Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Despite several favorable technical factors, oil bulls have failed once again and allowed their rivals to push the price of the black gold to a fresh November low earlier today. Does this mean that the barrier of $ 60 is already in the range of the bears’ paws?

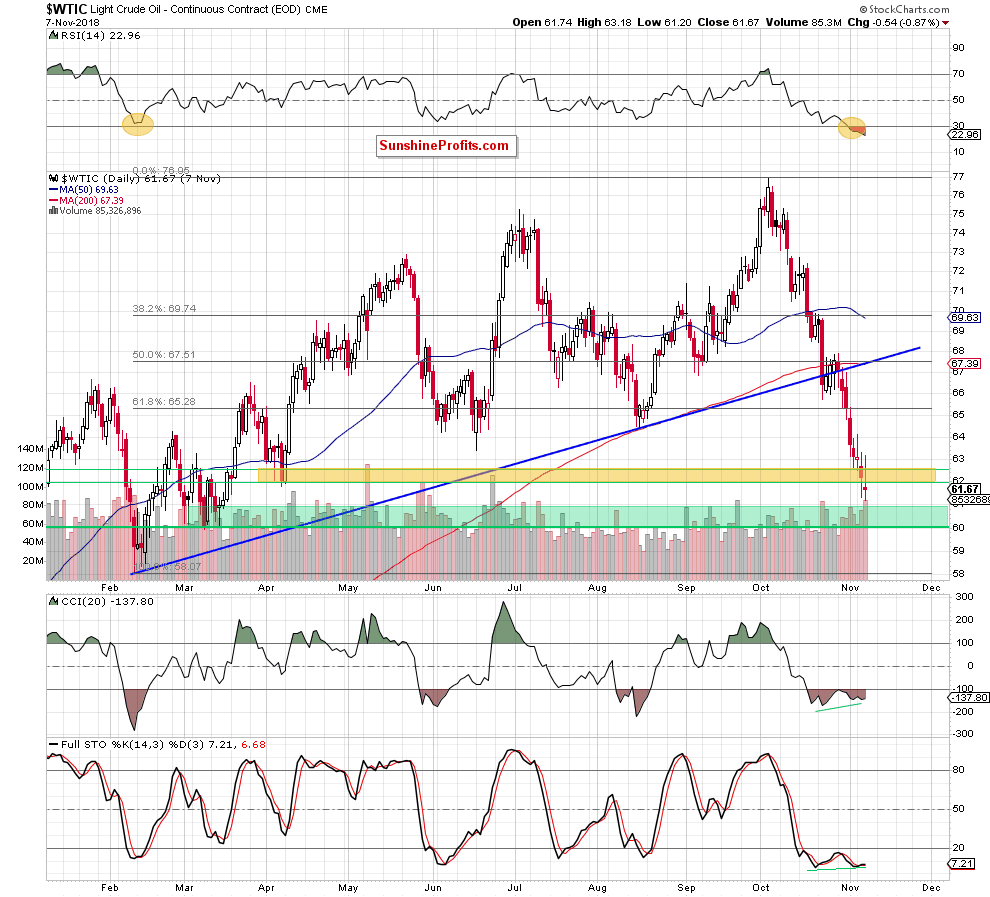

Let’s take a look at the chart below (charts courtesy of http://stockcharts.com).

Today’s alert is going to be very brief, because oil bulls didn’t do anything new during yesterday’s session. Although they pushed the price of black gold above the upper border of the yellow support zone (created by the 76.4% and 78.6% Fibonacci retracements), this improvement was very temporary and the commodity reversed in the following hours.

This show of weakness encouraged the sellers to act, which resulted in a daily closure below the yellow zone. In this way the buyers lost their last technical support, which increases the probability that we’ll see a test of the green support zone or even the barrier of $60 (the lower line of this support area) in the coming days.

Trading position (short-term; our opinion): none positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts