Trading position (short-term; our opinion): Long positions (with the stop-loss order at $65.10 and the initial upside target at $70.37) are justified from the risk/reward perspective.

On Tuesday, crude oil pulled back a bit and finished another day under the nearest moving average. Does this mean that the buyers have already lost their enthusiasm or is it just the calm before the storm?

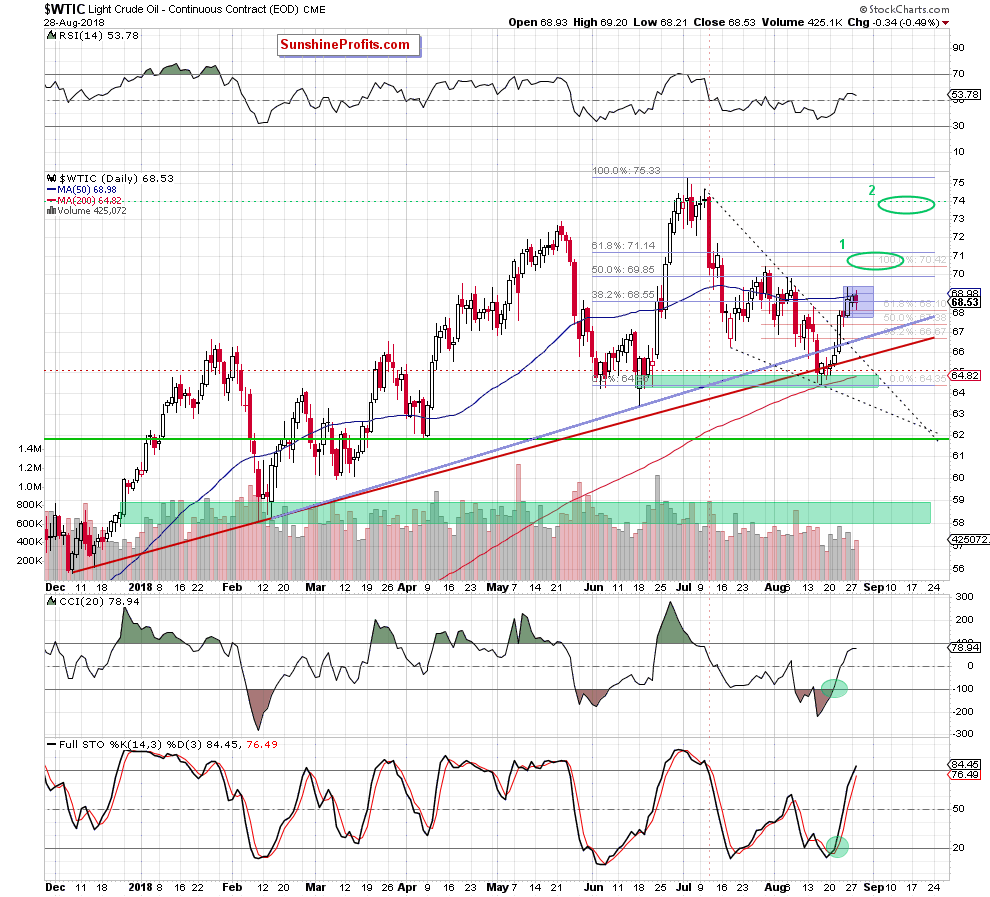

Let’s examine the chart below (charts courtesy of http://stockcharts.com/).

Technical Picture of Crude Oil

Today's alert is going to be even shorter than yesterday's issue, as once again nothing really changed in the price of crude oil, because the commodity stuck in the blue consolidation between the previously-broken 61.8% Fibonacci retracement (the third closure above this level in a row, which means that the breakout is confirmed) and the 50-day moving average, which continues to keep gains in check.

However, the buy signals generated by the indicators remain in the cards, supporting oil bulls and another attempt to move higher in the very near future.

So where will crude oil head next?

In our opinion, if light crude extends its trip to the north from current levels, we’ll see an upward move to around $70.20-$70.40, where the late July highs are (we marked this area with the green ellipse on the daily chart). Slightly above them is also the 61.8% Fibonacci retracement, which will be the next target for the buyers.

But if this quite solid resistance zone is broken, oil bulls could climb even to around $74, where the price was very often at the turn of June and July (the upper green ellipse seen on the daily chart).

Taking all the above into account, we believe that our profitable long positions continue to be justified from the risk/reward perspective. As always, we’ll keep you - our subscribers - informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts