Trading position (short-term; our opinion): Short position with a stop-loss order at $58.37 and the initial (!) downside target at $50.38 in crude oil is justified from the risk/reward perspective.

Yesterday was yet another day when the bulls took oil higher just to give up some gains before the closing bell. Today, they are making another run higher so far. Does it change the situation? Is it only the short-term one, or also the long-term one to reevaluate here? What is the likely course of action, what are we to do?

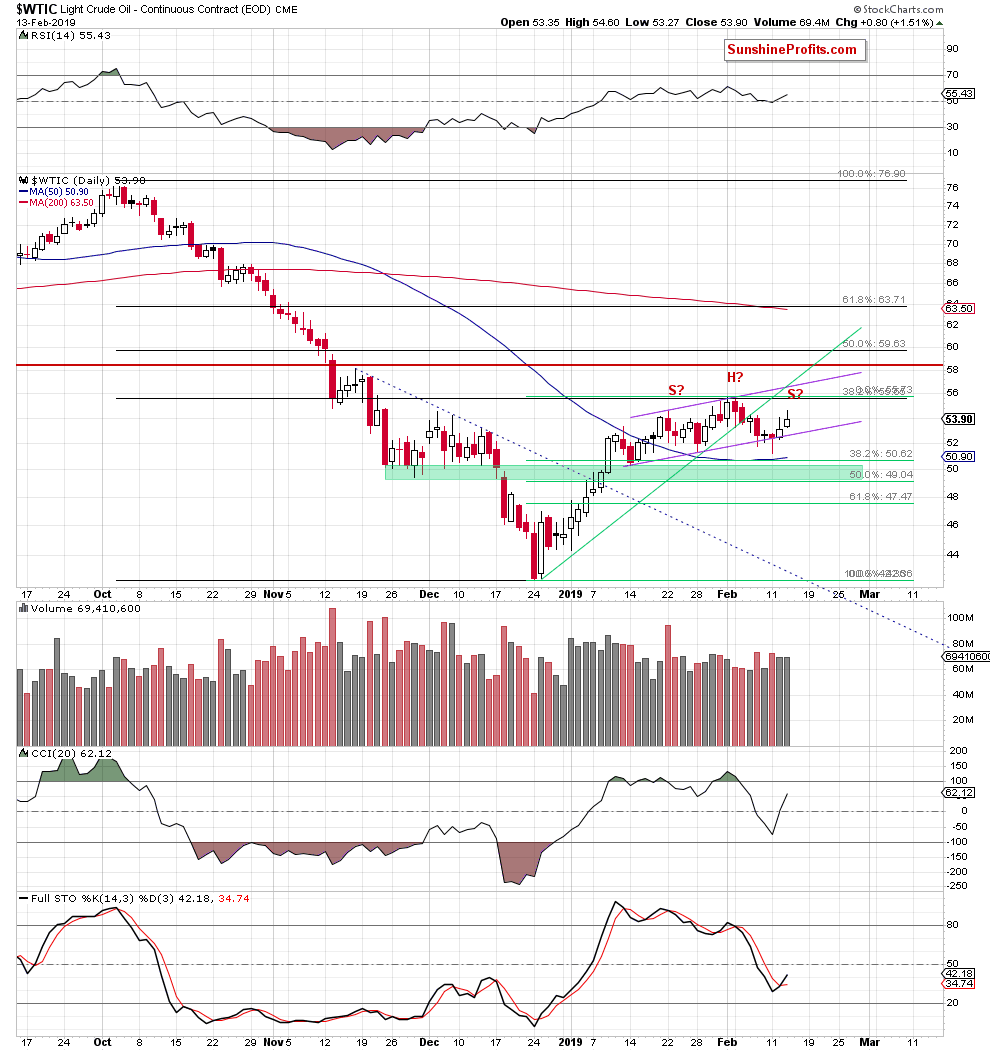

Let’s examine the chart below (charts courtesy of http://stockcharts.com).

Yesterday, crude oil moved a bit higher once again and the Stochastic Oscillator generated a buy signal. Certainly looks like a positive event for the bulls. However, can we really trust it? There are several reasons why not really.

First, we see that recent candlesticks have long upper shadows. These show that despite initial bullish sentiment, the buyers gave up a lot of their gains before the day was over. Such decrease of buying power is a bearish omen.

Second, there is the volume. Yesterday’s volume was only in line with the volume of the day before. Neither this fact confirms increasing participation of the bulls in the daily oil price upswing.

Third, let’s take a look at the chart structure as such. We see a potential head and shoulders formation in the making. The current move to the upside looks like creating the right arm of the formation. If we see the formation completed, it would also have bearish implications for the coming days.

Fourth, there are important resistance levels quite close to the current price. Black gold is still trading below both the 38.2% Fibonacci retracement and the upper border of the purple rising trend channel. These two were strong enough to stop the bulls earlier this month already.

Fifth, there is the bearish engulfing pattern on the weekly chart. It is a strong signal as weekly closing prices carry a greater weight than daily ones. The higher timeframe rules while the lower timeframe serves for finetuning the trading decisions. The pattern continues to support the sellers and another attempt to move lower in the coming day(s) or even week(s).

Taking all the above into account, we believe that even if light crude moves a bit higher from here, the space for gains seems limited and we won’t have to wait long for another reversal.

Summing up, the short position continues to be justified from the risk/reward point of view as all the above mentioned factors favor the sellers and another move to the downside in the coming days or weeks.

Trading position (short-term; our opinion): Short position with a stop-loss order at $58.37 and the initial (!) downside target at $50.38 in crude oil is justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.