Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Friday, crude oil lost almost 1%, but there are several technical factors that raise some doubts about the strength of the bears. Will their opponents use them to push black gold higher in the coming days?

Let's examine the charts below (charts courtesy of http://stockcharts.com).

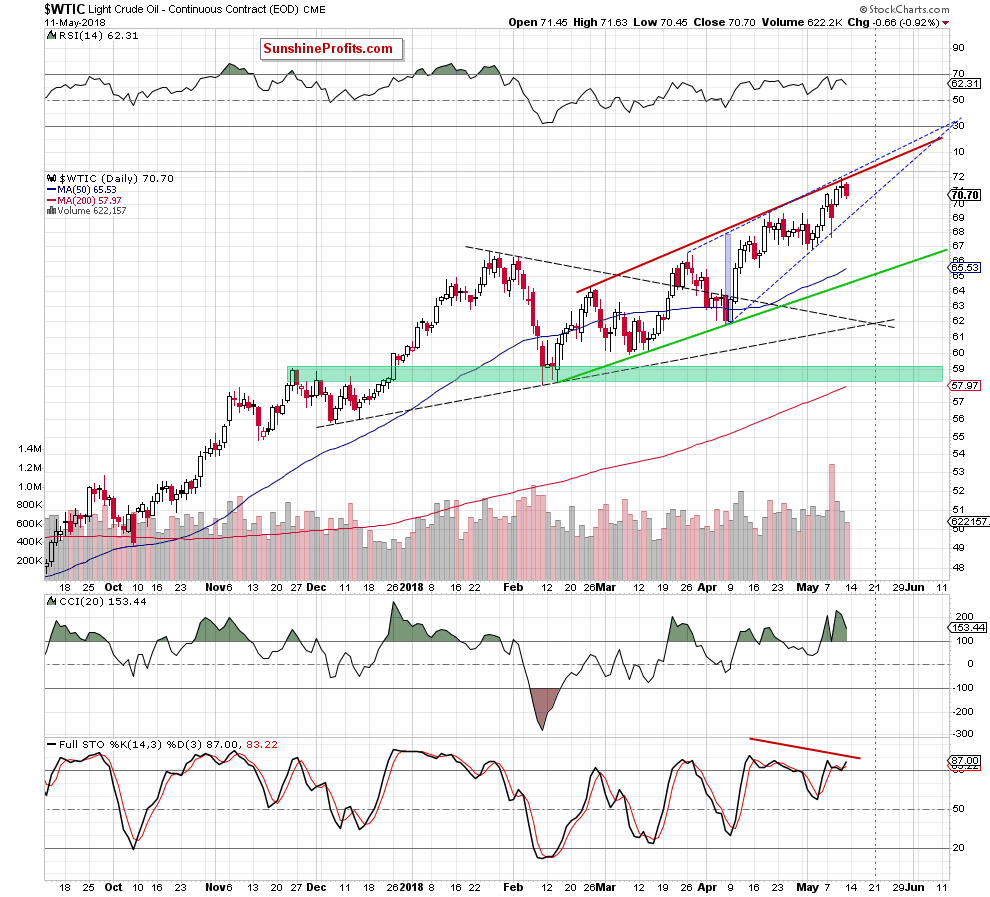

From today’s point of view, we see that the red rising resistance line (based on the late February and mid-April peaks) encouraged oil bears to act on Friday. Although the commodity lost almost 1%, the overall situation in the short term hasn’t changed much.

Why? Because black gold is still trading inside the blue rising wedge (marked with dashed lines), which means that as long as there is no breakout above the upper border of the formation or a breakdown below the line of the wedge, another bigger move is not likely to be seen.

Nevertheless, taking into account the fact that the Stochastic Oscillator invalidated the earlier sell signal and volume, which accompanied Friday’s decline, it seems that oil bulls could try to push light crude higher in the following day(s).

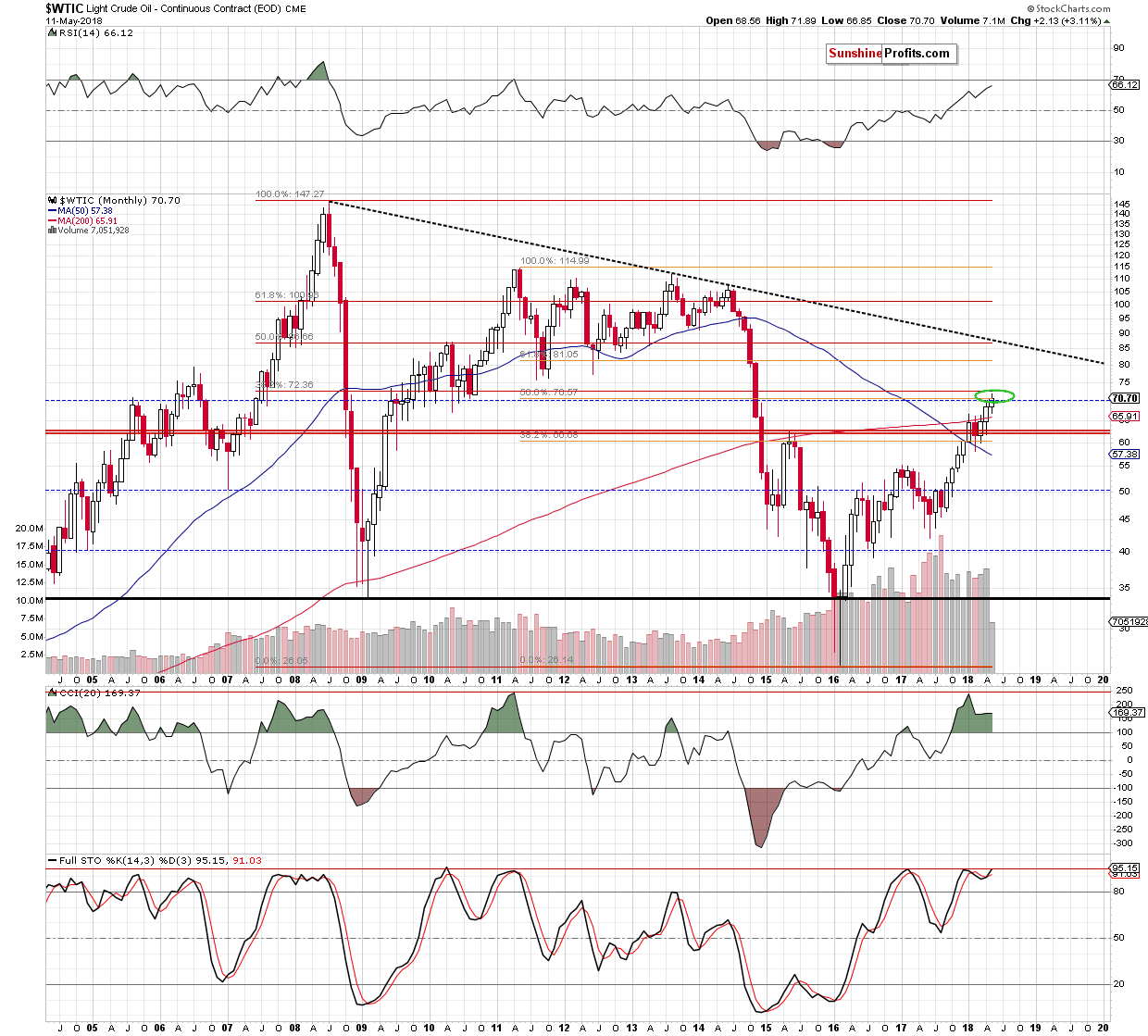

At this point, however, it is worth to mentioning that even if they succeed, the space for gains seems limited as the major resistance zone created by the 50% Fibonacci retracement based on the 2011-2016 downward move and the 38.2% Fibonacci retracement based on the entire 2008-2016 decline (we marked it with the green ellipse on the long-term chart below) continues to keep gains in check.

Summing up, the overall situation in the very short term is too unclear to justify opening any positions now. However, if we see a breakdown under the lower border of the blue rising wedge, we’ll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts