Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

It looks like oil bulls have hesitated after Monday's ride higher. Certainly, they haven't been able to progress as fast and as smoothly as the day before. Today, the oil price action is also marked with.... yes, hesitation. Is this what running into a resistance looks like? Take a look at our actionable game plan.

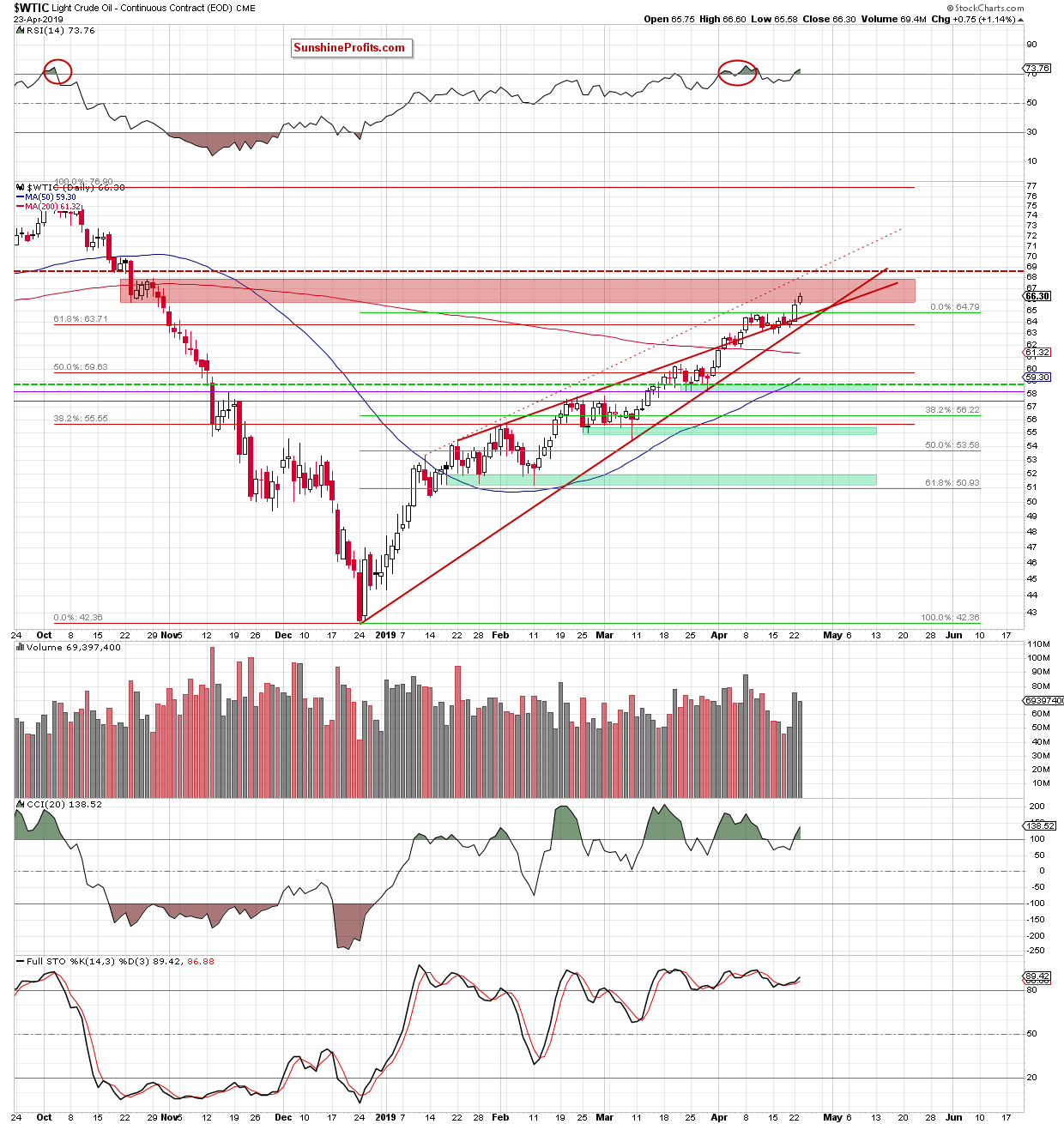

Let's take a closer look at the chart below (charts courtesy of http://stockcharts.com).

In yesterday's session, crude oil has moved higher once again, cutting into the red resistance zone. This red resistance zone however remains up and standing: it's still a major short-term resistance to count with.

Let's comment on yesterday's volume: it was somewhat smaller than the day before, which would suggest lower involvement of buyers than on Monday. It could translate into a reversal in the coming day(s).

Let's not forget the forming bearish divergences between the daily indicators and the oil price. Such a position of theirs has often preceded topping action. That would also support the bears.

Summing up, the red resistance zone continues to provide resistance to any potential oil upswing. With the daily indicators forming bearish divergences, they continue to support the sellers. Lower oil prices remain probable and the short position justified from the risk-reward point of view.

Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist