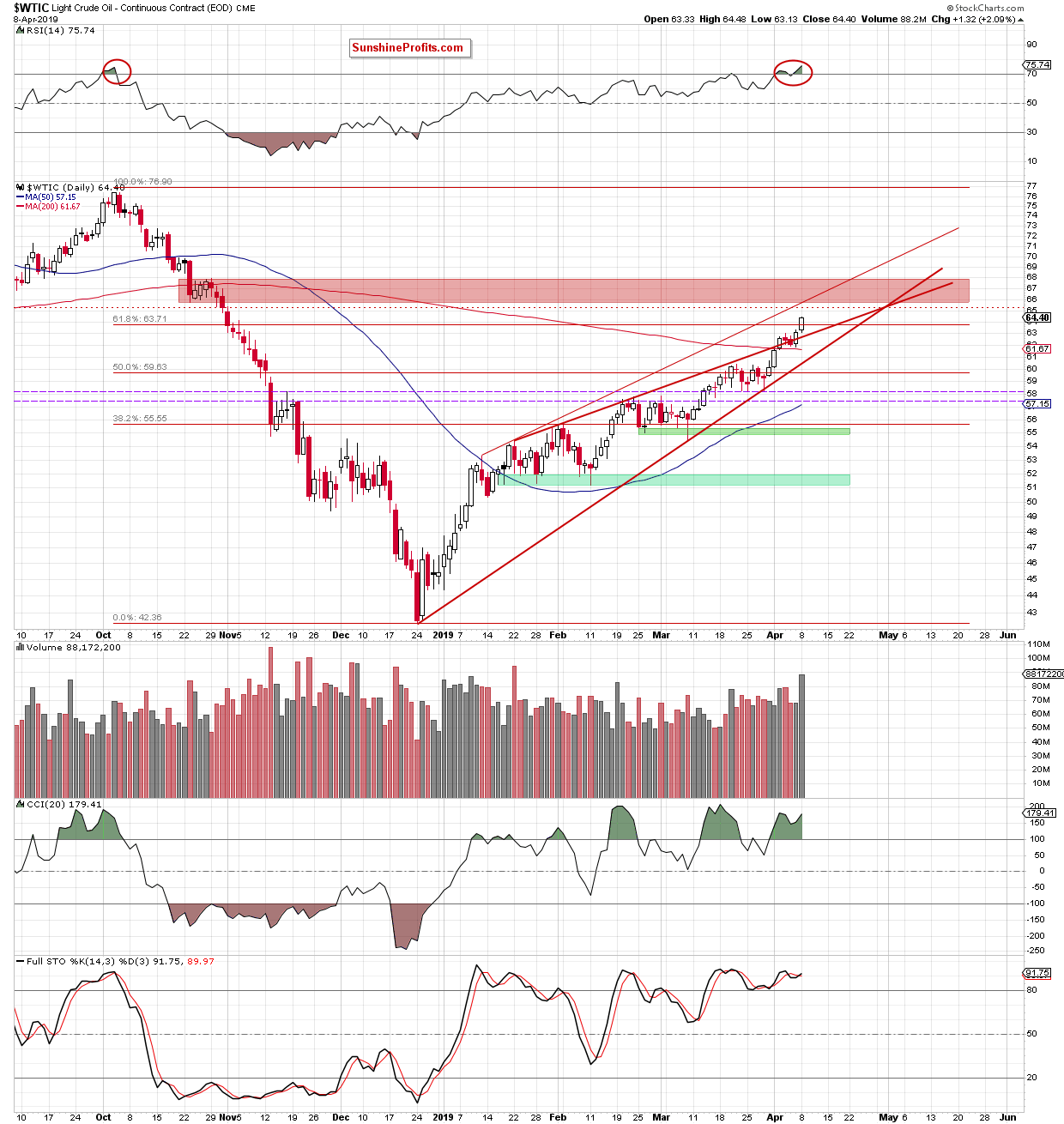

Let’s take a closer look at the chart below (charts courtesy of http://stockcharts.com).

Yesterday’s session was a show of force of the bulls. They broke out above the 61.8% Fibonacci retracement and did so on a sizable volume. The volume sign has bullish implications.

Let’s go on looking at the daily indicators.

The Stochastic Oscillator is extremely overbought (over 90), however it generated its buy signal. Neither CCI is relenting yet. This suggests one more upswing with a likely test of the red resistance zone before any reversal and move to the downside.

Trading position (short-term; our opinion): No position is justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist