Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Earlier today, crude oil extended gains and climbed to the highest level since June 2015. But did the outlook turn into bullish?

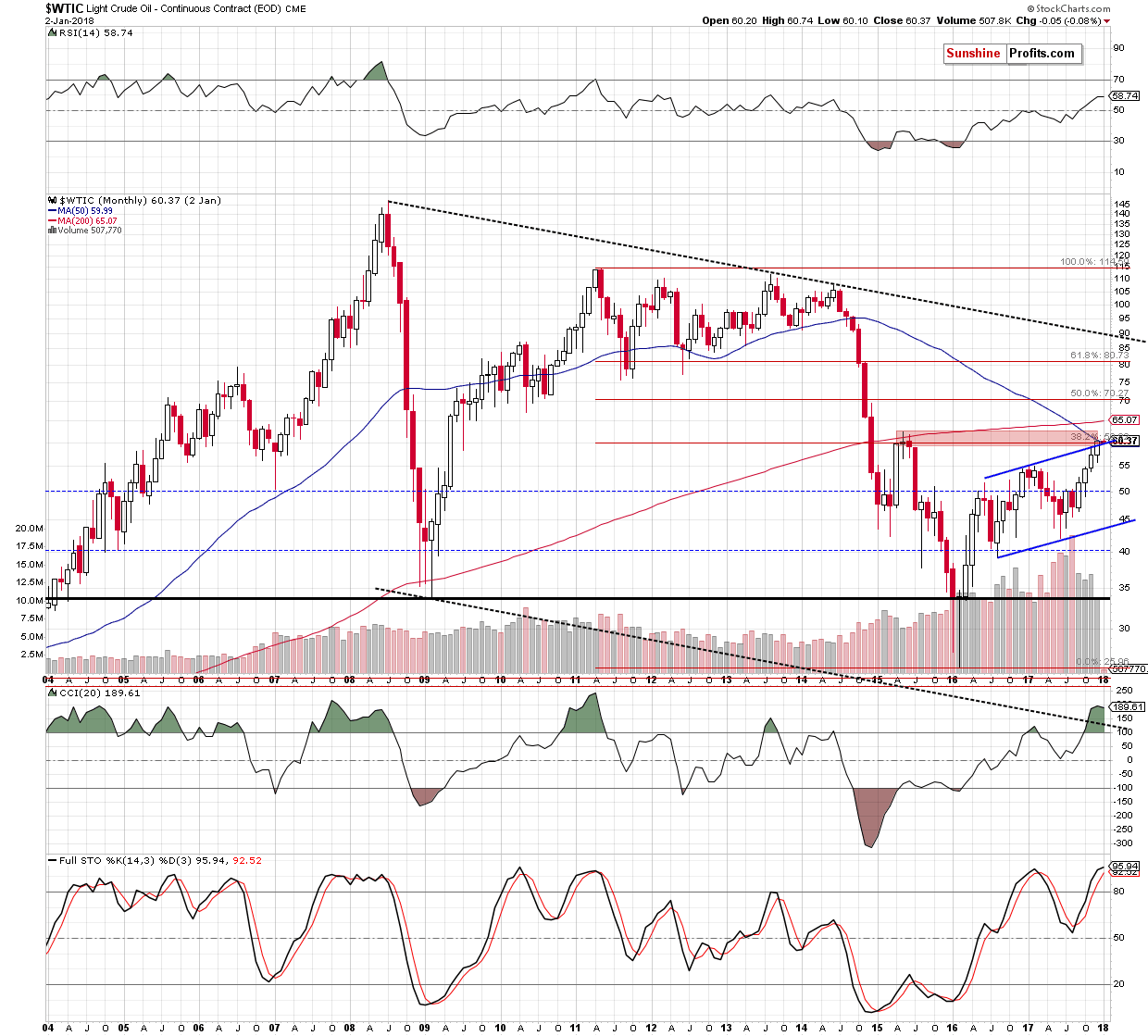

Today, after the market’s open oil bulls pushed crude oil to a fresh multi-month high above $61, which launched our stop loss order and saved us from bigger losses. Despite this increase, the outlook didn’t turn into bullish a crude oil remains under the key resistance zone marked on the long-term chart below (charts courtesy of http://stockcharts.com).

From today’s point of view, we see that although black gold extended gains (today’s move is not seen on the chart yet) the above-mentioned key resistance zone created by the 2015 peaks remains in cards. In other words, as long as there is no breakout above this important resistance area, the way to higher prices is blocked and reversal is just around the corner. Therefore, if we see a reliable bearish development (for example, an invalidation of the tiny breakout above the upper border of the blue rising trend channel), we’ll re-open short positions in the coming days.

As always, we’ll keep you - our subscribers - informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts