Trading position (short-term; our opinion): Short position with a stop-loss order at $58.37 and the initial (!) downside target at $50.38 in crude oil is justified from the risk/reward perspective.

The bulls took black gold higher yesterday but gave up some gains eventually. It looks inconclusive, this balance of forces in the last few days. On the surface, today’s action would not make one much smarter either. That is, if they didn’t know where to look. It’s time to share our take on the current situation.

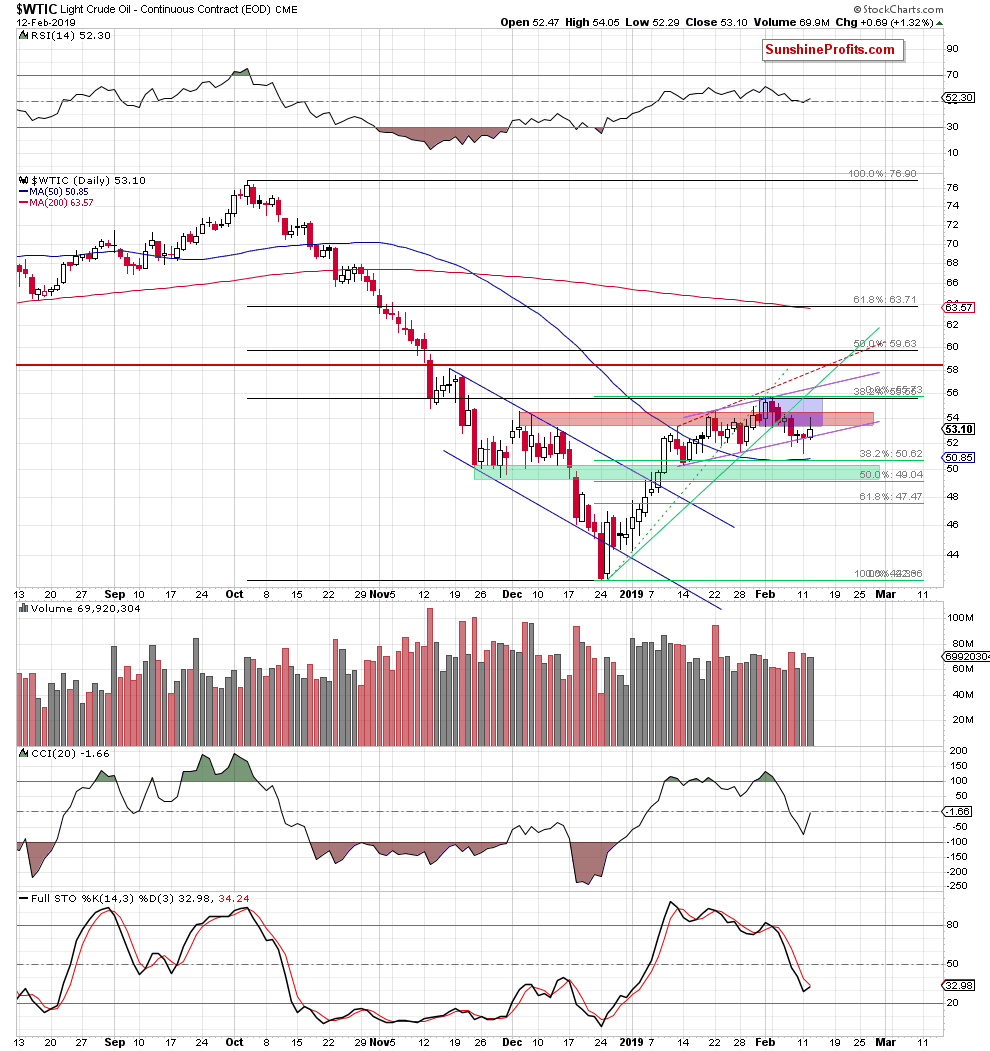

Let’s examine the chart below (charts courtesy of http://stockcharts.com).

Quoting our last observations:

(…) as long as the price of light crude is trading (on a closing basis and absent other clues) below the previously broken lower border of the blue consolidation and the red resistance zone, all upswings could be nothing more than a verification of the earlier breakdowns.

(…) the sell signals generated by the daily indicators and the bearish engulfing pattern formation (...) continue to support the sellers. Another attempt to move lower in the following days (even if we see first an upswing resulting in verification of the breakdowns) is still favored by the odds.

Looking at the daily chart, we see that the situation developed in line with the above scenario. Crude oil indeed moved higher, but oil bulls didn’t manage to hold on to their gains as evidenced by the long upper knot.

Black gold pulled back and closed the day below the lower border of the red resistance zone and also below the lower line of the blue consolidation. Today’s price action (oil is trading at around $53.40 now) shows another rejection of the bulls at the red resistance zone and the upswing appears to be slowly fizzling out.

Taking all the above into account, yesterday’s summary is up-to-date today, too:

Summing up, the already profitable short position continues to be justified from the risk/reward perspective as crude oil is currently still trading below the major short-term resistances on a closing basis and the sell signals generated by the indicators continue to support the sellers and another downswing in the near future.

Trading position (short-term; our opinion): Short position with a stop-loss order at $58.37 and the initial (!) downside target at $50.38 in crude oil is justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.