Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

The ongoing currency market situation continues to impact black gold prices, and things had not changed much since our analysis yesterday. We've thoroughly analyzed and explained how the USD Index's breakout and its invalidation currently affect crude oil in the preceding days. Taking into account the individual currency pairs' situation of the euro and the yen, the invalidation's bearish implications were not quite what we've expected.

To provide more context, let us refer to what we wrote about the USDX previously, on September 18th:

Namely, the USDX invalidated its breakout, which is clearly a bearish sign. Quite visibly, the USDX was above the declining resistance line, but it failed to hold these gains. In July, a failure to rally above resistance meant another big downturn, which translated into higher crude oil prices.

So, the question is, do the USDX and crude oil are after the same fate in the near future? Not necessarily.

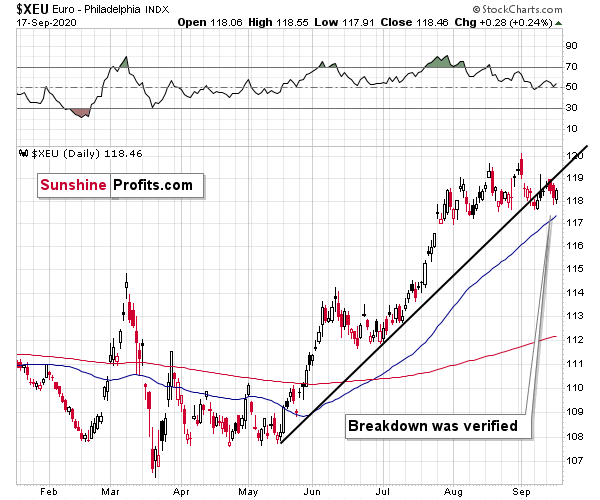

The USD Index represents a weighted average of several currency exchange rates. The biggest weight (over 50%) is attributed to the euro exchange rate, and the second biggest weight is attributed to the yen exchange rate. Let's see how the situation looks like in both currencies.

The euro is after a breakdown and a verification thereof. It is a very bearish situation, and bullish one for the USD Index and. Because of that, at least in the short run, it is bearish for gold.

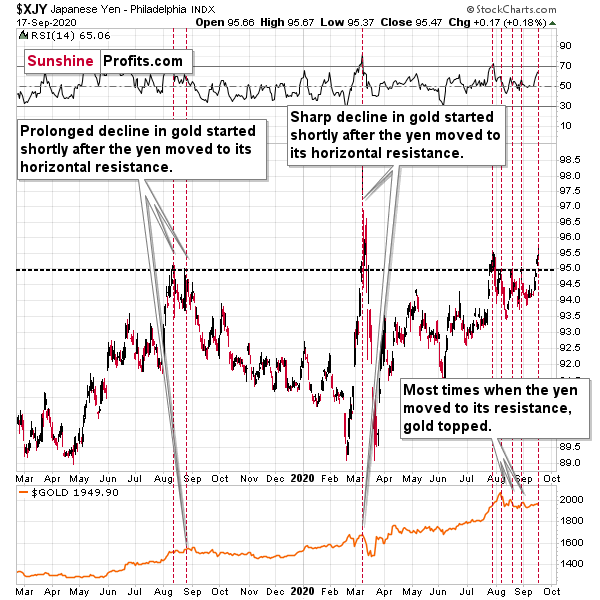

And what about the Japanese yen?

Turns out, as far as the implications are concerned, the situation is not that different. However, the direct reason for it is.

As you can see on the Japanese yen index chart above, for the past 1.5 years, it topped shortly and reversed its course whenever it tried to rally above the 95 levels.

The Japanese currency's implication can potentially invalidate the breakout once again. Therefore, history tends to rhyme, after all.

Given the suggestions that the individual currency exchange rates provide us with, should we really expect the USD Index's breakout invalidation to cause lower values? Not really. The individual currency exchange rates are more "basic", and their outlooks prevail the index chart that is essentially based on them.

In other words, the validity of the bearish implications of USDX's invalidation is suspicious.

The result is that the bearish outlook for crude oil didn't really change, even though we admit that it is not as bearish as it was before the USDX's breakout's invalidation.

That might not be a significant move in nominal price changes, but it remains a big move regarding the critical breaking resistance.

Yesterday's evident USDX breakout didn't quite turn the situation into a crystal-bullish one. The USD Index moved clearly and significantly above the declining resistance line. In summary, according to yesterday's USDX movement, the situation remains more bullish and more bearish at the same time for the crude oil price.

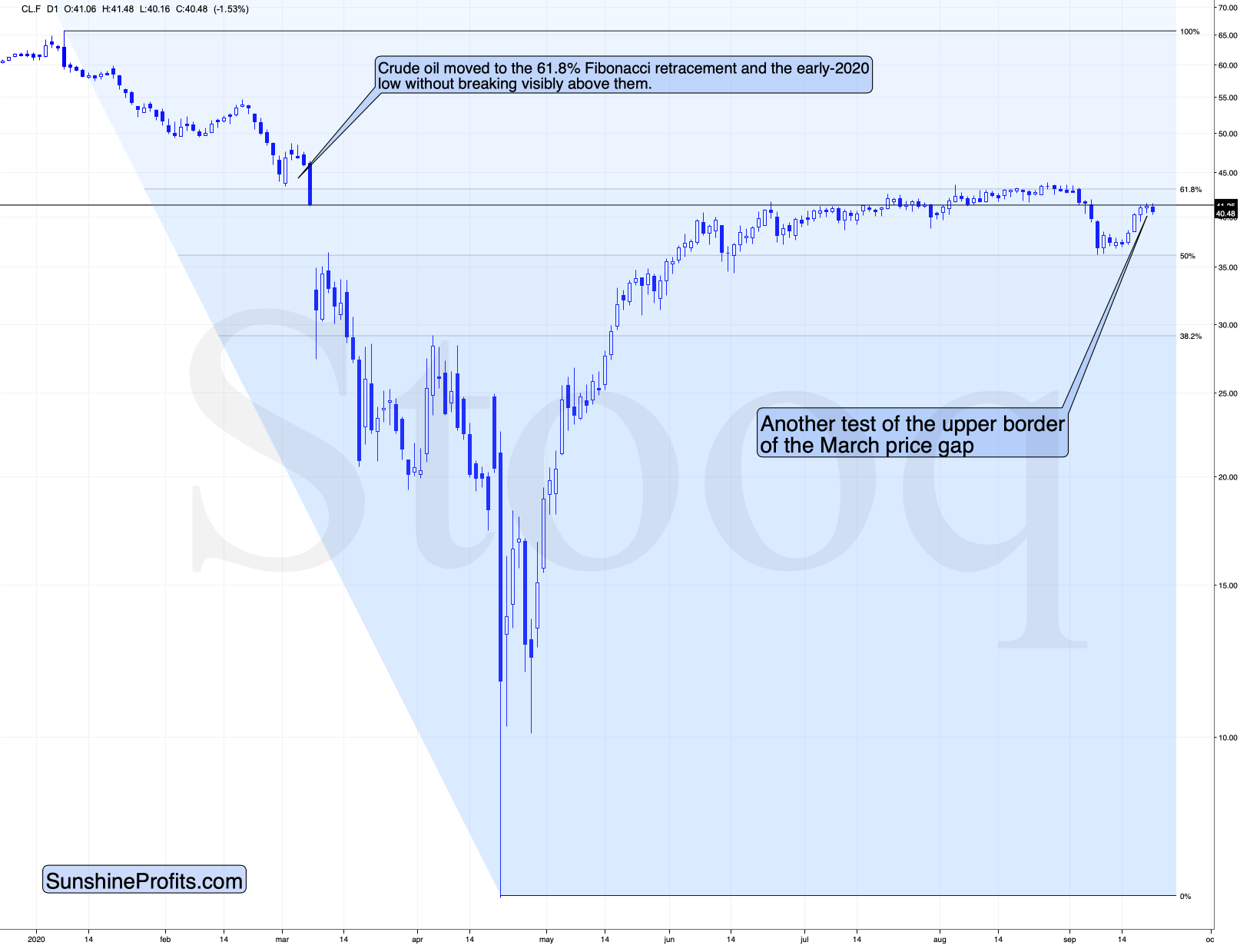

As we have confirmed previously, crude oil's price moves once again tested the upper border of the substantial March price gap. The conclusion that a bullish outlook is not possible at this point remains because, until crude oil breaks above the upper border of March's price gap, the early-March lows, and the 61.8% Fibonacci retracement, it simply won't happen.

Undoubtedly, crude oil still moves lower after approaching the aforementioned resistance, which only validates the bearish outlook.

To sum things up, in the upcoming weeks, the outlook for crude oil remains bearish, and the most recent upswing could not change that at all.

As always, we'll keep you - our subscribers - informed.

Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

In the futures contracts that are more distant than the current contract, we think adding the premium (the difference between the July and other contracts) to both: stop-loss and initial target prices is justified.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager