Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Looking at the crude oil chart from today's point of view, we can see that the general situation in the short term has not changed since the beginning of the month. When can we expect a breakthrough?

Let’s take a look at the charts below (charts courtesy of http://stockcharts.com).

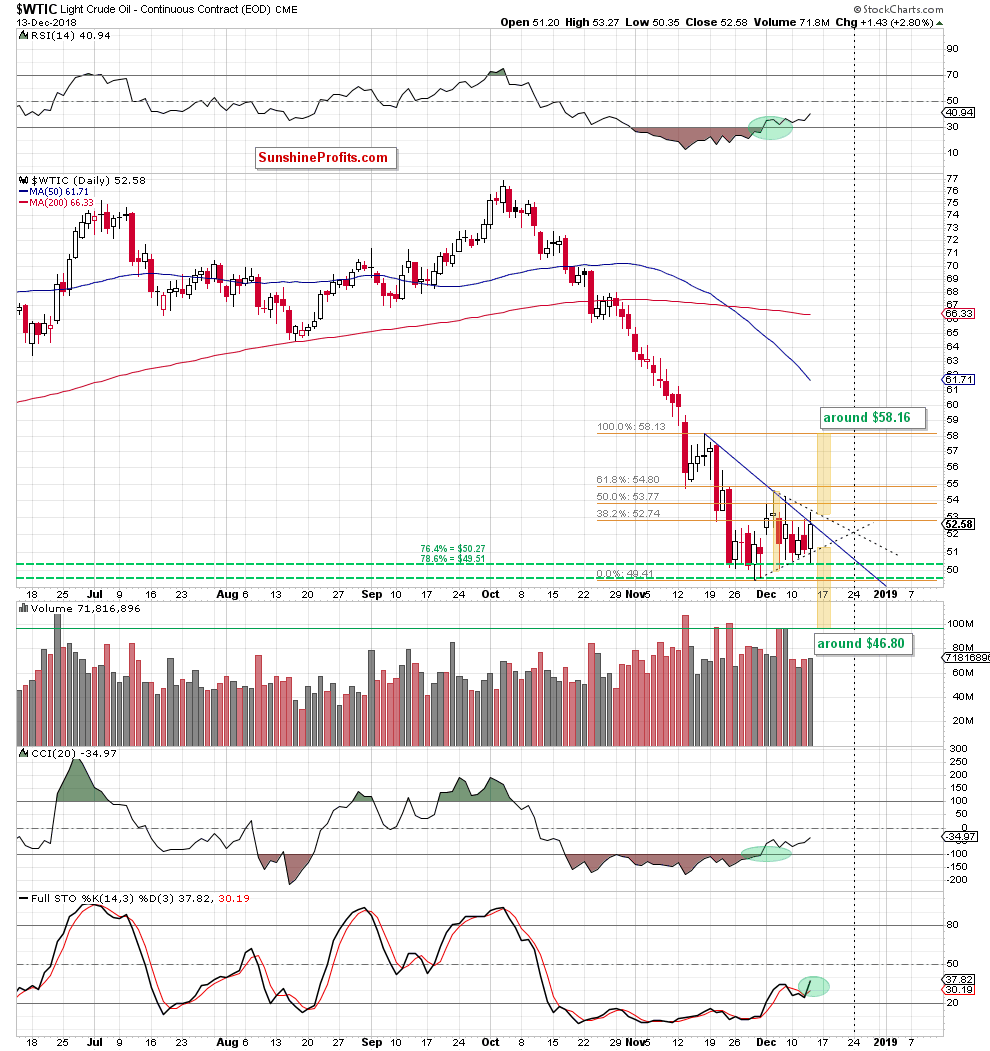

Looking at the daily chart, we see that although crude oil moved a bit lower after yesterday’s market’s open, the upper border of the support area created by the 76.4% and 78.6% Fibonacci retracements encouraged the buyers to push the commodity higher in the following hours once again.

Thanks to their action, black gold re-tested the 38.2% Fibonacci retracement and the very short-term blue resistance line based on the previous highs for a fourth time in a row. Did this upswing change anything in the very short-term picture of light crude?

Not really, because exactly the same as the day before, the buyers showed weakness and buckled under the pressure of the sellers, which resulted in another pullback and a daily closure under these resistances.

As you can see on the above chart, a similar price action we could observe at the beginning of the month (December 4 and December 7). In both cases, an unsuccessful attempt to go higher translated into a downswing on the following day, which suggests that we can see something similar later in the day.

If the situation develops in tune with the above assumption, crude oil will likely slip to at least $51.20. Why here? Because in this area you can see a black dashed line based on the previous lows, which is the lower line of the very short-term black triangle.

Nevertheless, before oil bears can think about the next bigger move to the south, they will have to break below the major short-term supports about which we have repeatedly written in recent alerts.

Before we summarize today’s comments on this commodity, we would like to draw your attention to the above-mentioned black triangle marked with dashed lines. As you see on the daily chart, we marked with yellow two potential scenarios - depending on which side of the market wins and in which direction the breakthrough will take place.

If oil bulls show strength and successfully break above the upper line of the formation (and also above the blue declining resistance line, the Fibonacci retracements and preferably above the December high), crude oil will likely climb to around $58.16, where the size of the upward move will correspond to the height of the black triangle. Additionally, in this area is also the mid-November peak, which could attract the buyers.

On the other hand, however, if they fail and the sellers trigger a decline below the lower border of the triangle and the recent lows, we can see not only a fresh 2018 low, but also a drop to around $46.80, where the size of the downward move will correspond to the height of the triangle.

Meanwhile, we can summarize yesterday’s price action just like we did on Wednesday:

Summing up, the overall situation in the short term remains almost unchanged as crude oil is trading in a narrow range between the barrier of $50 and the blue declining resistance line, which continues to keep gains in check since the beginning of the month. Nevertheless, oil bulls’ weakness in combination with the sell signal generated by the Stochastic Oscillator suggests that one more downswing and a re-test of the nearest supports might be just around the corner.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts