Trading position (short-term, our opinion; levels for crude oil’s continuous futures contract): No positions are currently justified from the risk/reward point of view.

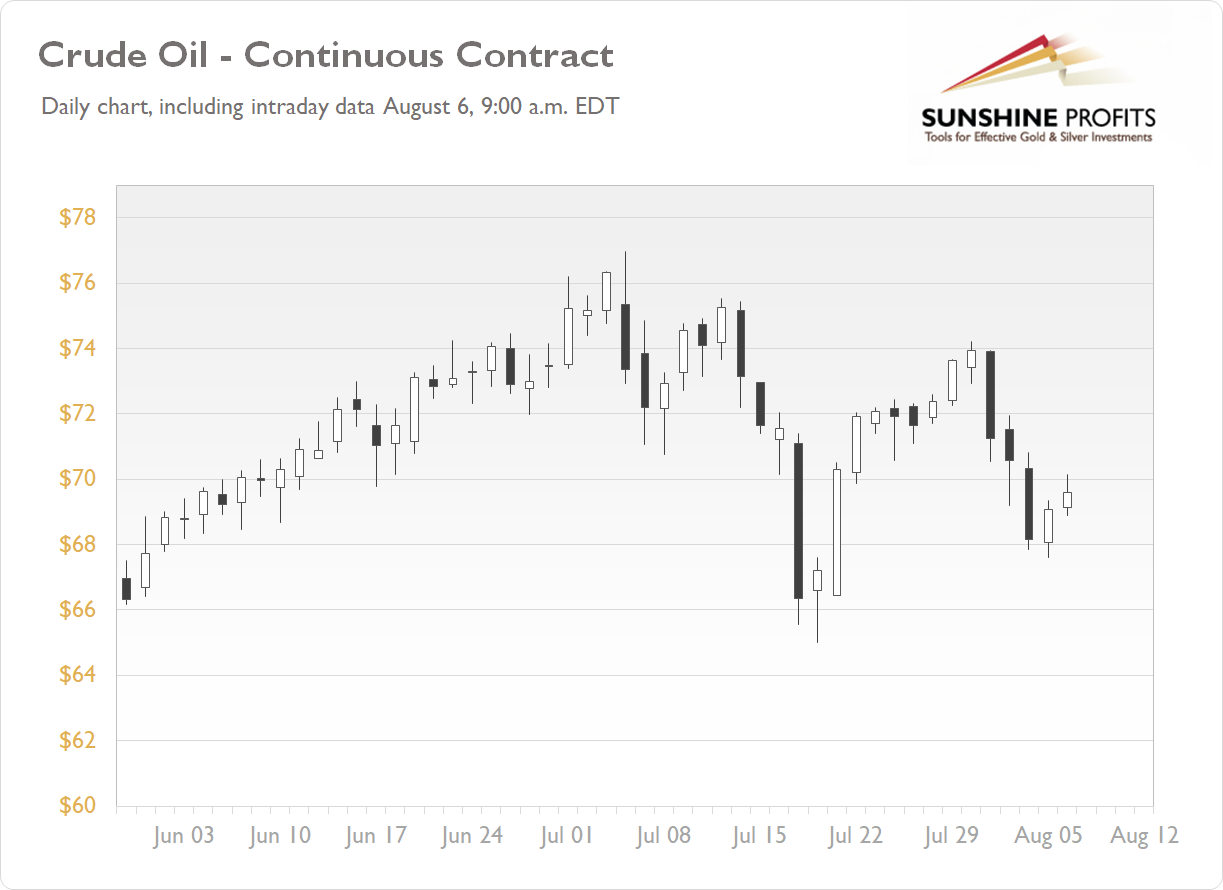

Crude oil extended its short-term downtrend yesterday, as it reached a local low of $67.61. The market got closer to its July 20 local low of $65.01 following a strengthening of the U.S. dollar. Additionally, Wednesday’s U.S. Crude Oil Inventories reported an increase of 3.6M barrels vs. the expected draw of 3.2M barrels. The increase in Crude Oil Inventories implies weaker demand, and it’s bearish for crude prices. However, crude oil price gained 0.9% yesterday, and today it’s 0.8% higher.

Today’s U.S. Nonfarm Payrolls release was better than expected (at +943,000), but oil keeps trading along the $70 price level.

Upward Reversal or Just Temporary Bounce?

The market reversed from the resistance level at around $74, broke the support level of $72, and then it further extended the decline. But, quite interestingly, on Thursday we did get a bounce from the $68 price level. Today oil is trading along $70 – it looks like an upward correction within a downtrend.

(the graph includes today’s intraday data)

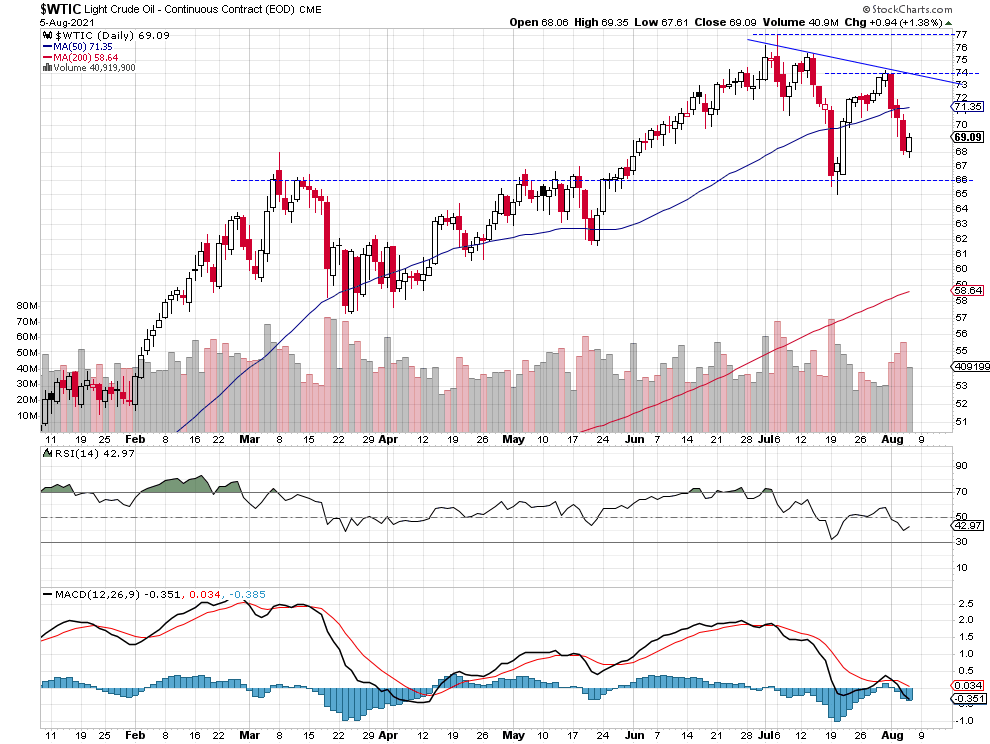

It Still Looks Like a Medium-Term Topping Pattern

The market is trading below a month-long downward trend line. The medium-term resistance level remains at $77, marked by the early July high. The support level is at $65-66, marked by mid-July local lows, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

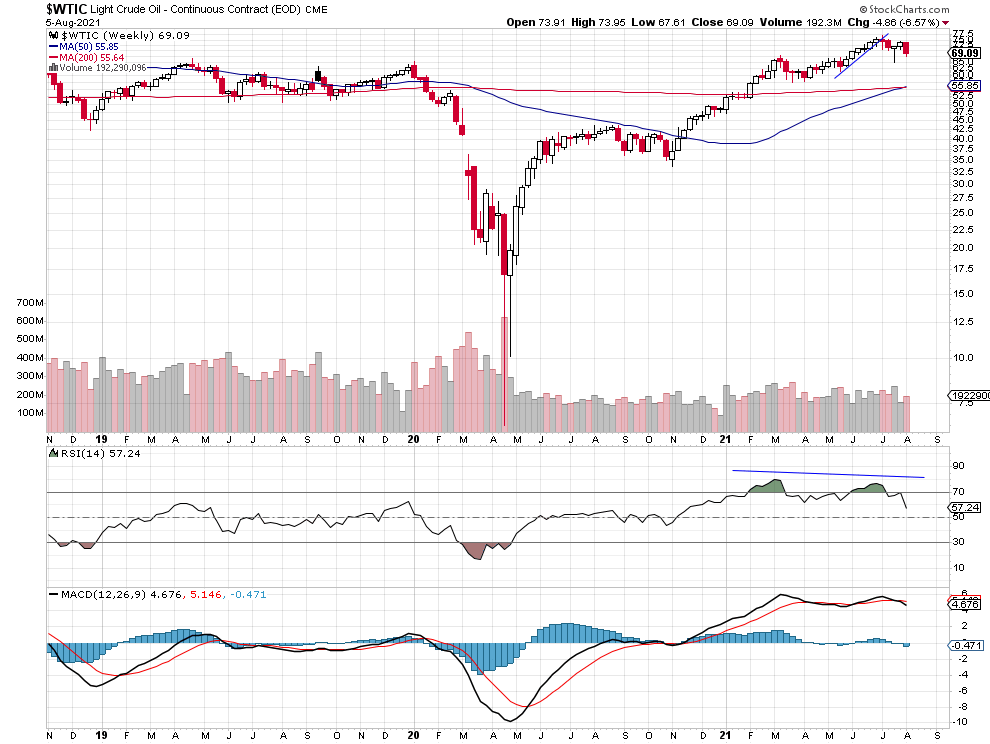

The weekly chart of the Light Crude Oil Continuous Contract is still showing clearly negative technical divergences between the price and the indicators. However, there have been no confirmed negative signals so far; the market remains relatively close to the medium-term highs:

Conclusion

Oil retraced most of its recent advances this week before bouncing off the $68 price level on Thursday. For now, it looks like an upward correction within a downtrend, and the market may be trading within a two-month-long medium-term topping pattern. At this moment, no speculative positions are justified from the risk/reward point of view.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for crude oil’s continuous futures contract): No positions are currently justified from the risk/reward point of view.

Thank you.

Paul Rejczak,

Oil Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care