Trading position (short-term; our opinion): Short position with a stop-loss order at $60.22 and the initial downside target at $50.38 in crude oil is justified from the risk/reward perspective.

Friday – what a day in the crude oil market. We saw another feeble attempt to move higher only to meet the fate of a resounding reversal down. Is this it? What else can we expect from the bears in the coming days? Let’s dive right in.

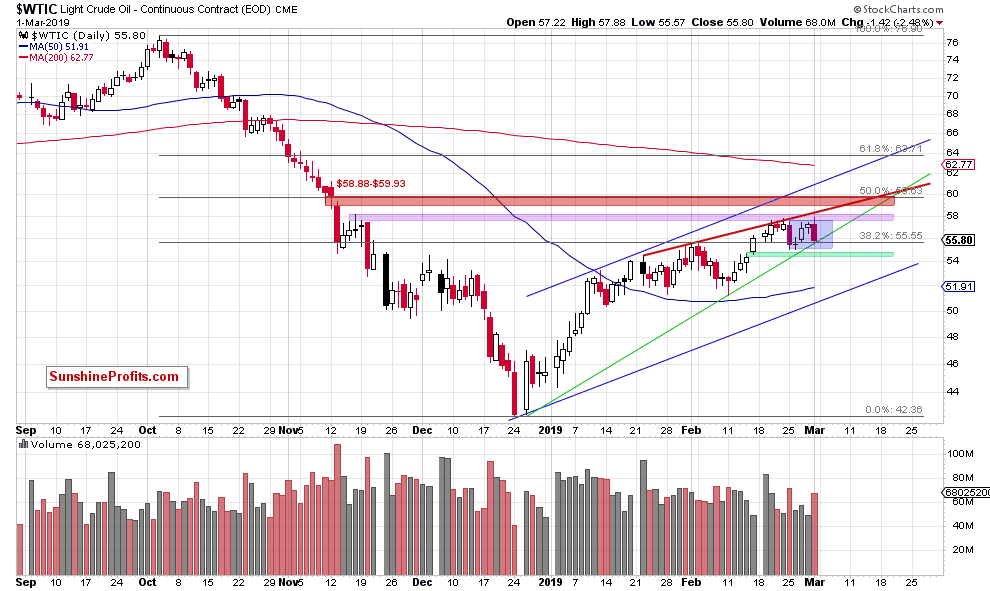

We’ll start with the chart below (chart courtesy of http://stockcharts.com).

On Friday, we wrote:

(…) the commodity is still trading below two nearest resistances: the upper border of the purple rising trend channel and the purple resistance zone. (...) Additionally, yesterday’s upswing materialized on smaller volume than day earlier. Combined with yesterday’s price compression and today’s hesitation (upside move has again been rejected and black gold changes hands at around $56.25 currently), this further underlines buyers’ weakness.

Our observations proved to be correct. Crude oil trades both below the upper border of the purple rising trend channel as marked on the first chart of the Friday’s alert, and also below the red resistance line based on the January 22, January 31 and early February peaks that we introduced in the second chart of the Friday’s alert.

Black gold price moved even lower eventually and the significant volume of the price slide continues to carry bearish implications into the future. Today’s upswing (oil changes hands at around $56.25 currently) remains likely to be muted, compared to the Friday’s ride.

Summing up, short positions continue to be justified from the risk/reward perspective as the bears have many factors on their side - recent tiny breakout invalidations, price trading beneath important resistances, the volume implications and the current position of the daily indicators (after Friday, the much discussed Stochastics is making tentative steps to curl in the bearish fashion). All these favor the sellers and another move to the downside in the nearest days.

Trading position (short-term; our opinion): Short position with a stop-loss order at $60.22 and the initial downside target at $50.38 in crude oil is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist