Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): No positions.

Crude oil soared after the surprising and somewhat fake employment numbers. There was practically no way to foresee such a positive jobs report, which was millions in the green instead of being millions in the red (what was the consensus expectation and what was indicated by previous reports). And yet, it happened, and markets reacted accordingly.

Crude oil soared well above our stop-loss level, and our small trade was exited. The move from the opening price was small as well, so overall it was not a big deal. If it wasn't for the SL, it could be turning into somewhat of a bigger deal, but the above kept the risk intact.

So, where does crude oil go from here? Unfortunately, at this time, the jury is still out. As black gold soared visibly above the midpoint of the price gap, the natural target now is its upper border.

Let's keep in mind that the 61.8% Fibonacci retracement is just above the upper border of the price gap and it's providing strong resistance as well.

Depending on what kind of confirmations we get when crude oil approaches these levels, we might re-open the short position, or open a long one, if that's what the market signals confirm at that time. In our view, the former still seems more likely.

And why would the Friday's jobs report be somewhat fake?

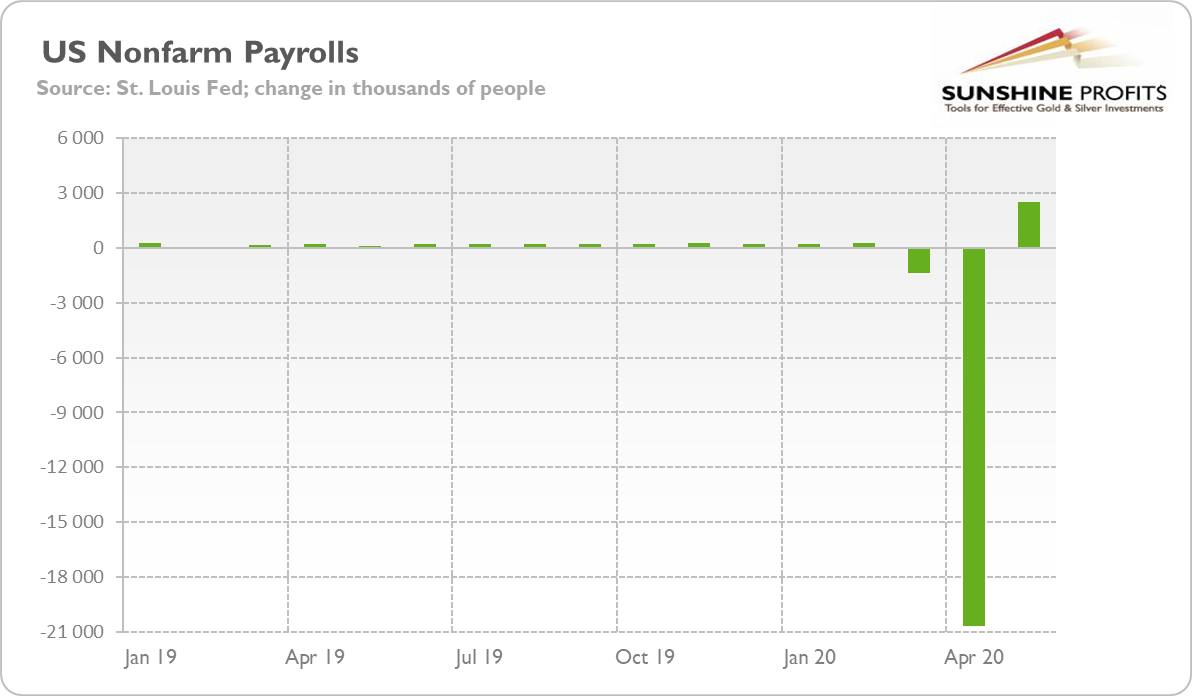

On Friday, the Bureau of Labor Services released the newest edition of the Employment Situation Report. The publication shows that the US economy regained 2.5 million jobs in May, constituting the biggest nonfarm payroll surprise in history. Indeed, the economists polled by MarketWatch had forecast a loss of 7.25 million jobs. The rebound is presented in the chart below.

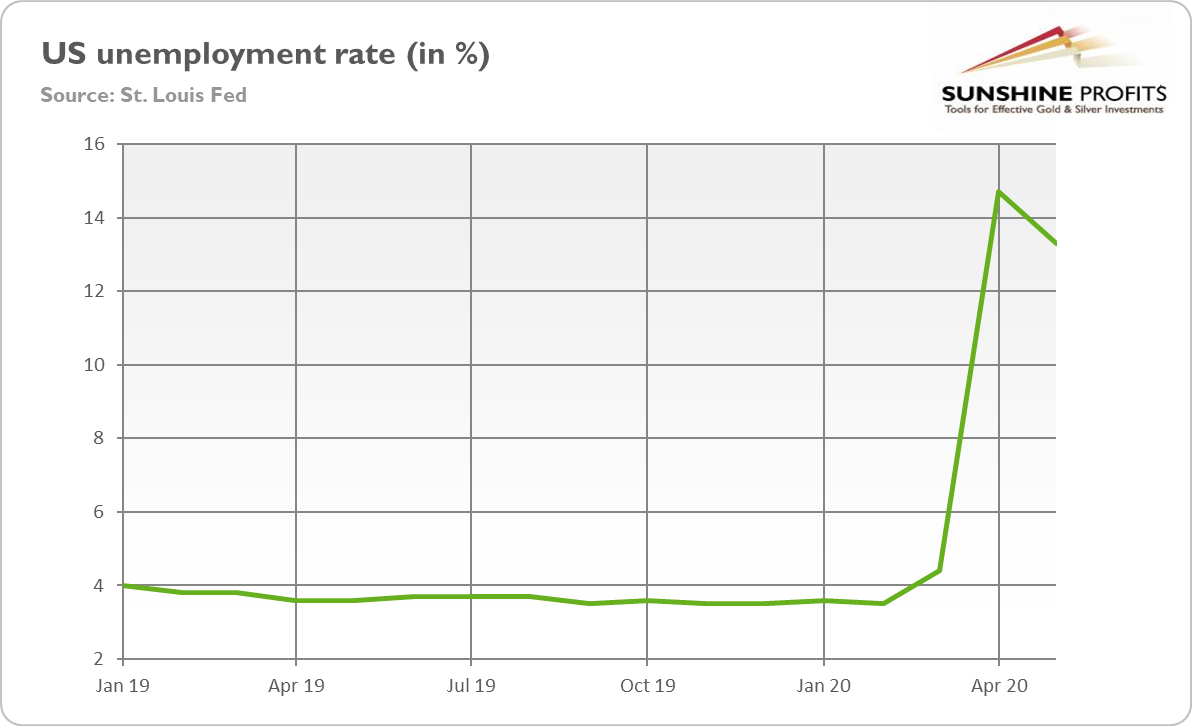

Meanwhile, the analysts expected that the unemployment rate would rise to 19 percent from 14.7 percent in April, but it declined to 13.3 percent, as one can see in the next chart. The report, if reliable, signals that the postpandemic recovery has begun, as the charts below show.

Not surprisingly, the stock market reacted euphorically, with the S&P 500 Index jumping more than 2.5 percent on Friday, while the price of gold dropped below $1,700.

But is the situation in the US labor market indeed so rosy? Not quite. After all, even if the data reported by the BLS is reliable, the number of working Americans is about 20 million lower than before the pandemic, and the unemployment rate is still at the highest level since the Great Depression. So, there is still a long way to go until the labor market returns to normalcy.

But it's not even the case that the recovery has really begun. You see, the report is not reliable. And the BLS admitted itself, writing that

If the workers who were recorded as employed but absent from work due to "other reasons" (over and above the number absent for other reasons in a typical May) had been classified as unemployed on temporary layoff, the overall unemployment rate would have been about 3 percentage points higher than reported.

In plain English, it means that the BLS incorrectly described the job status of millions of people and without such an error, the unemployment rate would be not 13.3 percent, but 16.3 percent. So instead of decreasing - suggesting the start of the recovery - it would rise further since April.

The ADP report released earlier in the week, based on data directly from the employers themselves, showed almost 3 million more lost jobs, not a gain in jobs. The number was also better than forecasts, but significantly worse than the BLS data.

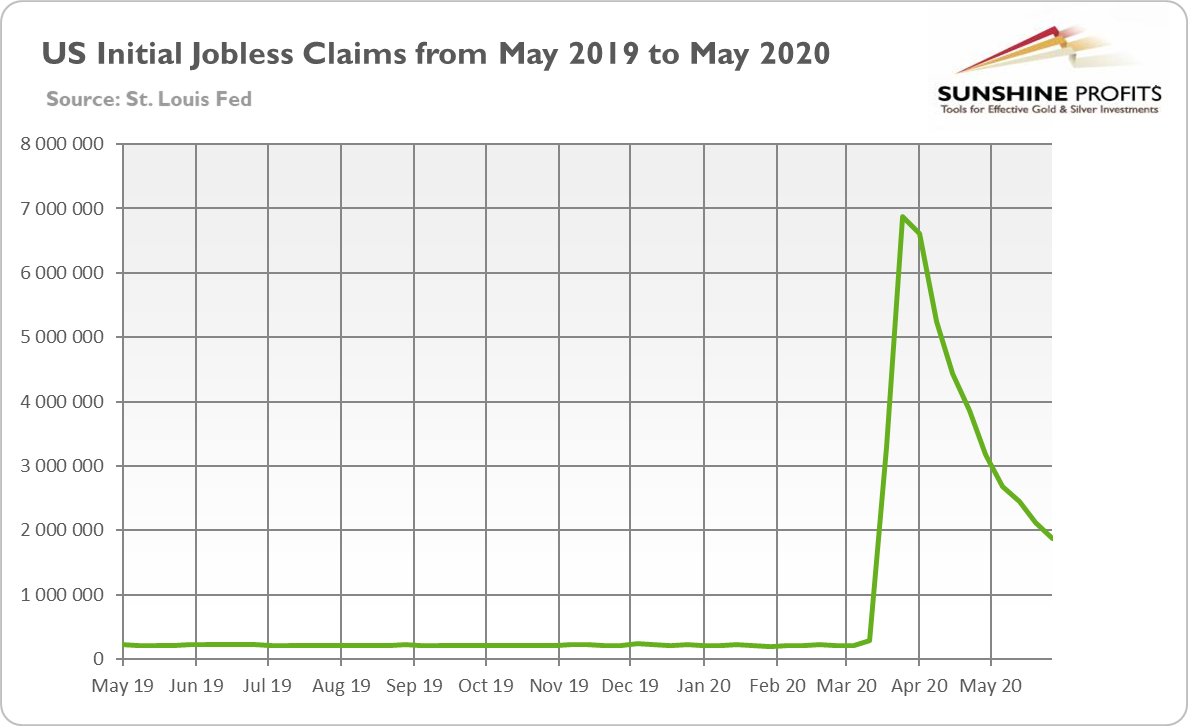

Initial claims also do not indicate the rebound in the US labor market. As the chart below shows, each week since the outbreak of the pandemic few millions of Americans applied for the unemployment benefits - and more than 42 million in total wanted to become unemployed, implying a bleaker situation in the US labor market.

Summing up, on the heels of strong employment data, black gold powered higher, and it's behavior around the 61.8% Fibonacci retracement will determine the outlook.

Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): No positions

In case of the futures contracts that are more distant than the current contract, we think that adding the premium (difference between the July and other contracts) to both: stop-loss and initial target prices is justified.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager