Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

Crude oil bulls took a pause yesterday. Are they just resting before another move higher? Let’s consider all the technical factors before answering. How much has actually changed since yesterday? How does today’s downswing fit into the picture? So many questions. Let’s jump right in to the answers. And their implications.

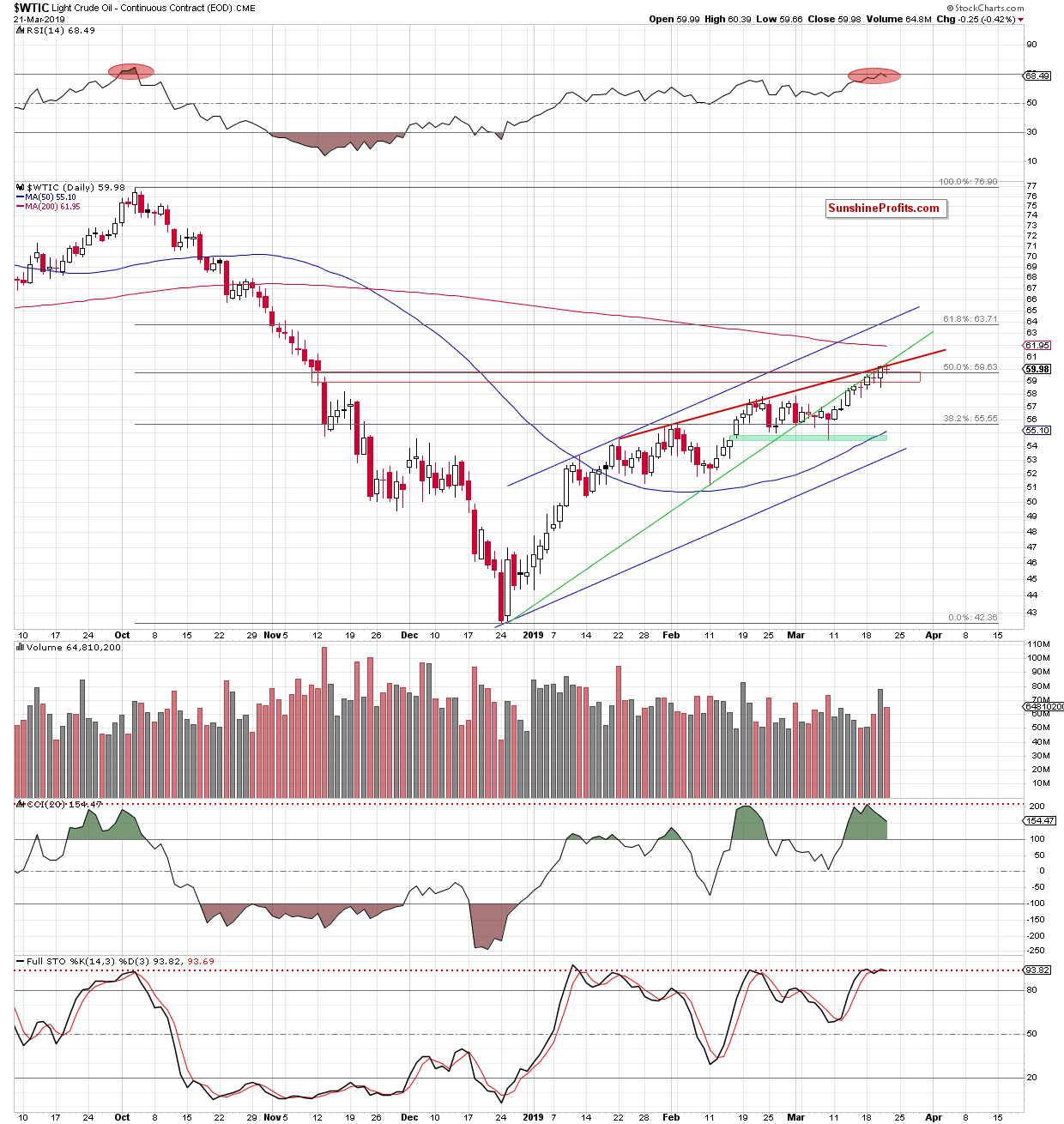

We’ll start with a closer look at the chart below (charts courtesy of http://stockcharts.com).

Yesterday, the oil market has dealt us another doji, the third such in the last five trading days. Black gold finished yesterday’s session above both the 50% Fibonacci retracement (based on the entire October-December downward move) and the red resistance zone (the November price gap). Looking at yesterday’s close, this would imply that not that much has changed since yesterday’s session. Quoting our yesterday’s words:

(…) However, the medium-term green line and the red resistance line based on January and February peaks have so far not been broken and continue to keep gains in check. The RSI climbed to its highest level since the November peaks. Taking a look at the CCI and Stochastics, we see clearly visible bearish divergences between their relative positions and the accompanying price action. Together with the above-mentioned resistances, the daily indicators point in the direction of a likely reversal in a very near future.

Earlier today, the bears are trying the firmness of the bulls’s conviction. Crude oil trades at around $59.00 at the moment of writing these words. This may turn out to be the start of the above-mentioned reversal. If crude oil closes today’s session below the 50% Fibonacci retracement, opening short positions might be the right call.

Trading position (short-term; our opinion): No position is justified from the risk/reward perspective. However, if crude oil closes today’s session below the 50% Fibonacci retracement, we’ll consider opening short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist