Trading position (short-term; our opinion): Profitable short positions with a stop-loss order at $73.10 and the next downside target at $66 are justified from the risk/reward perspective.

Monday’s session took crude oil above the 38.2% Fibonacci retracement and the barrier of $70. But did yesterday’s upswing change anything in the short-term outlook?

Let’s take a closer look at the charts below (charts courtesy of http://stockcharts.com).

Technical Picture of Crude Oil

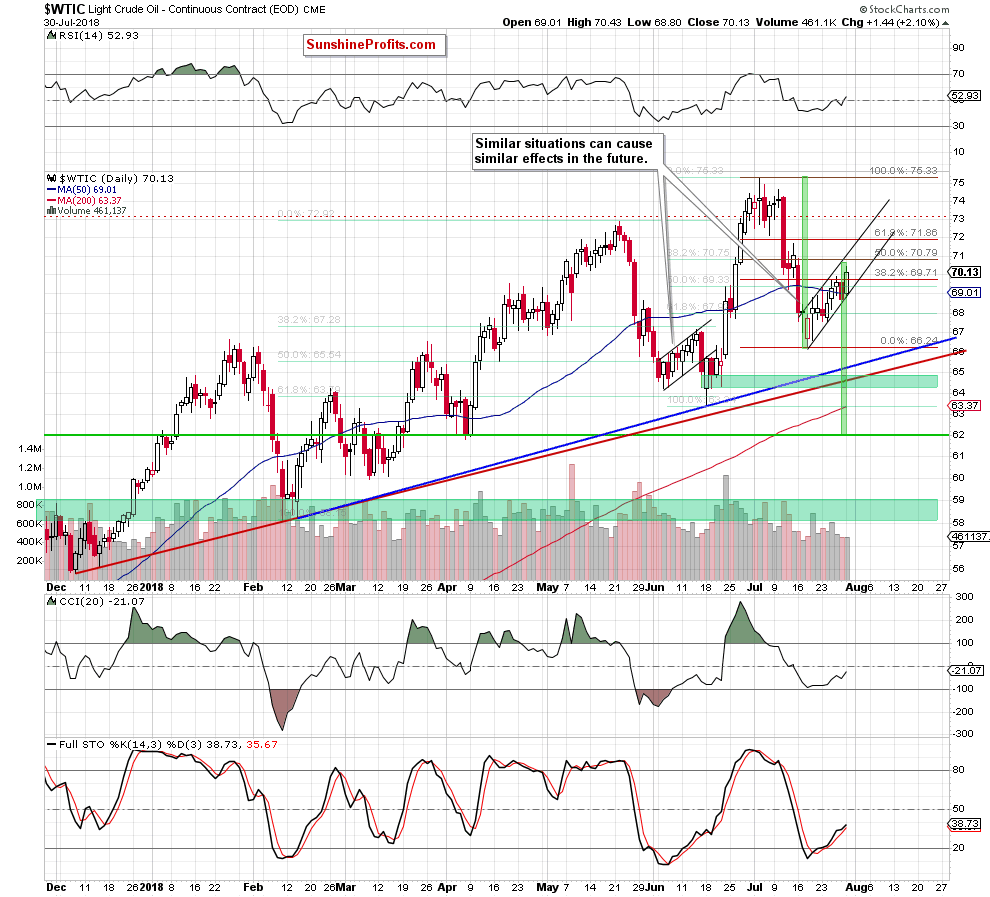

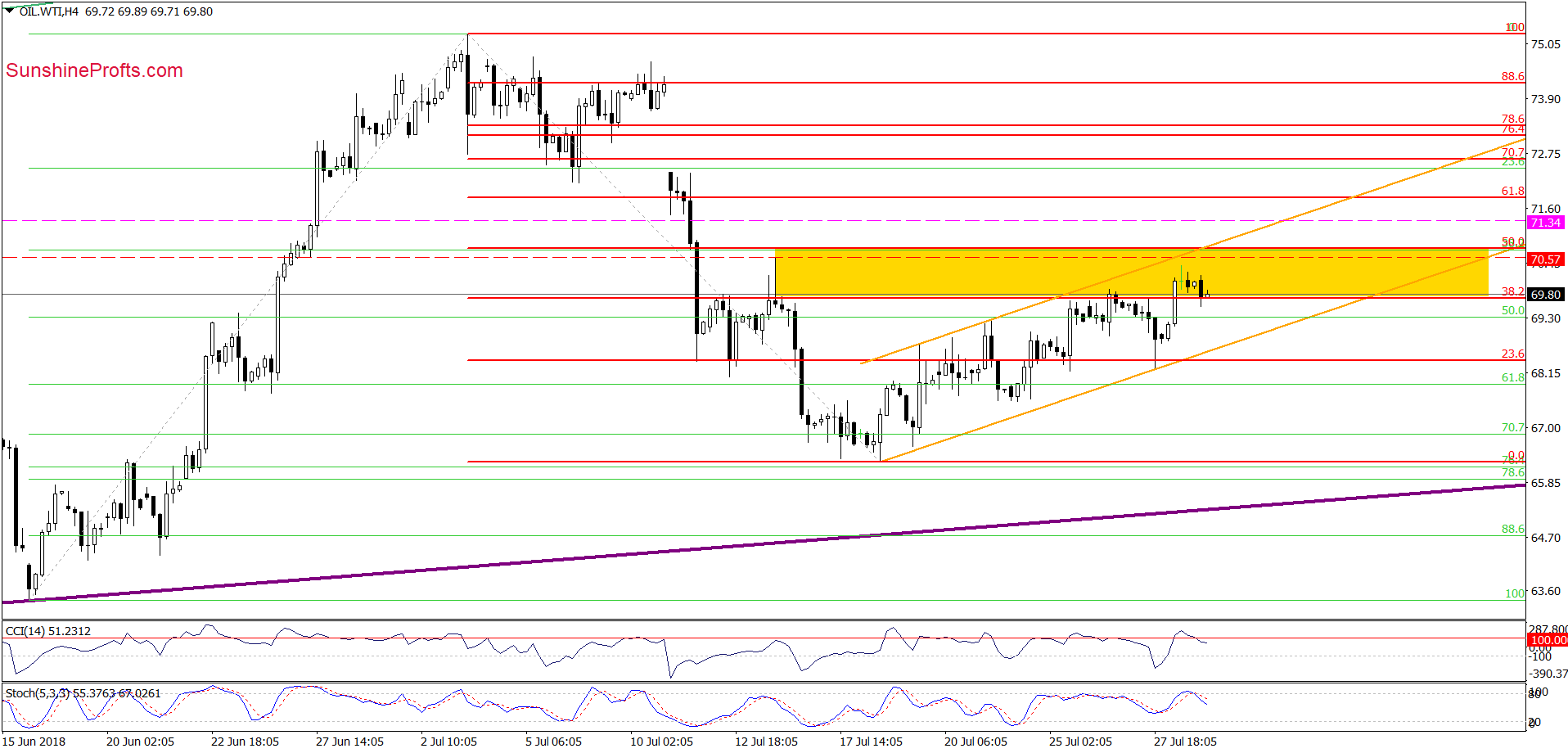

From today’s point of view, we see that the lower border of the very short-term black rising trend channel triggered a rebound, which took black gold above the 38.2% Fibonacci retracement.

Although this is a positive event, yesterday’s upswing dind’t materialize on a larger volume, which may be a sign of weakening bulls. Additionally, the price of light crude is still trading inside the very short-term rising trend channel, which means that what we wrote in our last commentary remains up-to-date also today:

(…) today’s upswing not only erased Friday’s drop, but also took light crude above the 38.2% Fibonacci retracement. Such price action suggests that we’ll likely see a test of the upper line of the trend channel, which currently intersects the red horizontal resistance line based on the July 13 high.

However, slightly above them, there is also the 50% Fibonacci retracement, which together with the above-mentioned resistances will likely activate oil bears. If the situation develops in line with the above assumption, we’ll likely see another reversal and another test of the lower border of the very short-term black rising trend channel marked on the daily chart in the very near future.

Summing up, profitable short positions continue to be justified from the risk/reward perspective as the short-term outlook remains bearish (despite yesterday's rebound), favoring the sellers and lower prices of crude oil in the coming week(s).

Trading position (short-term; our opinion): profitable short positions with a stop-loss order at $73.10 and the next downside target at $66 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts