Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

The beginning of the week brought another test of the previously-broken resistance line, but oil bulls didn’t impress the oil market’s observers with their strength and determination. Will today’s price action bring a breakthrough? We’ll see in the following hours, but before that happens, let's check what should we focus on today.

Let’s examine the charts below (charts courtesy of http://stockcharts.com).

Technical Picture of Crude Oil

Today’s alert will be quite short, because crude oil didn’t do anything new during yesterday’s session. The commodity moved to the previously-broken medium-term red resistance line, but there was no breakout above it, which means that what we wrote in our last Oil Trading Alert remains up-to-date:

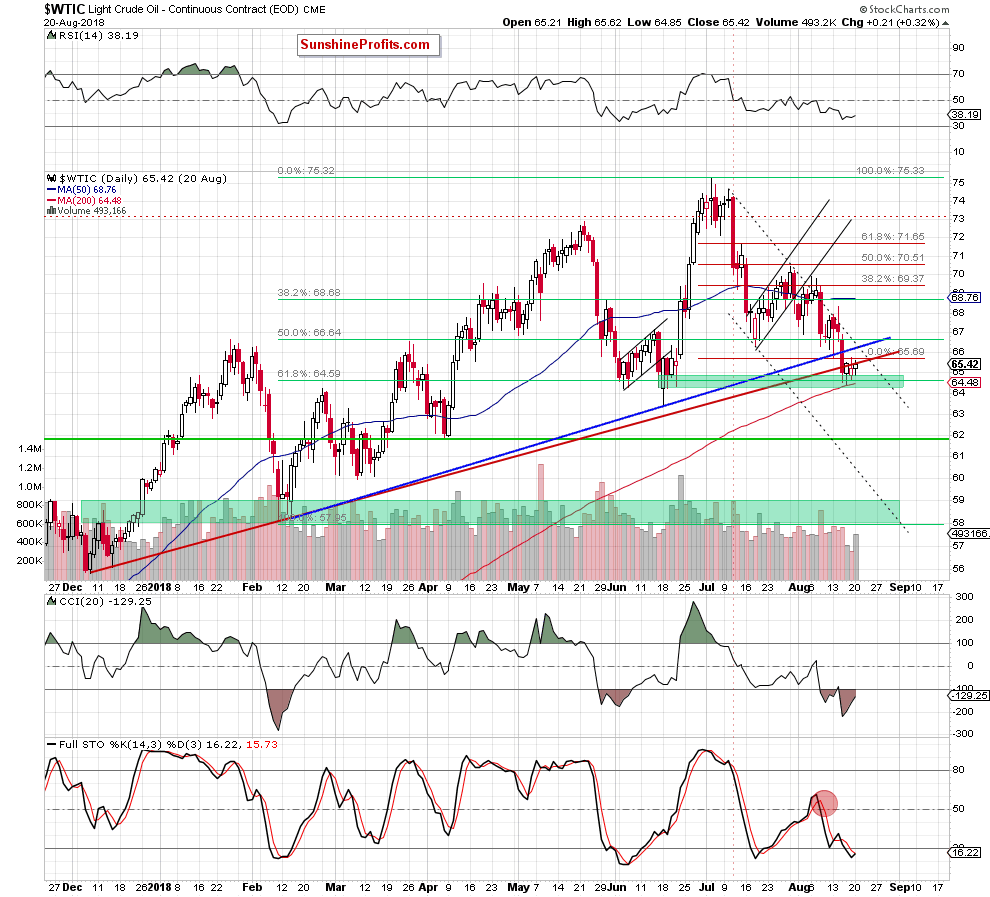

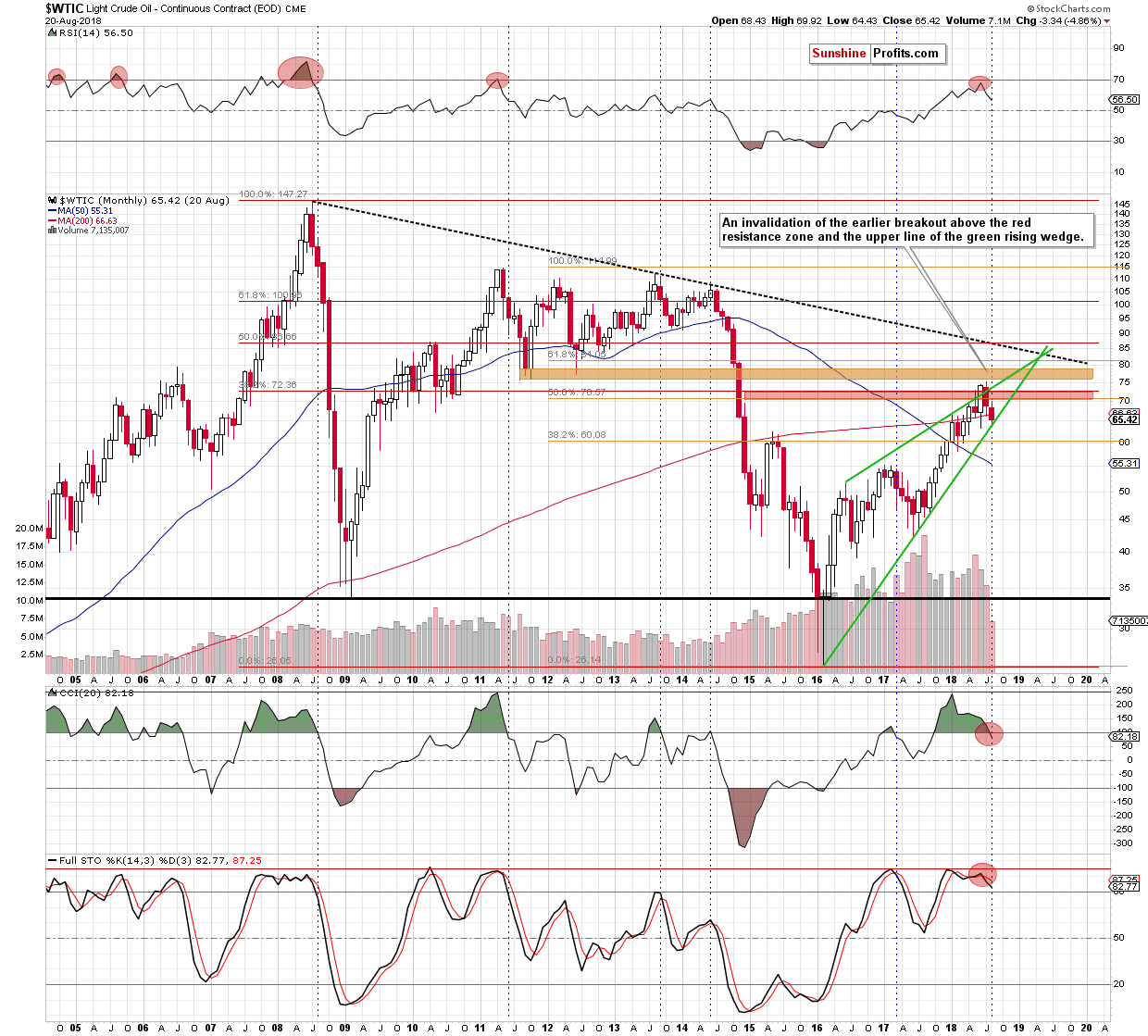

(…) in our opinion, as long as crude oil is trading above the green support zone, which is also reinforced by the 61.8% Fibonacci retracement and the 200-day moving average, a sizable move to the downside is not likely to be seen – especially when we factor in the proximity to the lower border of the green rising wedge seen on the monthly chart below.

In other words, a reversal from this area should not surprise us in the coming days – especially if the CCI and the Stochastic Oscillator manage to generate buy signals.

When can we expect next positions?

If black gold invalidates the breakdown under both the above-mentioned resistance lines marked on the daily chart and the daily indicators generate buy signals, we’ll consider going long.

On the other hand, however, if oil bears take the commodity lower and we see reliable breakdowns under the above-mentioned important supports, we’ll likely re-open short positions (very probably bigger positions than usual). Until this time, waiting at the sidelines for a confirmation or invalidation of the above is justified from the risk/reward perspective.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts